The U.S. Census Bureau released the nation’s trade figures for September. Petroleum imports for September 2015 were $13.8 billion. This was the lowest since $13.6 billion recorded in May of 2004.

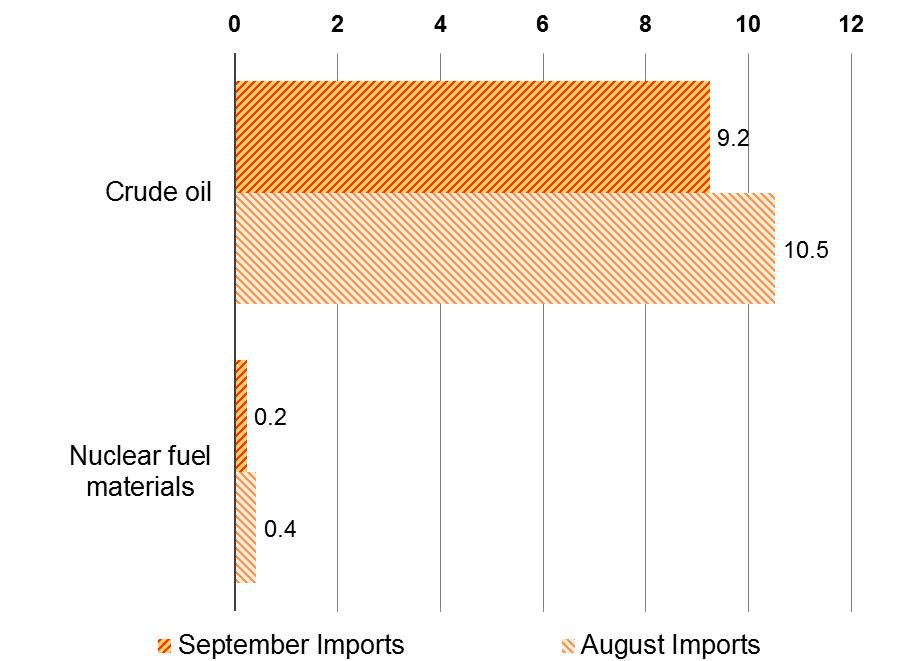

According to trade data published by the U.S. Census Bureau and U.S. Bureau of Economic Analysis – Economics and Statistics Administration – U.S. Department of Commerce, imports of industrial supplies and materials decreased $1.6 billion, reflecting decreases in crude oil ($1.3 billion) and in nuclear fuel materials ($0.2 billion). Note that the Commerce Department measures imports and exports in dollars, not barrels.

TOP DECREASES FOR IMPORTS OF INDUSTRIAL SUPPLIES AND MATERIALS

(BILLIONS OF DOLLARS)

Imports of Crude Oil in Aug. and Sept. 2015 – U.S. Dept. of Commerce – Measured in Billions of Dollars

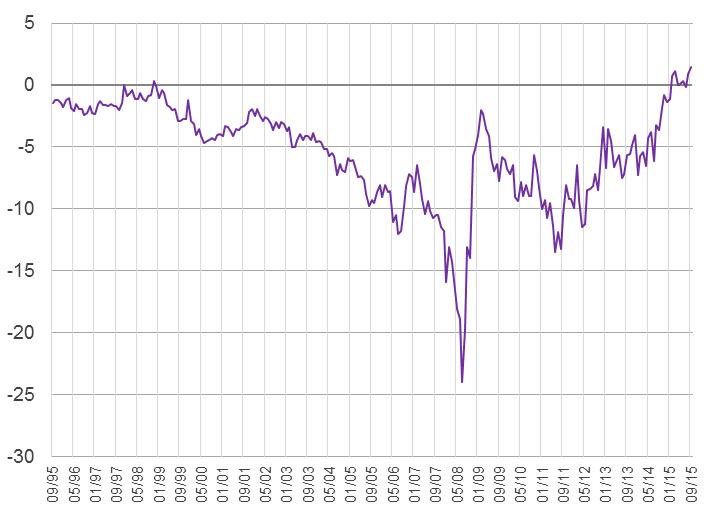

Trade Balance with OPEC

In reporting the trade data today, the Commerce Department made note of the overall balance of trade with OPEC members in the chart below.

BALANCE IN TRADE IN GOODS WITH OPEC MEMBERS

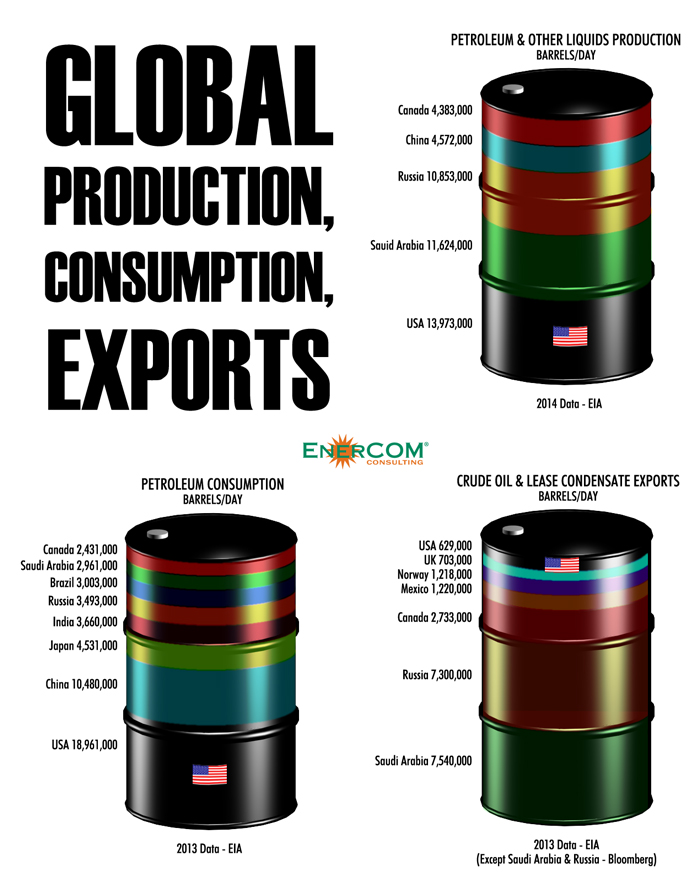

Petroleum Consumption, Production and Exports

On the petroleum side of the equation, the EnerCom graphic below looks at global production, consumption and exports of crude oil for the largest global contributors in each category. The graphic was compiled from the most recent full year data available for the countries shown, derived from EIA and other sources as noted.