Shortage of Frac Crews, Equipment Drives Favorable Pricing in Argentina

“Eighty percent of the shale in the world has been identified as being outside of North America,” EcoStim Energy Solutions (ticker: ESES) CEO Chris Boswell told Oil & Gas 360® in an exclusive interview at EnerCom’s 20th The Oil & Gas Conference® in Denver, “but eighty percent of the equipment and technology and know-how that you need to develop it is inside of North America.”

EcoStim Energy Solutions provides completion and stimulation services in Argentina’s Vaca Muerta shale play.

EcoStim is a well stimulation and completion services company that has found a region where it can achieve rapid growth. EcoStim works exclusively in Argentina serving shale drillers in the Vaca Muerta shale play. Boswell pointed out that it is estimated that the Vaca Muerta is four to five times bigger than the Eagle Ford. EcoStim has added a proprietary technology that helps horizontal drillers identify and target “sweet spots” within the rock so that specific frac stages can be targeted in order to produce more hydrocarbons in each well.

Boswell said the government-supported commodities pricing structure in Argentina—$77 per barrel of oil and $7.50 per Mcf of natural gas—is the key for the companies working there. Boswell told Oil & Gas 360® that analysts have projected EcoStim’s revenue to be in the range of $18 million to $22 million in 2015, “and we should have an opportunity to as much as triple that next year.” Boswell said the company closed a $30 million equity offering in July and is using the capital to immediately increase its overall horsepower and its manpower in Argentina. “Twenty-seven thousand horsepower is being moved from [the U.S.] and another 16,000 HP is being built in-country. That will all be available for us come January, February [2016] time frame … we’ve already started hiring people to operate that crew.”

View video interview with EcoStim Energy Solutions CEO Chris Boswell here.

Operators Eliminate Expense by Eliminating H2S in Texas Wells

Integrated Environmental Technologies (ticker: IEVM) is another innovator on the services side that has found success and is in the process of expanding operations in the U.S., thanks to a proprietary technology that eliminates hydrogen sulfide from wells.

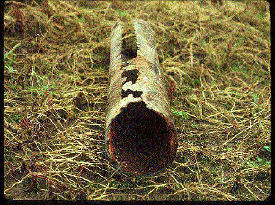

Corrosion in a pipe caused by hydrogen sulfide. Integrated Environmental Technologies’ technology eliminates H2S from oil and gas wells. Photo: OSHA

A typical well will use approximately $300-$700 per month of IET’s Excelyte® product to eliminate H2S, LaVance told Oil & Gas 360®, but it will save in the neighborhood of $3,000 – $7,000 in costs associated with corrosion, worker safety, and regulatory requirements that occur when H2S is present in oil and gas wells.

IET’s business model for the oil and gas side of its business is a “depot” model. The company is focused on Texas for now, with recent personnel additions, and it is planning to build and open new depots in the Permian basin to supply Excelyte® to operators there. LaVance compared it to starting up a nationwide restaurant franchise: “We want to open as many production depots as we possibly can.”

View video interview with Integrated Environmental Technologies CEO David LaVance here.

Company presentations from The Oil & Gas Conference® 20: