VAALCO Energy, Inc. is a Houston based independent energy company principally engaged in the acquisition, exploration, development and production of crude oil. VAALCO places high emphasis on international opportunities and holds acreage in Gabon, Angola and Equatorial Guinea in West Africa. A total of 2,500,000 gross acres (884,000 net) are in EGY’s portfolio, with the majority (roughly 89%) located offshore.

VAALCO serves as the operator in Gabon and Angola, and holds working interest (WI) ranging from 28% to 40% across all of its properties. Approximately 98% of its production stream is oil. The company holds 14.4 MMBO in total reserves, and half (7.2 MMBO) are in the proved category, according to a report conducted by Netherland, Sewell & Associates.

Gabon Operations

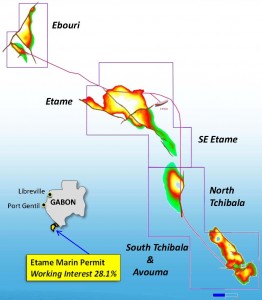

VAALCO engages in both onshore and offshore operations in Gabon. Its onshore properties consist of 270,000 gross acres (111,000 net) with a 41% working interest (WI), while its offshore properties span 760,000 gross acres (213,000 net) with a 28% WI.

Source: EGY April 2014 Presentation

VAALCO’s offshore fields in Gabon are its only producing asset. Gross production is currently 18 MBOPD and the construction of two new platforms is underway. The Etame platform is expected to come online and spud its first well in 2H’14. Estimates believe the platform will develop 10 MMBO of gross incremental reserves and six development wells are scheduled to be drilled once operations commence. The SEENT platform will come on slightly later, with the first well expected to be spud in 2015 with plans to develop 7 MMBO of gross reserves. As of March 31, 2014, the platform was 95% complete and the deck sections were 70% complete. Installation costs are $325 million per platform ($91 million net to VAALCO).

VAALCO, in addition to fellow operators like Shell (ticker: RDS.B) and Total (ticker: TOT) continue to work with the government of Gabon with potential industry changes. New proposed petroleum laws include the country’s national oil company taking a 15% stake in all new projects and mandating 90% of all energy sector jobs be held by locals. The law was supposed to be enacted in 2014 but has since been delayed to 2015.

Onshore Gabon, EGY has one discovery well which was drilled in Q4’12 and found 49 feet of net oil pay. EGY and its concession partner, Total Gabon, are in the process of submitting a Plan of Development to the government.

Could West Africa Hold a Libra Field (Brazil’s Giant Oil Field)?

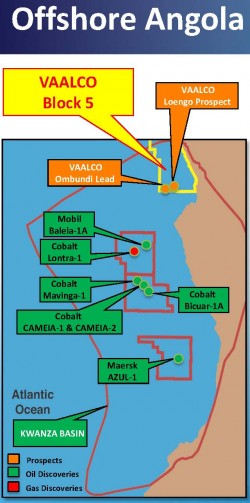

EGY’s other two areas of interest are in Angola and Equatorial Guinea.

Angola’s geology is similar to Brazil and contains the same pre-salt systems, according to geologists of Petrobras (ticker: PBR). Marcio Mello, president of the Brazilian Association of Petroleum Geologists, said: “What exists in Brazil exists in Angola, even the rocks containing oil are the same. It’s a certainty, not a possibility. Giant deposits will be found there.”

Source: EGY April 2014 Presentation

The Libra Field offshore Brazil is expected to hold 8 billion to 12 billion BOE. A handful of companies, including TOT and RDS.B, paid PBR a total of $7 billion for rights to the massive project. Drilling is expected to commence in 2H’14 and conclude by mid-2015.

EGY’s Angola position spans 1.4 million gross acres. EGY holds a 40% working interest in the region – amounting to 560,000 net acres. The company holds long-term plans to drill two exploration wells and is currently in discussions to extend the time frame on its exploration permit by three years. The current date has implied a mandatory spud date of November 30, 2014, and EGY has a rig under contract if the company elects to accelerate its program.

“This is a post-salt test,” said Steve Guidry, Chief Executive Officer of VAALCO Energy, in a conference call with investors and analysts. “So it definitely has the characteristics of being one of our higher probability success wells.”

Exploration operations in Equatorial Guinea cover 57,000 gross acres, or 18,000 net if EGY’s 31% working interest is considered. The company is currently in discussions with GEPetrol to develop a joint operatorship model and two exploration wells are expected to be drilled by the end of 2015.

Guidry said: “We previously expressed interest to supplement our exciting exploration growth with an effort to acquire new opportunities in West Africa, which would provide balance to our growth portfolio. That effort continues as we are reviewing discovered, undeveloped, shallow water and onshore resource opportunities across all of West Africa from Cote d’Ivoire to Namibia.”

Catalysts

At the time of its Q1’14 earnings release on May 8, 2014, VAALCO held cash and cash equivalents of $93.7 million. The company received a loan agreement for $65 million in January but none has been withdrawn from its credit facility. In fact, the company has no debt on hand. Management said its capital expenditure program of $117 million is sufficiently funded for the remainder of 2014.

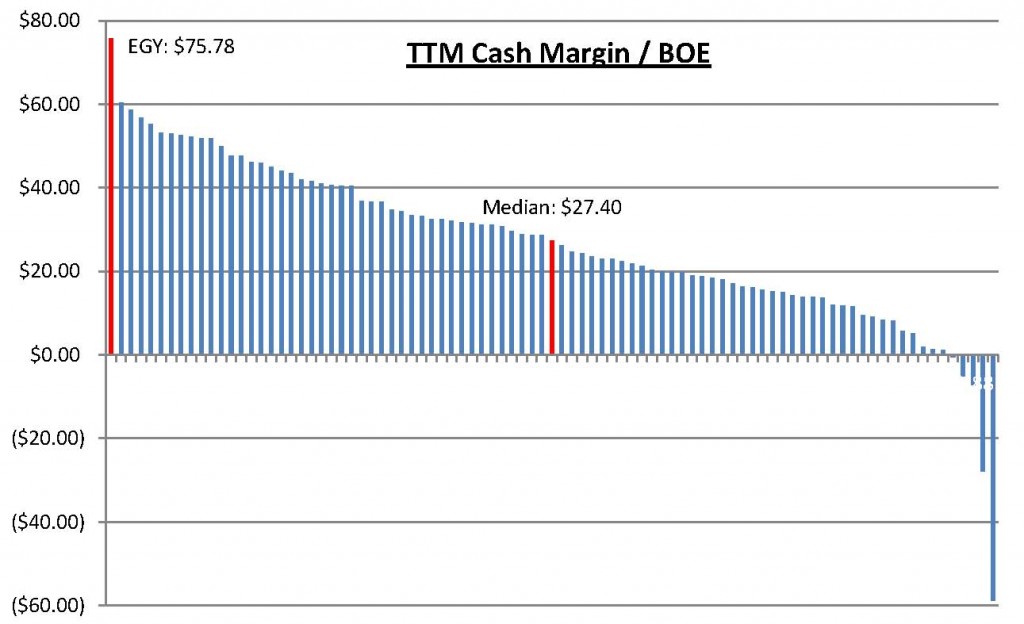

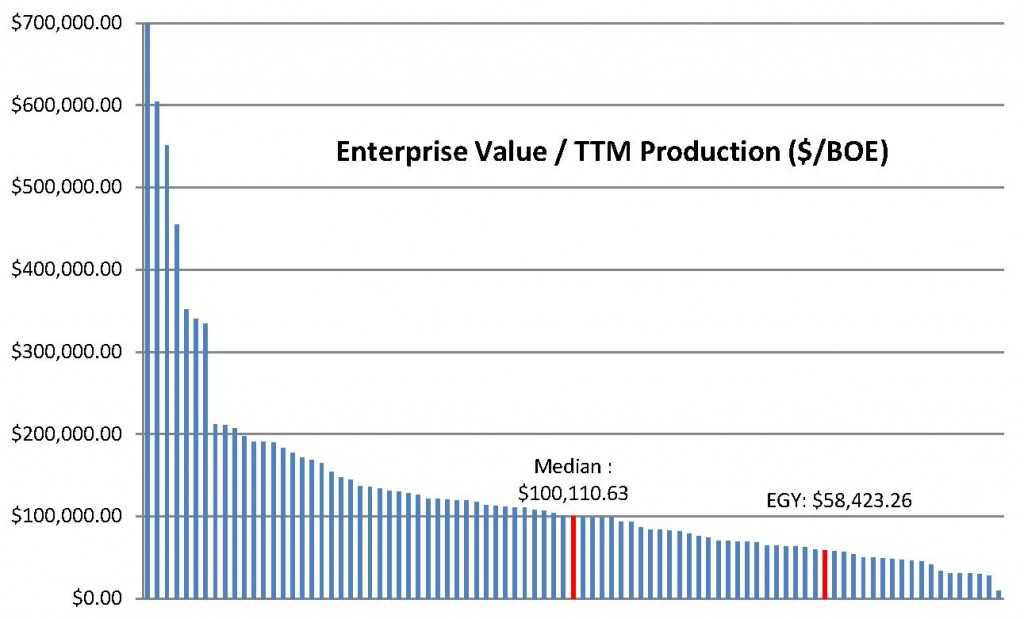

According to EnerCom’s E&P database, VAALCO has the highest cash margin/BOE on a trailing twelve months basis of any of the 88 companies in the database. TTM cash margin/BOE is defined as TTM oil and gas sales (less the effects of realized derivatives) minus LOE, production taxes, transportation expense, G&A and net interest all divided by TTM production.

Its $75.78/BOE is 26% higher than the second highest company whose margin is $60.31/BOE.

However, on EGY’s enterprise value / TMM production on a $/BOE basis is below the median. The metric assigns a market-based valuation per flowing unit of production. The company’s enterprise value/cash flow per share trades at a 3.7x multiple, which is below the peer median of 6.0x.

Q1’14 Results

EGY reported a net loss of $7.0 million for the quarter ended March 31, 2014. One drilled well was determined by EGY to not be commercially viable and resulted in a $9.7 million expense resulting from the dry hole. The company also lifted four wells in the quarter, and management said the third lifted well was lifted one day following the time frame for Q1’14. “Had the third lifting occurred one day earlier, our revenues would have been higher in the first quarter by approximately $8 million,” said Greg Hullinger, Chief Financial Officer of VAALCO.

“With our production having returned to normal levels after the March turnaround, we are very confident that we will see strong second quarter performance, said Guidry in the call. “We think that VAALCO is moving in the right direction and the increasing rate of progress that we’re making on projects we find particularly exciting.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. An EnerCom, Inc. employee has a long only position in Shell and Petrobras.