The EIA’s Short-Term Energy Outlook shows declining production as prices drop

The U.S. Energy Information Administration (EIA) released its July Short-Term Energy Outlook (STEO) today, showing lower production in the month of July as prices continue their downward trend. The EIA reported that U.S. crude oil production declined by 100 MBOPD in July compared with June. Production is expected to continue decreasing through mid-2016 before growth resumes late next year, according to the EIA.

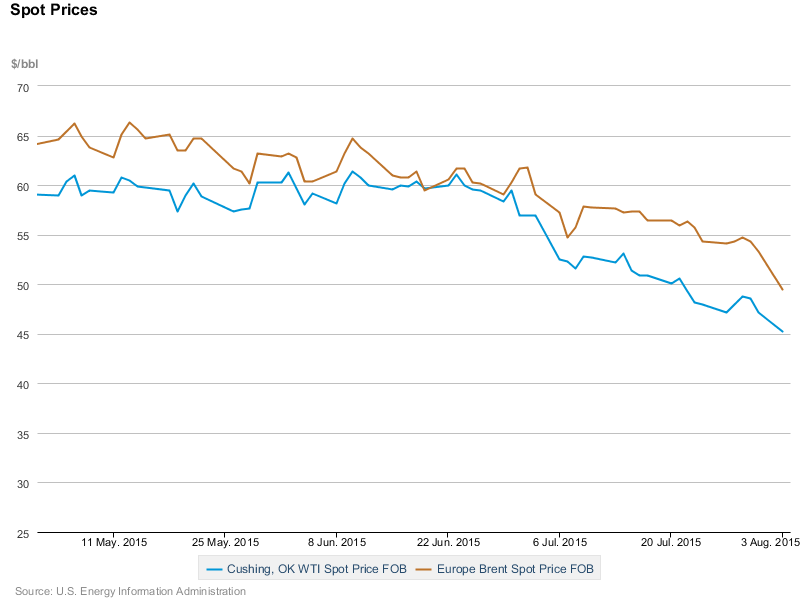

The crude oil glut has pushed prices down globally, with the EIA reporting both Brent crude and West Texas Intermediate losing value from June to July. Brent prices averaged $57/bbl in July, a $5/bbl decrease from June, and fell further to $48/bbl in August. WTI continued its slide today, shedding $1.71 of its value and closing at $43.25 per barrel.

The EIA forecasts that Brent crude oil prices will average $54/bbl in 2015 and $59/bbl in 2016, $6/bbl and $8/bbl lower than in last month’s STEO, respectively. The current values of futures and options contracts for November 2015 delivery suggest the market expects WTI prices to range from $34/bbl to $64/bbl in November 2015, according to the EIA.

Production roll-over

Prices have continued to feel downward pressure as the global market struggles to absorb production that continues to rise from OPEC and other parts of the world. OPEC reported production of 31.51 MMBOPD in July, an increase of 101 MBOPD, in its Oil Market Report earlier today.

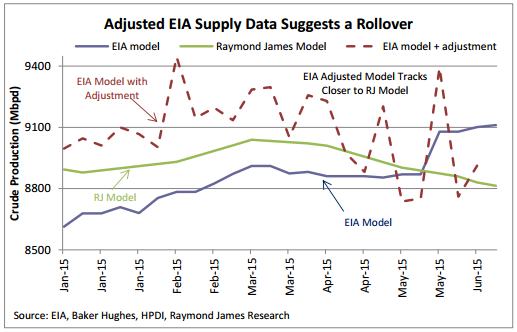

As production from OPEC countries continues to climb, U.S. production may have rolled over in March. On July 31, the EIA released data that showed U.S. production hit a 44-year high of nearly 9.7 MMBOPD in March, but declined to 9.5 MMBOPD by the end of July.

This follows estimates made by Raymond James that predicted more accurate numbers from the EIA would show a production rollover in March. The EIA uses a plug number to balance missing production. While that number likely stems from chronic underreporting of demand, the EIA’s data in recent months suggests the administration has been overstating supply.

Gasoline prices down $0.82 year-over-year

U.S. regular gasoline average retail prices averaged $2.79/gallon in July, a decrease of $0.01/gal from June, and $0.82/gal lower than in July of last year. The EIA expects gasoline prices to fall further, averaging $2.11/gal in the fourth quarter of the year. The administration expects gasoline prices to average $2.41/gal for all of 2015.

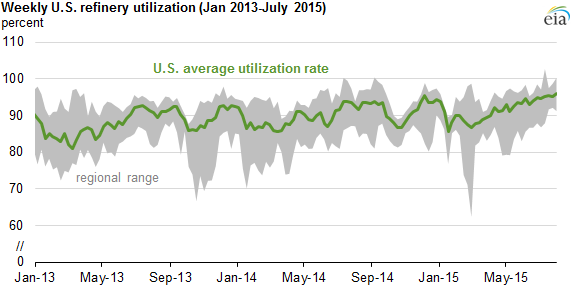

High demand for gasoline has supported record high gross inputs to U.S. refineries, which reported more than 17 MMBOPD of input in each of the past four weeks. Gasoline crack spreads reached $0.66/gal on July 8, a level not seen since September 2008.

The EIA expects that demand for gasoline will taper off, bottoming out at about 15.8 MMBOPD in the first quarter of 2016, before increasing through next summer to even higher levels. Refinery runs tend to be highest in the second and third quarters of the year when demand for gasoline tends to be at its highest to support summer driving.