Wilcox Horizontals Maintaining Rates 210 Days After First Production

Unit Corporation (ticker: UNT), a Tulsa-based exploration and production company with subsidiaries in midstream and contract drilling, provided additional detail on its premier oil and gas assets in its Q3’15 earnings release on November 3, 2015.

The company released a guidance update about one month ago, forecasting a year-over-year production increase of 6% to 8%, up from its initial range of 2% to 4%. In addition to the guidance increase, UNT expects costs on the E&P segment to be $30 million lower on the year due to greater efficiencies. Unit management believes it will close the year on the high end of its guidance range, while some analyst firms, including Capital One Securities and KLR Group, expect the company to surpass its expectations.

SOHOT, Wilcox Exceeding Expectations

Unit plans on running two rigs through Q1’16, with one in its Southern Oklahoma Hoxbar Oil Trend (SOHOT) and the other in the Wilcox Play in Southeast Texas.

Targets in the SOHOT area consist of the Marchand and Medrano formations, with the former being a near-term target due to its oily makeup. To date, three Marchand wells have been completed with average 30-day rates of 1,345 BOEPD (90% liquids) and are exceeding its 480 MBOE type curves by 7%. Nine Medrano wells have returned 30-day averages of 7.0 MMcfe/d (71% gas). Overall production from the region averaged 6,574 BOEPD in the quarter, representing a year-over-year increase of 186%.

In the Wilcox area, production climbed 18% sequentially to 82 MMcfe/d as new horizontal and vertical completions were brought online. Five vertical wells were completed, bringing its 2015 total to 13 wells (three horizontal). The Wing Unit #14 vertical well was flowing 8.6 MMcfe/d upon completion in September at costs of $4.6 million.

UNT management discussed its three Wilcox horizontals at length in a conference call following the release, with its first well (completed in March) producing an average of 12.5 MMcfe/d. Its volumes increased as the year moved along, ultimately reaching 16.4 MMcfe/d after 120 days online. The 16.4 MMcfe/d output continues today, 210 days after it was first brought online.

Its second well in the region had similar results, with initial volumes of 12.9 MMcfe/d upon its completion in May. After 150 days online, the volumes are at 12.8 MMcfe/d. KLR Group estimates the two wells should provide internal rates of return of 80% to 100%.

Its third well, a short lateral of only 1,400 feet, was brought online in January with volumes of 11.4 MMcfe/d and continued to produce 6.4 MMcfe/d after 120 days of production due to the length of the lateral. KLR believes the well should generate a 50% internal rate of return.

“There’s a little difficulty in predicting the EURs because the wells, at this point, still have flowing pressure above what line pressure is,” said Brad Guidry, Senior Vice President of Exploration, in the call. “Until those two pressures match, you really shouldn’t see a whole lot of decline on those wells, so where you project that out to is still a little bit questionable at this point. So the range, it’d be very economic, but we have not put out anything on EURs yet.”

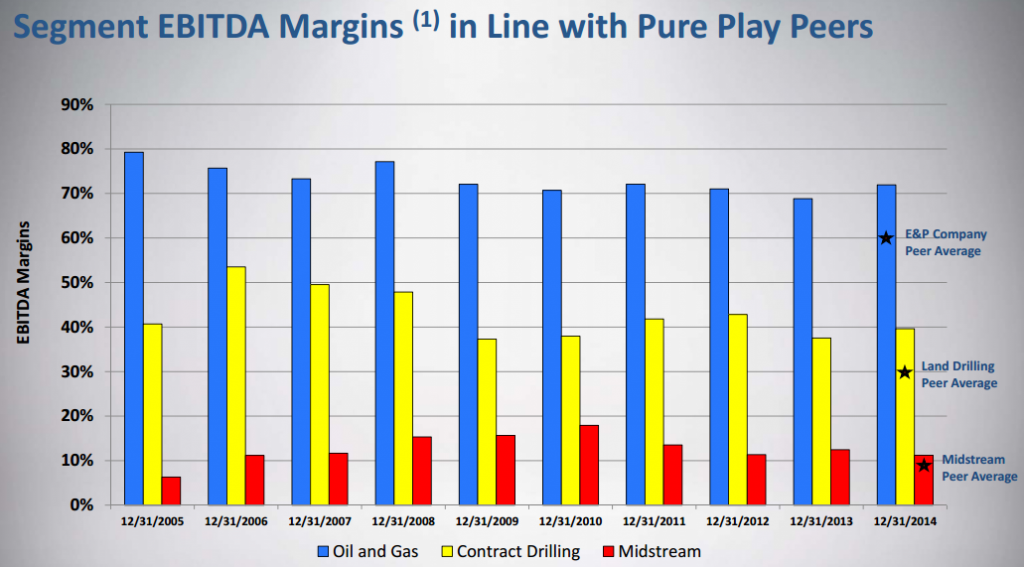

Unit estimates as many as 120 locations remain in the core of the SOHOT, while the Wilcox has gross resource potential of 440 Bcfe – of which only 13% has been produced to date. The general affordability of these plays, combined with what is expected to be an early stage of their life span, measures Unit favorably against its competitors in EnerCom’s E&P Weekly Benchmarking Report. Its asset intensity (defined as the percentage of every EBITDA dollar required to maintain a flat production rate) is 59%, well below the industry median of 88%.

Financial Situation

For the quarter ended September 30, 2015, Unit holds $908.2 million of long-term debt and a reaffirmed borrowing base of $550 million, of which $261.7 million is drawn. Its elected commitment is $500 million, which the company believes “will meet its financing needs during this current commodity cycle.”

Unit previously had a borrowing base of $725 million but has maintained its $500 million commitment, meaning the recent redetermination will not affect its plans. “I wouldn’t say anybody was overly concerned with Unit’s leverage, but it’s certainly reassuring that their committed level was not impacted,” said Brian Velie, Equity Analyst for Capital One Securities, in a previous interview with Oil & Gas 360®.