Coal loses support as demand in China falters

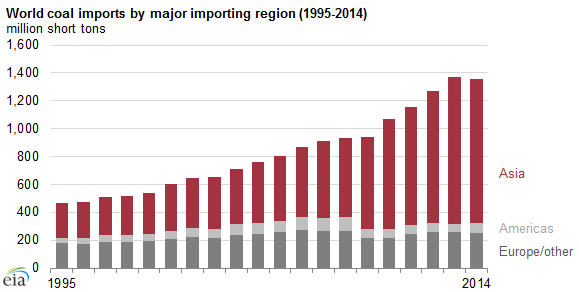

The global coal trade declined for the first time in 21 years in 2014, and likely contracted further this year as well, according to information from the Energy Information Administration (EIA). The global coal trade grew rapidly from 2008 to 2013 as demand in Asia picked up to support expanding economies in the region, particularly in China. Declines in China’s import demand have led to declines in total world coal trade in 2014 and, based on preliminary data, in 2015 as well.

Nearly all of the 47% growth in total world coal trade between 2008 and 2013 was driven by rising coal import demands by countries in Asia, specifically China and India. Coal trade in the rest of the world declined over the same period. However, data for 2014 and 2015 indicate a reversal of this trend, with declines in China’s coal imports currently on pace to more than offset slight increases in other countries in both years.

China imported 341 million short tons of coal in 2013, up from 45 million short tons in 2008, while India imported 203 million short tons, up from 69 million short tons. About 75% of China’s coal imports and 90% of India’s coal imports were steam coal, used primarily for electricity generation. Coking coal, used in the manufacture of steel, made up the remaining volumes.

While China’s coal imports have been declining in 2014 and 2015, India’s imports continued to rise in 2014 and through the first half of 2015 as coal demand increased at a faster pace than domestic supplies. In China, rising output from domestic mines, improvements in coal transportation infrastructure, and slower growth in domestic coal demand have resulted in lower domestic coal prices and reduced demand for coal imports.

China’s National Development and Reform Commission (NDRC), the country’s top economic planner, also announced this week that it plans to reduce the benchmark city-gate prices for natural gas by 0.7 yuan ($0.11) per cubic meter for industry and commercial users. Analysts believe the move effectively reduces the cost of city-gate natural gas by 28%. The Chinese government should help spur higher natural gas demand as the country makes a switch away from coal for cleaner-burning natural gas.

India to become the main source of growth in Asia

India is likely to be the main driver behind Asia’s future growth, replacing China, and becoming one of the main drivers of energy demand over the next decade.

India’s GDP is expected to grow at a faster rate than China’s, with the International Monetary Fund (IMF) reporting GDP growth of 7.3% and 6.8% for India and China, respectively, in 2015, and a wider spread to 7.5% and 6.3% for the two countries next year.

Efforts are underway to substantially increase domestic coal production in India over the next few years and to complete three major rail transportation projects for facilitating increased shipments of coal from major producing regions in northeastern India to demand centers in other parts of the country. Although India’s coal producers have already increased domestic production in 2014 and through the first few months of 2015, the first of India’s three major coal railway projects, the Jharsuguda-Barpali railway link, is not scheduled to be completed until approximately 2017.

India’s population is also expected to surpass China’s in the next ten years, according to United Nations’ forecasts. By 2022, both countries should have about the same population size of 1.4 billion, but the U.N. expects India to continue growing to about 1.7 billion in 2050, while China levels off around the 2020s and 2030s before declining, even when considering the Chinese government’s recent decision to end the “one-child” policy. The larger population in India will likely result in larger overall energy consumption as well.

Demand for other types of energy in India are also expected to balloon, with natural gas demand in the country expected to grow to 523 MMcm/d in 2018-2019 alone, a 30% increase from its current level of 405 MMcm/d, according to the country’s oil ministry.