At one of today’s sessions at the 2014 Natural Gas Symposium in Denver, hosted by Colorado State University’s Energy Institute, panelists discussed global implications of the abundance and accessibility of North American natural gas and how the shale revolution is changing the geopolitics of energy.

The panel looked at such things as how U.S. shale gas could affect global economic development, energy access in developing countries, and implications for the U.S. of deeper gas market integration with the rest of the world, principally from LNG exports.

Panelists included Pete Stark, Senior Research Director and Advisor, IHS; David Sandalow, former Under Secretary of Energy, now Inaugural Fellow at Center on Global Energy Policy at Columbia University; Christopher Smith, Principal Deputy Assistant Secretary for Fossil Energy, Department of Energy; and Andrew Ware, Director of Strategic Projects for Cheniere Energy.

The key to manufacturing growth, whether domestically or globally, is the cost of energy and accessibility to feedstocks, the panel said. Panel members went through the history of development of the vast natural gas and oil resources that the shale revolution has unlocked, estimating that U.S. shale production has reversed $1 trillion in oil imports into the U.S. And that “the unexpected surge in U.S. oil and gas production is quickly moving the country toward a surplus.”

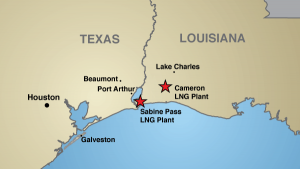

Cheniere Energy (ticker: LNG) Director of Strategic Projects Andrew Ware said the U.S. is a sleeping giant in the LNG markets. “We are giving LNG buyers something they’ve never had before—an alternative.” Ware discussed that the company’s Sabine Pass LNG export facility on the Gulf Coast will be the first U.S. LNG export plant in operation.

Cheniere Energy (ticker: LNG) Director of Strategic Projects Andrew Ware said the U.S. is a sleeping giant in the LNG markets. “We are giving LNG buyers something they’ve never had before—an alternative.” Ware discussed that the company’s Sabine Pass LNG export facility on the Gulf Coast will be the first U.S. LNG export plant in operation.

“Globally natural gas will be the fastest growing hydrocarbon in the world,” Ware said. “Gas versus coal in Asia is going to be a slugfest.”

Other panel members discussed shale development in China, but concluded the country is far behind North America in developing its own shale gas resources, leading to the need to import U.S. LNG. Chris Smith, who said he manages approval of LNG projects for the Department of Energy, gave some history of LNG in the U.S., noting the move to create destination facilities for LNG pre-shale, which was replaced by a move to create LNG export facilities post-shale. He said, “We want to help the Chinese achieve their [energy] goals.” Smith also said Africa is a developing region in need of cheap energy sources and that U.S. LNG could fill a need for those developing countries as well.

The discussion turned to how long the shale revolution will last. The panel said if production grows 30%-40% in 5-7 years and if it can be sustained at those levels for 30 years, the export role for U.S. LNG is clear.

Referring to the vast size of total shale gas resources in the U.S. shale basins, and the increasing volumes that the industry is learning how to extract with each well, Pete Stark summarized the situation as such: “The shale boom is only ten years old–we’re in the first inning of a nine inning ballgame.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.