The Brent/WTI spread disappears

Last Friday, Dec. 18, the United States Senate adopted the Omnibus Appropriations Act by a vote of 65-33 as did the House of Representatives by a 316-113 vote. Later that day, President Obama then signed into law the $1.1 trillion funding bill. Those actions brought an end to the 40 year old law that had banned exporting of U.S. crude oil, a ban that was in effect since the Arab Oil Embargo in 1974.

“The Arab Oil Embargo of 1973-74 caused long gas station lines, soaring fuel prices and rationing for American drivers. Member nations of the OPEC oil cartel cut off the U.S. for supporting Israel, and the U.S. responded by banning virtually all American oil exports. Oil imports into the U.S. nearly quintupled during the 1970s.” That is how the Wall Street Journal remembers the beginning of the oil embargo days that resulted in the U.S. government’s ban on exporting U.S. produced crude oil. As of Friday, that’s over.

So what happens next?

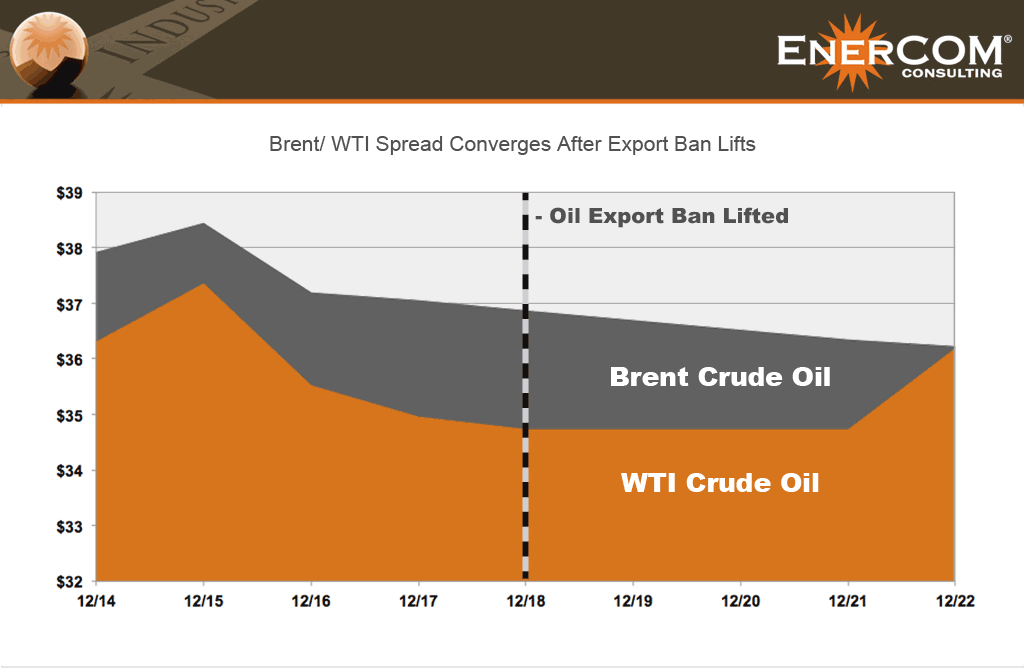

Oil & Gas 360® asked The Marwood Group’s Vice President of Energy Research Jeb Armstrong that question. Armstrong said the immediate impact would be to virtually eliminate WTI’s discount to Brent. Almost on cue, by the end of trading on Tues. Dec. 22, the two benchmark oil spot prices had converged.

While some of the U.S. refiners are complaining they expect to lose business if U.S. crude is shipped to overseas refiners, the gates to sell oil produced from the Williston, Permian and D-J basins have now been thrown open, and some forecasts of increasing mid-long term demand from India and other regions of Asia can offer a ray of hope for new markets, once the current global oil glut is worked through. OPEC, in summarizing its demand forecasts from its 2015 release of its annual World Oil Outlook (scheduled to be published on Dec. 23), said “Long-term demand is dominated by the developing Asia region, which accounts for 70% of the increase by 2040.”

Visit Oil & Gas 360® for the latest international oil and gas news and analysis, company reports, financial news and interviews with CEOs and global energy leaders.