The United States Department of Commerce said it has begun approving requests to sell light processed oil on the international market. The transactions, which now can be conducted by companies without government approval, pertain only to selling crude that has either been processed or refined. The export of raw crude is still outlawed.

The announcement, which Reuters describes as “wrapped in regulatory jargon and couched by some as a basic clarification of existing rules,” is a welcome sight to many in the energy industry seeking a broader market. Distillate crude was previously the only grade permitted for trade. The U.S. has exported approximately 400 MBOPD since August 2014. The rate of 420 MBOPD in early October is the most on record, according to the Energy Information Administration. Only two companies, Pioneer Natural Resources (ticker: PXD) and Enterprise Products Partners (ticker: EPD), are currently allowed to trade without government consent.

Reuters first broke the news on Tuesday, with sources saying the main U.S. export authority was telling certain companies to export condensate without formal permission. The authority was reportedly encouraging companies to “self-classify” their product in order to take advantage of a possible loophole in the oil embargo, which has outlawed crude trade since 1973. The majority of refineries in south Texas, America’s main oil hub, are equipped for heavy grade crude, leaving fewer options for the lighter grades.

API Backs the Move

The American Petroleum Institute (API), the largest trade association in the industry, published a 13-page document in November on the benefits of exporting America’s crude. “This is a new era for American energy, but our energy trade policies are stuck in the 1970s,” the report says. “The U.S. and China are the only major oil producers in the world that don’t export a significant amount of crude. It’s time to let free trade unlock more of the benefits of our energy abundance for U.S. consumers and further strengthen our position as a global energy superpower.”

Source: American Petroleum Institute

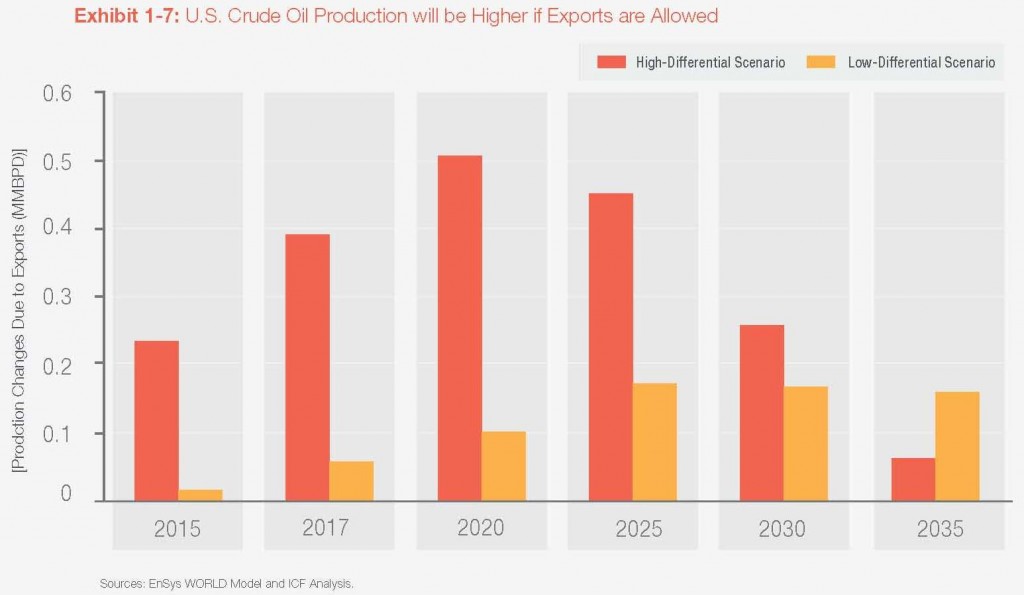

The report also explains the benefits of exporting the lighter crude in exchange for heavier crude in what would be a “swap” of goods, and a “net financial gain” for the U.S. Removing the ban would encourage an increase in production and not even affect the amount of imported crude, which is expected to decline into 2035 regardless of government action. The API said exports could exceed 2,000 MBOPD by 2017 if the ban is redacted – roughly five times greater than the amount today.

Another expected benefit is the stabilization of the global market. “Additional supply from the U.S. could help diversify the market, strengthening it and shielding against price spikes due to supply disruptions elsewhere in the world,” it says.

Daniel Yergin, Vice Chairman of IHS, supports the connection on a global scale and made the following comments prior to the recent developments: “Lifting the ban on crude exports would be a signal of U.S. commitment to global energy security. For four decades the U.S. government urged other countries’ free flow of energy but it didn’t matter that we had a ban on U.S. export of crude oil. But you know what, it matters now. … All the rationales for the export ban are gone, but the ban is still there.”

On Dec. 10, Oil & Gas 360® reported on a bill that was introduced in the U.S. House of Representatives by Rep. Joe Barton of Texas to end the ban on exporting crude oil.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.