95% of 2017 Capital Program Focused on Montney, $195 million to Support Liquids-rich Gas Handling

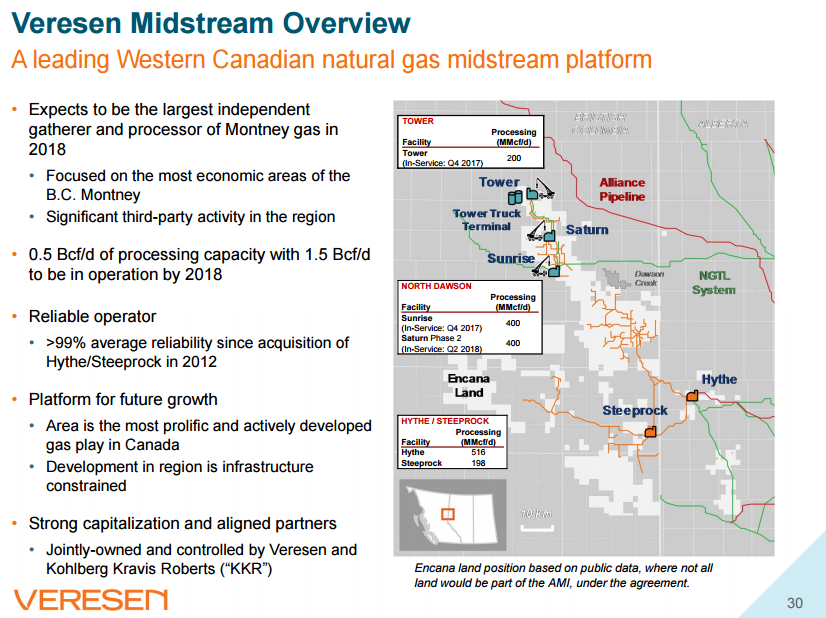

Veresen Inc. (ticker: VSN) has announced the sanction of an additional $195 million to new gas processing facilities at Veresen Midstream, further expanding its footprint in the prolific, liquids rich Montney region of Northern Alberta and British Columbia.

This builds on the company’s recently announced 2017 capital program of $475 to $525 million, bringing the current inventory of projects under construction to $1.4 billion.

“As Veresen Midstream’s capital projects come into service, the significant increase in cash flow will reduce Veresen’s leverage and bolster our financial flexibility to fund new growth opportunities generated from our strong footprint in the heart of the Montney play,” said Don Althoff, President and CEO.

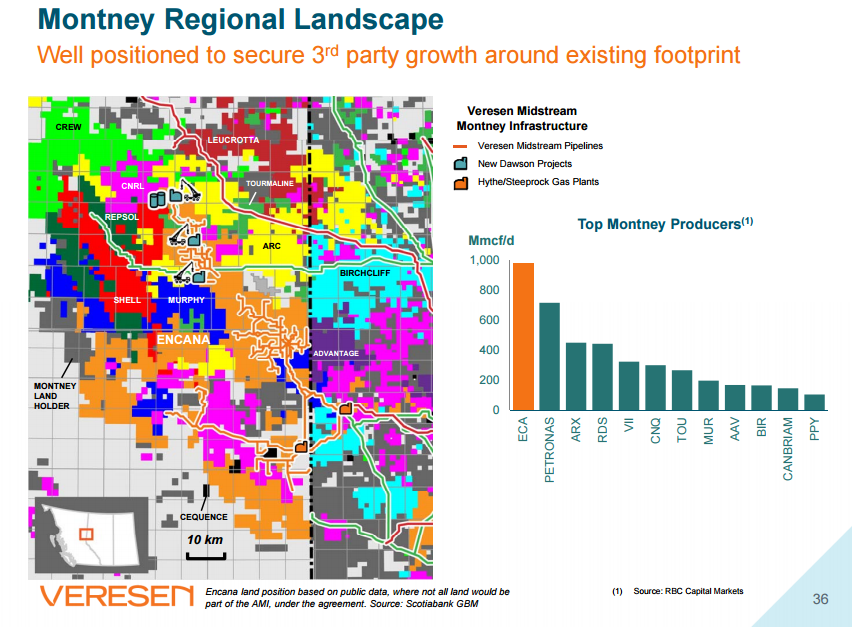

Veresen Midstream is a 50/50-owned limited partnership between Veresen and Kohlberg Kravis Roberts & Co. Though the LP, Veresen intends to be a leading Western Canadian gas and NGLs midstream provider.

Providing Takeaway for Montney Growth

Two new projects, the South Central Liquids Hub and the Tower Liquids Hub, will support ongoing development plans by Encana and the Cutbank Ridge Partnership. Cutback Ridge is an agreement between Mitsubishi and Encana to oversee liquids-rich development in northeast British Columbia.

The South Central project will allow the area’s gathering system to handle anticipated development over the next several years and is expected to be in service by the end of 2Q 2017. It may also be expanded to provide services to area third party producers and meet Cutback Ridge’s liquids handling needs.

The Tower Hub will support handling and storage of NGLs produced at the Sunrise, Tower and Saturn Phase II processing facilities and will allow NGLs to be delivered into a third party system. The Hub will include capacity to handle third party NGLs that could be either trucked in or connected directly by a future pipeline and is expected to be in service in 3Q 2017.

When completed, the Tower and Sunrise processing facilities will double the company’s existing processing capacity in the area by adding 600 MMcf/d. Both are expected to be in service towards the end of 2017 with Saturn Phase II in service in mid-2018.