Expects to Significantly Expand its Midstream Business Long Term

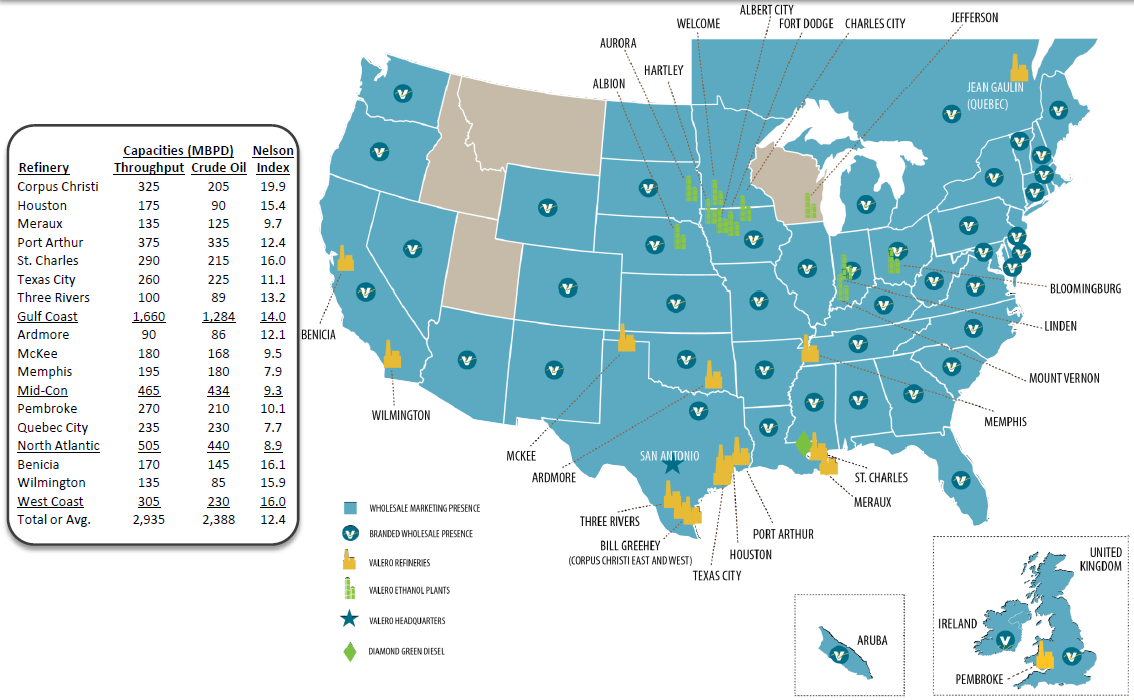

Valero Energy (ticker: VLO), the largest refiner in the United States with throughput capacity of 2.90 MMBOPD, reported net income of $964 million, or $1.87 per share, in its Q1’15 results on April 28, 2015. The results are a record for VLO’s first quarter operations and are 16% higher than Q1’14 but are about 20% lower than Q4’14’s results of $1,200 million.

Valero operated at 92% capacity in the quarter, in line with total U.S. utilization rates. Management says the majority of its refineries has completed maintenance and will be available to capture additional volumes on the market. Throughput volumes are expected to fall in the range of 2.72 to 2.83 MMBOPD in Q2’15, up slightly from Q1’15’s total average of 2.70 MMBOPD.

Brent Prices an Asset

The company realized throughput margins at $12.39 per barrel, down slightly from Q4’14 but about 14% higher than Q1’14, due to the lower costs of Brent crude and natural gas. The margins were partially offset by the lower prices of sweet and sour crude grades but still represented a greater margin spread. Its greatest operating income per barrel came from operations in the North Atlantic due to cold weather and the strength of the U.S. dollar compared to the euro. Total cash operating expenses per barrel remained below the $4.00 mark for the 12th straight quarter.

The natural gas declines are apparent in VLO’s ethanol segment, which reported Q1’15 operating income of $12 million – in line with Q4’14 totals. However, ethanol income in Q1’14 was more than 20 times greater due to traditionally higher gasoline prices. Henry Hub prices have dropped nearly 45% in that time frame.

The natural gas declines are apparent in VLO’s ethanol segment, which reported Q1’15 operating income of $12 million – in line with Q4’14 totals. However, ethanol income in Q1’14 was more than 20 times greater due to traditionally higher gasoline prices. Henry Hub prices have dropped nearly 45% in that time frame.

Balance Sheet

As of March 31, 2015, VLO has $2.0 billion in cash with $7.4 billion in total debt, equating to a debt to capital ratio of 20.3%. Total stockholder equity is about $20.7 billion including about $10 billion in available liquidity. The company returned $531 million in cash to shareholders in the quarter through dividends and stock buybacks – a 55% payout to earnings ratio, on track to exceed 2014’s ratio of 50%.

Its 2015 capital program is unchanged at $2.65 billion, including $1.15 billion for growth investment.

Valero plans to drop down $1 billion in transactions in 2015. The first phase was executed on March 1, involving the transfer of its Houston and St. Charles terminals to Valero Energy Partners (ticker: VLP), its sponsored Master Limited Partnership. The deal had a value of $671 million and included a 10-year terminaling agreement with VLO subsidiaries, expected to provide EBITDA return of $75 million in 2015 alone. VLP had virtually no debt in its Q4’14 release and is scheduled to announce its upcoming quarterly results on May 5.

Management Comments

“Our real focus is the distribution increase [to VLP],” said Joe Gorder, Chairman, President and Chief Executive Officer of Valero, in a conference call following the release. Valero Energy Partners announced a quarterly distribution increase of 4.3% last week, boosting Q1’15 distributions to $0.2775 per unit. “We’re committed to growing it at that 25%-plus this year and for the next couple of years,” Gorder said.

VLO, meanwhile, plans on advancing its refining and logistics segments to increase access to North American crude oil. The construction of two topping units in South Texas are currently underway and will loosen up a region that VLO says is currently “bottlenecked.” Future logistics investments will likely be dropped down to its LP subsidiary.

While expanding operations to the upstream division were all but ruled out in the conference call, Gorder did mention some other aspects of the business may have room for growth. He explained: “I do think we’re going to see our midstream business expand significantly over the next several years. And as we’ve said, our strategy in midstream is really to develop projects and acquire assets that are supportive of Valero’s core businesses. And I think if you look at the investments that we’ve made to date, it would certainly support that. That being said, the refining portfolio is large enough and the renewable portfolio is large enough that it provides plenty of opportunity for growth within that midstream business.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.