The UAE is looking to use enhanced oil recovery to increase production moving forward

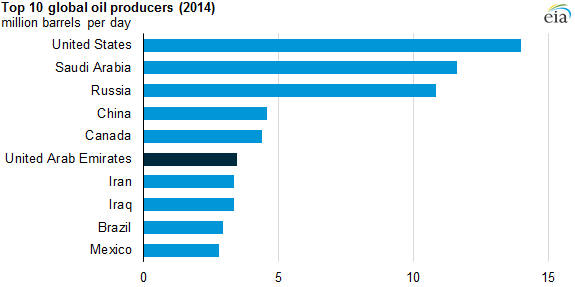

The United Arab Emirates (UAE) is looking to enhanced oil recovery (EOR) to push its production higher as the chances of finding new reserves decrease. OPEC’s second-largest producer of petroleum and other liquids, and the world’s sixth-largest oil producer, hopes to expand production by 30% by 2020 through the use of EOR, according to the Energy Information Administration (EIA).

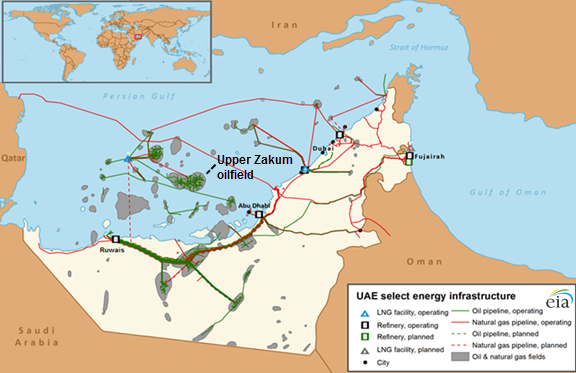

The Upper Zakum oilfield – the second-largest offshore oilfield and fourth-largest oilfield in the world, according to the EIA – is one of the primary targets of the UAE’s EOR program. The Upper Zakum currently produces about 590 MBOPD, but the Zakum Development Company signed an $800 million engineering, procurement and construction contract to Abu Dhabi’s National Petroleum Construction Company in July 2012 with the goal of increasing production by 27% to 750 MBOPD in 2016.

The UEA also hopes to increase production from the Lower Zakum by 23% to 425 MBOPD. The lower field currently produces 345 MBOPD.

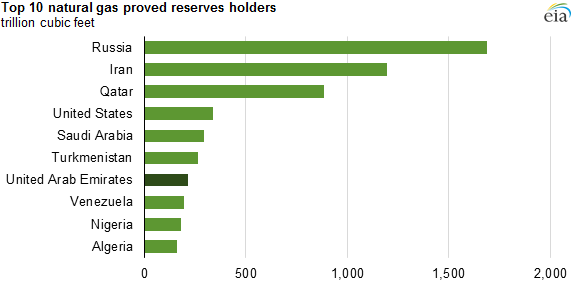

The UEA uses its extensive natural gas production to facilitate its EOR, with 30% of the country’s 2012 natural gas production going towards EOR in the UAE’s oilfields. The UAE produced approximately 1.9 trillion cubic feet (Tcf) of natural gas in 2013. The country’s natural gas reserves stand at 215 Tcf, the seventh-largest in the world. Despite the size of the country’s reserves, it became a net-importer of natural gas in 2008 due to the heavy use of domestic production in EOR and the country’s growing demand for natural gas in gas-fired electrical generation.

The UAE has struggled to develop its own natural gas reserves due to difficulties associated with processing the gas, which has a relatively high sulfur content. Advances in technology and growing demand have made the UAE’s reserves an economic alternative to imports, and UAE has several ongoing projects that will increase the country’s production in coming years.