Some analysts say U.S. refiners won’t be hurt by exports

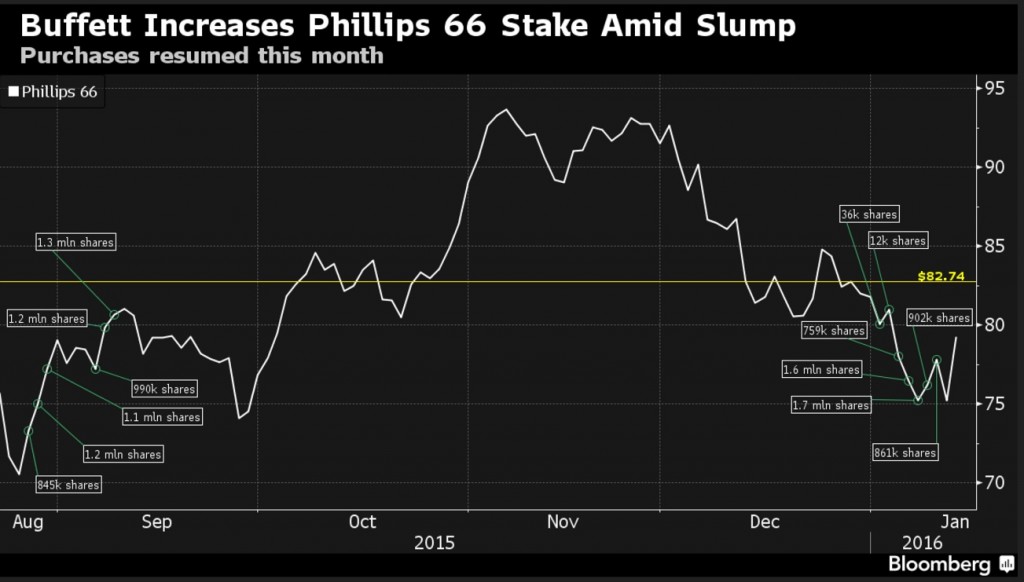

Don’t count Warren Buffett as a participant in the energy market selloff – the legendary investor has purchased nearly $5 billion of Phillips 66 (ticker: PSX) stock since August 2015.

Berkshire Hathaway (ticker: BRK), a multinational holding company chaired by Buffett, now owns 13% of the refiner and has a value of about $5.3 billion overall. The company disclosed a huge stake in PSX in the summer of 2015 (about $4.5 billion), and held off on more purchases until this last week, culminating in an additional 6 million shares valued at more than $450 million.

In August, The Wall Street Journal speculated that Buffett’s move was indicative of a potential rebound in infrastructure. The prospects of investing in a renowned refiner, as opposed to an exploration and production company, provides additional security as the downstream segment is (more or less) guaranteed hydrocarbon volumes (and its associated revenue) from the vast array of upstream companies. Although the upstream segment has drastically pulled back on drilling activity, crude oil storage remains at an all-time high.

Phillips 66, meanwhile, closed on 2015 with a $4.6 billion capital plan aimed at building out its midstream assets and its master limited partnership vehicle. An estimated $3.2 billion (about 70%) was directed on natural gas liquids and transportation business lines. More than $3.3 billion of the expenditures were classified as “growth capital,” and midstream garnered nearly 90% of that particular section. Christopher Helman of Forbes points out that the similar infrastructure footprints of BNSF and PSX make Berkshire Hathaway a “natural buyer” if PSX ever decided to sell off part of its rail assets.

Its 2016 capital plan, as announced in its Q3’15 release, is nearly $3.9 billion. An estimated $2.6 billion is directed at growth capital. The company also increased its share repurchase program by $2 billion and maintained its annual dividend of $2.24/share, meaning BRK will receive nearly $150 million annually for its holdings of 65.6 million PSX shares.

Refiners in the New Era of Crude Exports

While the majority of the oil and gas industry applauded the lifting of the crude export ban, many analysts speculated that refiners would be negatively impacted from volumes being sent abroad. A Bloomberg index of 11 independent U.S. refiners has fallen by nearly 10% since mid-December and is currently at its lowest level since February 2, 2015.

Despite the recent downtrend, traders are still optimistic in long-term returns for domestic refiners. The end of the export ban included tax breaks expected to amount to $119 million in 2016 alone. Analysis from the Joint Committee on Taxation believes the provision is valued at $1.9 billion over the next ten years.

“They’re positioned to succeed regardless,” said Carl Larry, head of oil and gas for Frost & Sullivan LP, in an interview with Bloomberg. “They can still make products cheaper than anywhere in the world. It’s the largest refining system in the world. Regardless of whether the U.S. exports crude, they’ll be ahead of the game.”

Although spot prices for West Texas Intermediate fell below $30 in today’s trading, its discount to the Brent benchmark has evaporated. The United States has wasted no time on the international trading opportunity: ConocoPhillips (ticker: COP) shipped its first tanker load just weeks after the announcement and China reportedly purchased its first ever batch of U.S. crude earlier today.