California gas prices $0.95 above national averages

Nationally, the average price of a gallon of gas is just $2.77. But the average price in California is $3.72, with average prices in the L.A. area even higher at $4.05/gal, the Automobile Club of Southern California told the LA Times.

Problems with refining, along with California’s stricter rules for gasoline, have sent consumer gasoline prices soaring. The Tesoro Corp. (ticker: TSO) refinery in Carson recently reduced its refining capacity to perform maintenance, following a decision in February to idle its refinery in Martinez after union walkouts. An ExxonMobil (ticker: XOM) refinery also had to reduce its output following an incident that damaged an air pollution monitoring unit.

“This is a complete disconnect with the rest of the country,” said Tom Kloza, global head of energy analysis for the independent Oil Price Information Service. “This really is illustrative of the fact that California is its own market.”

California gasoline prices are normally about $0.70/gal higher than in the rest of the country just from taxes and other fees, according to the LA Times. The state requires that motor vehicles use a special, low-pollution blend that few refiners outside the state are able to produce, making the effect of the closed refineries disproportionately large on regional gas prices.

The rest of the U.S. sees lowest gasoline prices in six years

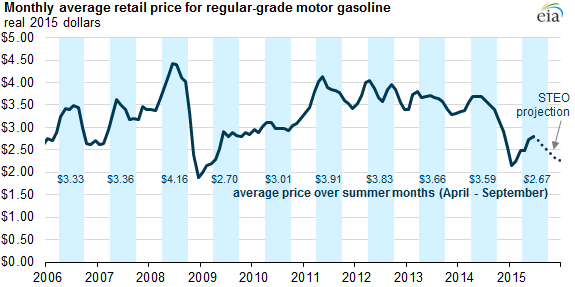

While California drivers get hammered by high gas prices, the rest of the U.S. is expecting average retail gasoline prices for this summer (April through September) to average $2.67/gal. When adjusted for inflation, anticipated gasoline prices for this summer will be the lowest since 2009, according to the Energy Information Administration (EIA).

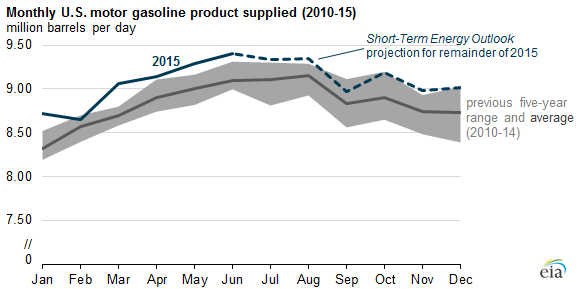

Travel and gasoline consumption are expected to be higher this summer compared to levels in 2014, according to the EIA. Gasoline consumption is expected to increase by 194 MBOPD, up 2.1% from last summer.

Vehicle miles traveled is expected to be up 2.2% from the summer of last year, the largest year-over-year increase in 11 years. With disposable income 3.6% higher than last summer in real dollars (adjusted for inflation), higher employment, stronger consumer confidence and low oil prices, the EIA expects U.S. drivers to take to the roads in greater numbers.

This summer should also see a large draw on motor gasoline and gasoline blending components, according to the EIA. Primary inventories of finished motor gasoline and gasoline blending components began the summer season 10.7 MMBO above the five-year average, and are expected to end the season 3.7 MMBO above the average. The projected 14.3 MMBO draw is 70% larger than last year’s draw of 8.4 MMBO, which the EIA anticipates will translate into a 62 MBOPD decline in the net imports of gasoline and blending components.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.