U.S. coal exports continued to decline from record volumes in 2012, according to an EIA report out today.

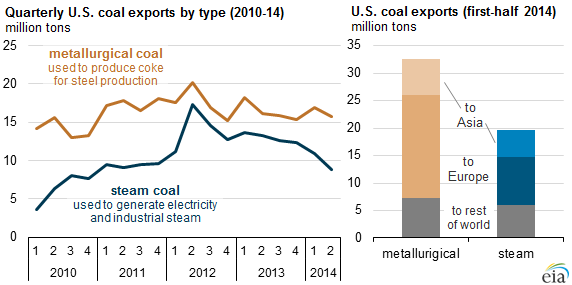

In the first half of 2014, U.S. coal exports were at 52.3 million short tons (MMst), down 16% from the export levels in the first half of 2013. The EIA attributes the drop to reduced demand for steam coal from Europe and Asia, combined with increased supply from Australia and Indonesia and increases in metallurgical coal supply from Australia, Canada and Russia.

Metallurgical coal production, primarily from the Illinois and Appalachian coal basins, represented less than 8% of overall production but 56% of total U.S. coal exports in 2013. Europe is the leading destination for metallurgical coal exports, followed by Asia. Together, these two regions accounted for nearly 80% of U.S. metallurgical coal exports in the first half of 2014.

Steam coal, used to generate electricity, but with applications at combined heat and power plants to produce steam used in industrial processes, accounted for more than 90% of domestic coal production. “During the first half of 2014, Europe received 8.8 MMst of U.S. steam coal exports, a drop of 7.4 MMst from the same period in 2013. Asia’s share of U.S. steam coal exports increased in 2014, but export tonnage to Asia decreased 2.4% from the first half of 2013,” the EIA reported.

In 2013, six U.S. ports shipped 89% of U.S. coal. Fifty-five percent shipped from Baltimore and Norfolk, while Houston, Mobile and New Orleans shipped 30%. Seattle accounted for 4%. Eastern and southern ports generally export metallurgical coal from the Illinois and Appalachian Basins.

Weekly average coal prices for the week ended September 26 were $54.50 per short ton for Southern Appalachia, $63.30 for Northern Appalachia, $43.40 for Illinois Basin, $11.25 for Powder River Basin and $37.00 for Uinta Basin coal.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.