“My desk is at the end of the production line.”

As CEOs go, there is not much about Elon Musk that is orthodox.

Example: Tesla Motors’ (ticker: TSLA) Q1 conference call took place this week. Musk held the Tesla call at 5:30 p.m. Eastern time, bucking a generally adopted morning conference call tradition embraced by a majority of public companies.

In the call, Musk mostly ignored recent quarter details and instead dove head-first into the future, quickly detailing how he plans to reach his goal to convert Tesla into an automotive manufacturing dynamo. “It’s easy to get wrapped up in like a bunch of sort of short-term issues, but I think in terms of what matters for the future, I think that’s the most significant thing,” Musk said in his brief remarks.

Earnings call: why not recruit employees?

Musk also used the Q1 investor call opportunity as a platform to recruit manufacturing employees: “I really want to sort of send the message out there to the best manufacturing people in the world; we want you to come join our company.”

Can Musk build enough electric cars to disrupt fossil fuel use by 2022?

Bloomberg writer Tom Randall believes Tesla can deliver “enough electric vehicles to disrupt fossil fuel use by as early as 2022.” That was based on the Model 3 2020 timeline. “If you believe Tesla can reach its new goal [2018], that timeline just moved up,” Randall said.

“Hell-bent on becoming the best manufacturer on earth”

Can Tesla successfully ramp up its manufacturing to meet Musk’s goal? Here is where Musk sees Tesla Motors going, and the direction that he is personally steering it.

Based on the surprisingly large customer demand for the Tesla Model 3, Musk is taking the steps needed to be able to manufacture 500,000 of the fully electric, technology-filled cars per year by 2018. That means Musk is gearing up to hit the ‘half million units per year’ run rate two years ahead of schedule.

That means quickly ramping up production of “large, complex objects,” as Musk put it, to a pace 10 times beefier than the number of vehicles the company produced in 2015. That’s his two-year goal.

The biggest strategic challenge

“The key thing we need to achieve in the future is to also be the leader in manufacturing. We take manufacturing very seriously at Tesla,” Musk said. “It’s the thing that we need to obviously solve if we’re going to scale and scale rapidly and make the cars more affordable.”

Tesla’s Q1 shareholder letter put it like this: “Our objective with Model 3 is to create the world’s best car with a base price of $35,000, before any incentives, with a range of at least 215 miles on a single charge, and with strong gross margins. We plan to incorporate our best technology into Model 3, yet keep it relatively simple to build at high volume and with high quality.”

In the conference call Musk said that “[manufacturing] is going to be the primary focus of Tesla; how do we get super-good at making large, complex objects? So that’s I think the most salient point. It’s easy to get wrapped up in like a bunch of sort of short-term issues, but I think in terms of what matters for the future, I think that’s the most significant thing.” And he puts his energy where his mouth is.

Sleeping bag adjacent to the production line

In the earnings call, Musk drove home the point about how serious he is. “My desk is at the end of the production line. I have a sleeping bag in a conference room adjacent to the production line, which I use quite frequently. The whole team is super-focused on achieving rate and quality at the target cost. So I felt very confident in us achieving that goal.”

Bloomberg analyst Salim Morsy said this about Musk’s plan: “It would reshape the entire global car industry. But a lot of things have to go right, and they have to go right on the extremes.”

Bloomberg reported that its New Energy Finance arm had tracked 234,000 electric car sales worldwide last year, of which Tesla made up a fifth of the market, according to Morsy. “For Tesla to stay on its new track, it would need to produce more cars next year than the entire global electric-car industry made in 2015. … Telsa’s battery factory in Nevada must flourish, costs must come down, and car-making capacity must scale up at an astonishing rate.”

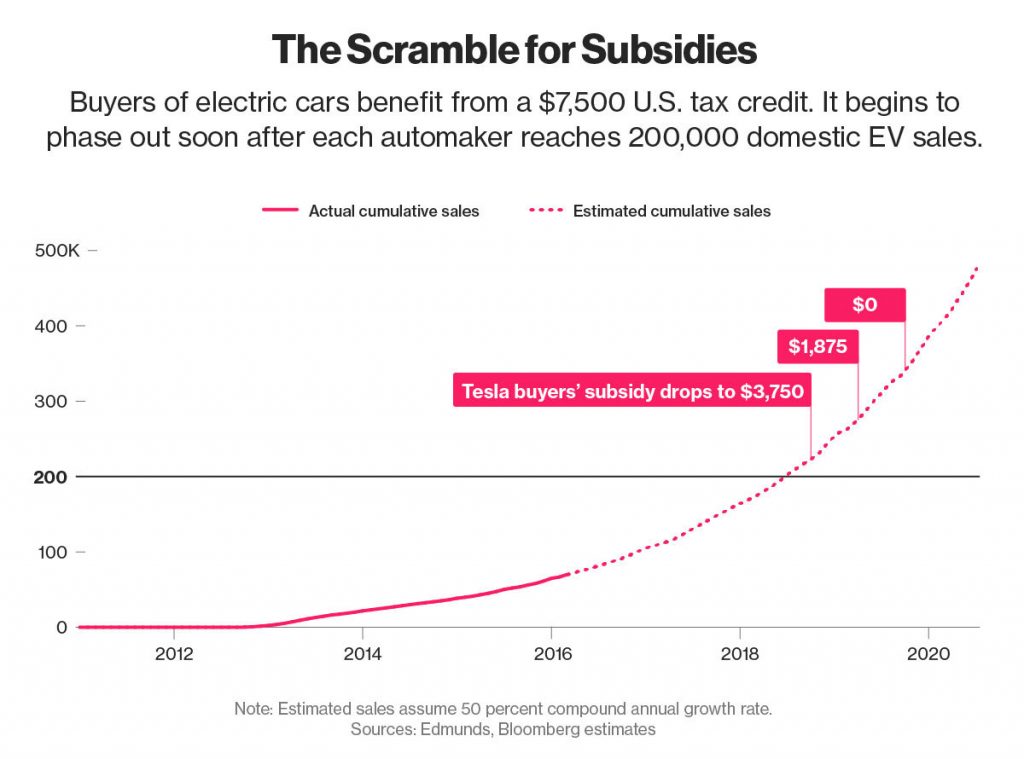

Thank you American taxpayer for allocating $7,500 to your neighbor’s new Tesla

Musk’s ability to deliver a high performance automobile that happens to be powered by electricity is the first slice of the appeal of Tesla. But the rush of Tesla’s 400,000 customers to plunk down a $1,000 advance deposit for a Model 3 can be partly attributed to the beefy $7,500 federal tax credit for people who buy an electric vehicle, courtesy of U.S. taxpayers. That subsidy will drop to $3,750 by 2018 or whenever the U.S. automaker reaches 200,000 domestic electric vehicle sales, and then it will scale down eventually to $0, Bloomberg reported.

Different CEO, Same Long-Term Vision

LNG visionary sets out on a new path to become the largest U.S. LNG exporter—using a modular liquefaction scheme

“Headwinds are good. If it were easy, everybody would be doing it,” Charif Souki told Oil & Gas 360® in an interview last August when he was CEO of U.S. LNG pioneer Cheniere Energy (ticker: LNG), presenting Cheniere at the EnerCom conference in Denver.

Souki’s vision for taking low-priced U.S. shale gas, super-cooling it to a liquid state and shipping it to high paying customers on multiple continents is what moved Cheniere from concept to reality.

Souki’s vision for taking low-priced U.S. shale gas, super-cooling it to a liquid state and shipping it to high paying customers on multiple continents is what moved Cheniere from concept to reality.

But in December, the founder and driving force behind the first U.S. LNG exporter was booted out of the corner office of the company that he started. That was after strategy disputes with Cheniere’s board of directors (representing stakeholder Carl Icahn) moved the board to replace Souki. That happened just in time for Souki to miss seeing his dream of exporting U.S. natural gas to Europe and Asia from Cheniere’s Sabine Pass LNG export facility become a reality.

No problem; here’s Plan B

Shortly after exiting Cheniere, Souki and former BG Energy LNG vet Martin Houston launched a new LNG venture. It’s called Tellurian Investments. This venture lets Souki pick up where he left off. But the plan is different. The idea is to create a better, smarter, scalable LNG export operation—that could outpace Cheniere eventually. First Souki and Houston need to raise the estimated $11 billion capital to build the project.

Tellurian’s scheme is to undercut rival LNG exporters by 15%-20%, the Financial Times reported this week. Souki is planning to build an LNG plant in Louisiana that could eventually become the largest in the U.S.

Can Souki meet global demand for LNG with U.S. shale gas? U.S. natural gas prices “are going to be lower forever … the rest of the world doesn’t stand a chance”

Souki shrugs off today’s LNG global pricing headwinds that are pressuring the LNG exporters, saying today’s LNG oversupply will shrink in the next five years and prices will come back just in time for Tellurian’s initial shipments. “If the demand for LNG is there, U.S. suppliers will be best placed to meet it,” Souki said in an interview with the Financial Times. … “The shale boom is expected to provide cheap gas for a very long time.” Souki told the Times he believes natural “gas prices in the U.S. are going to be lower forever. … The rest of the world doesn’t stand a chance.”

With access to the world’s largest supply of (low cost) natural gas—U.S. shale gas—Souki’s plan is to charge customers a fixed fee of $2.50 per million British thermal units of gas that they have contracted to buy, plus 115% of the U.S. benchmark Henry Hub price for the LNG. Souki’s former company has fixed fees that are mostly $3 per mBTU at its Sabine Pass plant in Louisiana and $3.50 at its Corpus Christi facility in Texas, and it is also charging 115 per cent of Henry Hub for the LNG, according to the Times report.

A modular LNG plant that can scale to demand

Tellurian says it will produce LNG using a modular approach that produces LNG in units of approximately 0.7 mtpa, “making our projects much more flexible than megaprojects. We have designed mid-scale trains with one compressor per liquefaction unit.” Tellurian says the idea is to be able to quickly scale up when the market demands LNG, from America’s low-cost supply of natural gas.

Souki believes there will not be enough to LNG from other sources to meet the expected growth of global LNG demand into the 2020s.

Disruptive CEOs: Souki’s scheme at Tellurian is to undercut rival LNG exporters by 15%-20% with modular liquefaction plan.

At the EnerCom The Oil & Gas Conference® interview with Oil & Gas 360®, Souki characterized the global LNG opportunity and the enviable U.S. natural gas position as follows:

“The United States has become the largest producer of natural gas in the world, passing Russia a couple of years ago, and within the next two years we’ll become a net exporter of natural gas on a global basis.” Souki talked about the ability of the E&P companies in the U.S. to produce “natural gas at $2.00 – $3.00 per Mcf at the wellhead, compared to $5 to $6 at the wellhead in most other countries in the world. So we already get the benefit of the very cheap natural resource.”

In addition to advantaged pricing, Souki discussed the benefits of locating an LNG liquefaction facility in the U.S., on the U.S. Gulf Coast—you have access to a large workforce where the workers go home at night and can work all year around, avoiding the one-month-on/one-month-off schedule of LNG plant workers in remote locations. “You don’t have to build a city to accommodate [4,000 workers], and you don’t have to provide all the services that you would at a remote location, [such as] Western Australia where you are a thousand miles from anything, or places like Angola where the infrastructure has to be built and the labor force has to be imported.”

Tellurian has been working to secure a 650-acre site in Louisiana. It is working with Bechtel on how to deliver Tellurian’s new plant for the price Souki is looking for, which is about $500 per tonne of capacity, or $12bn for the full-size facility, the Times reported.

Souki and Houston discuss their concept and plans for the new operations in the video below.

Charif Souki’s full interview with Oil & Gas 360® is available below.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.