VAALCO Energy, Inc. (ticker: EGY) reported net income of $3.1 million ($0.05 per diluted share) in its Q3’14 earnings release, but the company is already anticipating results for the fourth quarter. The independent energy company based in Houston, Texas, is escalating its operations across the Atlantic Ocean in West Africa and expects near-term catalysts to be reflected on its year-end results.

“Our results this quarter were impacted by lower prices and reduced liftings due to scheduled maintenance performed by the operator of our FPSO facility located offshore Gabon,” said Steve Guidry, Chief Executive Officer of VAALCO Energy, in a conference call following the announcement. “More significantly, the operational progress we made during the quarter is expected to provide for increased production in future periods as our new development wells come on stream.”

Operational Update

EGY operates in three areas of West Africa: Gabon, Angola and Equatorial Guinea. Approximately 89% of its 2,500,000 gross acreage (884,000 net) is located offshore. Gross production totaled 16,ooo BOEPD (3,900 BOEPD net) for the quarter, coming entirely from its Gabon segment.

In Gabon, two new production platforms contracted from Transocean (ticker: RIG) arrived in its offshore Etame Marin block and have been installed as scheduled. The first of six development wells commenced drilling in October 2014, and first oil is expected no later than December. Once the six wells are complete, a seventh targeting dry gas will be drilled and tied into the existing wells to serve as a power source, eliminating the need for diesel while cutting back on operating costs.

EGY is currently weighing options for bringing its two Ebouri field wells back online and expects a final decision by Q1’15. Production is expected to be re-established by 2H’17. Another well was temporarily shut in due to pressure issues. Onshore, EGY continues to work with its concession partner, Total Gabon, to finalize a production sharing contract with the government of Gabon.

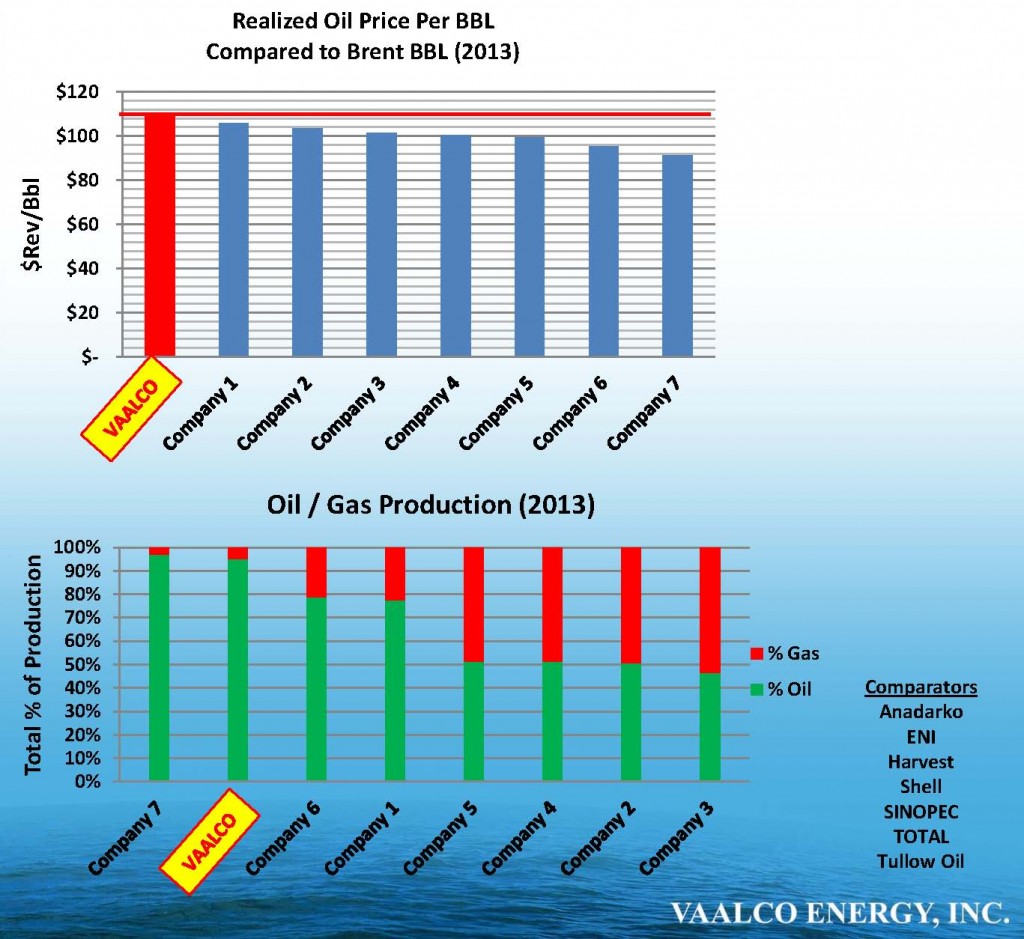

Source: EGY 10/14 Presentation

A contract for Block 5 in Angola was ratified on October 24, 2014. Per the terms of the agreement, EGY must drill four exploration wells prior to November 30, 2017. A 3D seismic program covering 1,058 square kilometers has already been conducted and the results are being analyzed. Drilling of the first well is expected to commence in December 2014 and will test the post-salt layer. The Kindele well, as mentioned by management, is an offset well to a 20-year old discovery made by Conoco (ticker: COP) which yielded 1,100 BOEPD. Drilling time is expected to take 41 days with a net cost of $19 million to VAALCO. An April 2014 discovery by Cobalt International (ticker: CIE) in the nearby Kwanza pre-salt formation returned an initial production rate of approximately 6,500 BOEPD and is believed to hold 550 MMBO at its midpoint.

Offshore Equatorial Guinea is in the early stages and EGY (31% operating interest) is currently coordinating with the country’s energy ministry, along with operator GEPetrol, to finalize a joint ownership model. Long term plans are projecting first oil in 2017 with production of approximately 11,000 BOEPD.

Source: EGY 10/14 Presentation

Q3’14 Financial Results

VAALCO operated at a net profit in the quarter despite being impacted by lower realized oil prices and scheduled maintenance. Revenues totaled $24.5 million for the three month period and $104.6 million for the nine months ended September 30, 2014. The 2014 net income to date equates to $0.36 per share – an increase compared to $0.29 for the period in 2013, which actually saw greater revenue but was offset by higher income tax prices.

Management said the lower commodity prices may affect longer term projects but its near-term plans will continue as scheduled. “Certainly all markets have changed significantly, but VAALCO and our balance sheet remain as strong as ever,” said Guidry. “We maintain a high level of confidence in the economic viability of the work activity on the Etame Marin investments, offshore Gabon, even at somewhat lower prices than what we’re seeing today.”

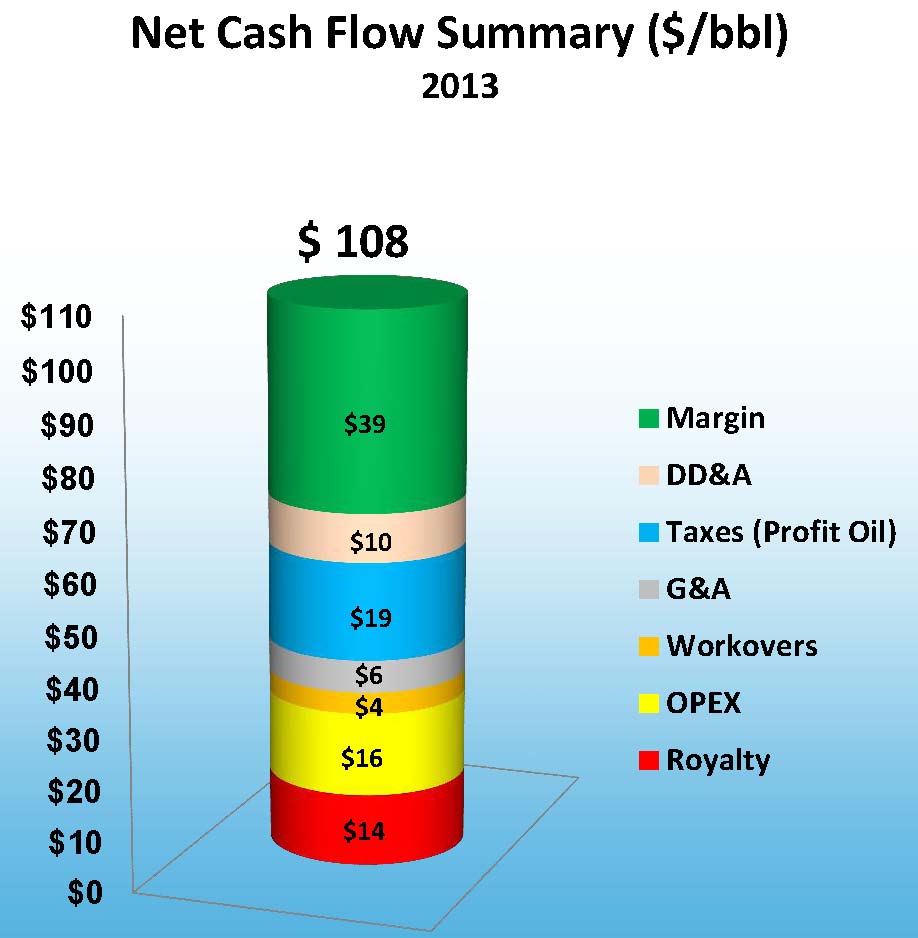

As discussed in OAG360’s “Introduction to VAALCO” article in May, EGY is a shareholder friendly company with reliable cash flows and zero debt. The company still generates the greatest trailing twelve month (TTM) cash margin/BOE ratio in EnerCom’s E&P Weekly Database, which consists of 84 of EGY’s peers. TTM cash margin/BOE is, defined as TTM oil and gas sales (less the effects of realized derivatives) minus LOE, production taxes, transportation expense, G&A and net interest all divided by TTM production. VAALCO’s current margin is $77.86/BOE, approximately 28% above the second-place company and roughly 270% above the median of $28.84.

VAALCO reported unrestricted cash flow of $133.5 million as of September 30, 2014, with an IFC credit facility of $15 million. The company believes its current cash is sufficient to fund operations for the remainder of 2014, which is expected to total $99 million for the full fiscal year.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.