U.S. unemployment continues to drop while oil and gas industry sheds jobs

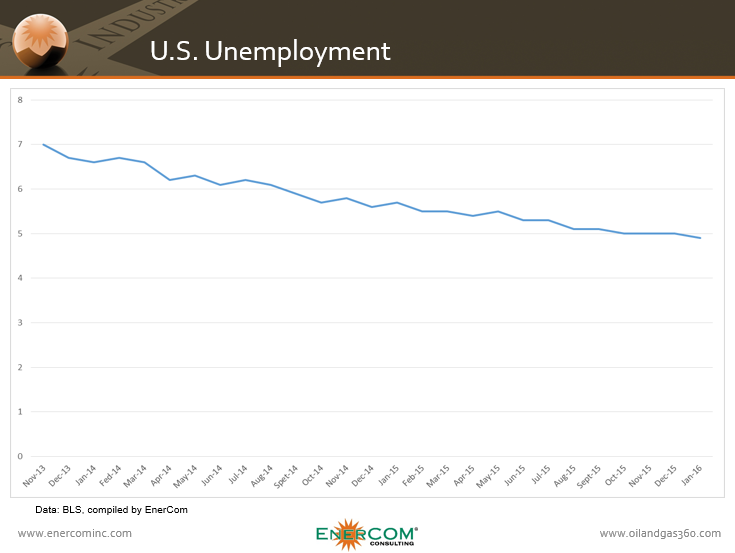

The U.S. economy added 151,000 jobs in January, according to the latest release from the Bureau of Labor Statistics. The additional jobs pushed unemployment below the 5% mark for the first time since February 2008, just before the collapse of Bear Stearns and the financial crisis.

The job growth in January was sluggish compared to the three months prior, when the U.S. economy added enough jobs to make 2015 the second-best year for job creation since the late 1990s. The slower job growth at the beginning of this year could keep the Federal Reserve from raising rates again until the middle of the year, reports The New York Times.

“I don’t think 151,000 jobs added last month takes a Fed rate hike off the table this year, but it probably does push the next one off until June at the earliest,” said Scott Anderson, chief economist at Bank of the West in San Francisco.

“The headline number was a bit of a disappointment but not too bad, and the rest of the report suggests steady improvement,” said Michael Hanson, a senior economist at Bank of America Merrill Lynch. “The financial markets are leery, but the labor market still looks like it’s continuing to grow.”

Average hourly earnings continued to rise last month, increasing by 0.5%, leaving wages up 2.5% over the last 12 months.

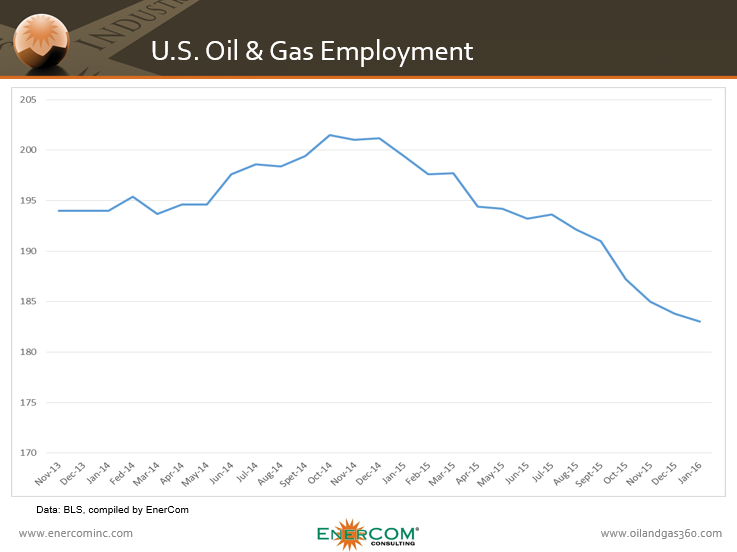

The oil and gas sector did not enjoy the same growth as the wider economy, however. The preliminary numbers from the BLS showed the sector’s total employment fell to 183,000, down 8% from January of last year. The BLS also revised its December numbers down, showing oil and gas lost 1,200 jobs between November and December.