Halliburton (ticker: HAL) and Baker Hughes (ticker: BHI) have begun preliminary talks of a merger, Dow Jones reported on November 13, 2014. BHI confirmed the report later in the evening but did not make any guarantees as to the completion of the merger. “Baker Hughes does not intend to comment further on market speculation or disclose any developments unless and until it otherwise deems further disclosure is appropriate or required,” the statement read.

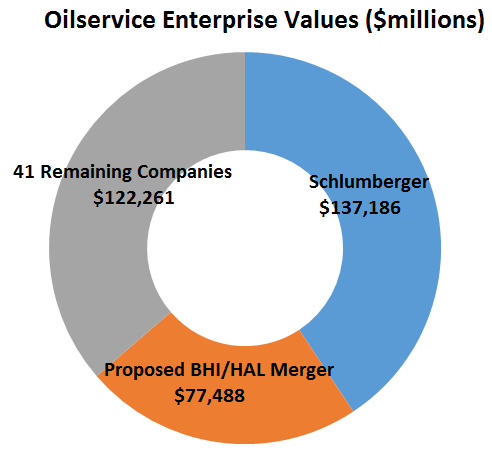

HAL and BHI hold enterprise values of approximately $51 and $26 billion, respectively, according to EnerCom’s OilService Weekly report. The two giants are the second and third largest oilservice companies in the world, trailing only Schlumberger (ticker: SLB) and its enterprise value of $137 billion. The three companies together make up approximately 64% of the entire oilservice sector in EnerCom’s report, which consists of 44 companies.

If completed, the combination will be the second largest energy deal of the year behind Kinder Morgan’s consolidation of its MLP subsidiaries – a deal amounting to roughly $140 billion.

If completed, the combination will be the second largest energy deal of the year behind Kinder Morgan’s consolidation of its MLP subsidiaries – a deal amounting to roughly $140 billion.

Department of Justice May be a Huge Hurdle

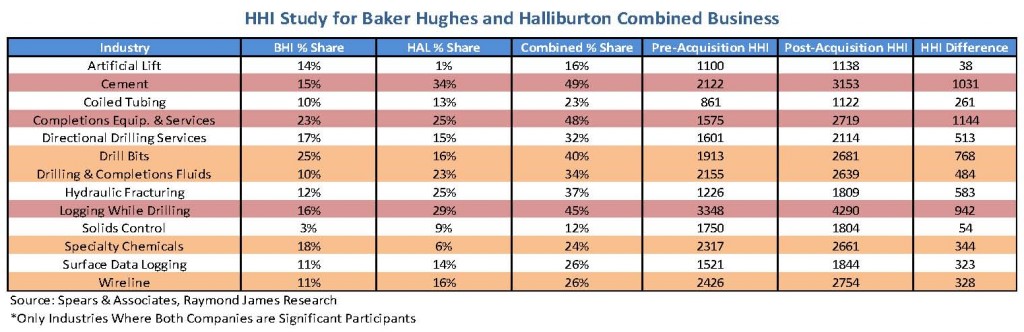

A common point of several analyst write-ups concerned reaction from the Department of Justice. Raymond James preceded any statements regarding the merger with the word “potential” four different times in as many sentences in a note on November 14. “While the merger of two of the largest players in the oil service arena would cause a significant shift to the oil service landscape, it would unsurprisingly face a significant amount of scrutiny from the Department of Justice,” says the note. “As demonstrated below [with the Herfindahl-Hirschman Oilservices Index (HHI)], we expect the DoJ to place scrutiny on a number of segments. The market segments that screen the most concerning by this metric are Cementing, Completions Equipment and Services, and Logging While Drilling.”

Benjamin Schuman, an analyst with Drexel Hamilton LLC, agreed in an interview with the Associated Press. “They would be so dominant that you may even see some pushback… Folks could be concerned. You could have one player with close to 40 percent market share if nothing is divested or shut down.”

Raymond James says the two companies are so massive there will certainly be considerable overlap. Halliburton would also gain a much greater share in the United States and a rough estimate on synergies estimates value “north of $1 billion.”

A comparison by 24/7 Wall Street said the HAL-BHI combination would likely top Schlumberger’s revenues but not match its profitability. “That’s where the magic word — synergies — comes in, and we could expect to see some sizeable cuts to headcounts. Halliburton reports 80,000 employees and Baker Hughes reports 61,100 for a total of 141,100. Schlumberger reports 123,000 employees. That offers some idea of where more profits will have to come from.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.