Purchased First NTI Stake in 2013

Western Refining (ticker: WNR) is attempting to enhance its Midwest footprint, proposing a $2.56 billion buyout deal of Northern Tier Energy LP (ticker: NTI). WNR already owns 100% of the partnership and 38% of NTI shares. The proposal consists of a cash-and-stock offer that includes $17.50 and 0.2266 shares of WNR in exchange for one NTI share, amounting to a premium of 15% relative to Northern Tier’s average 20-day closing price as of October 23, 2015.

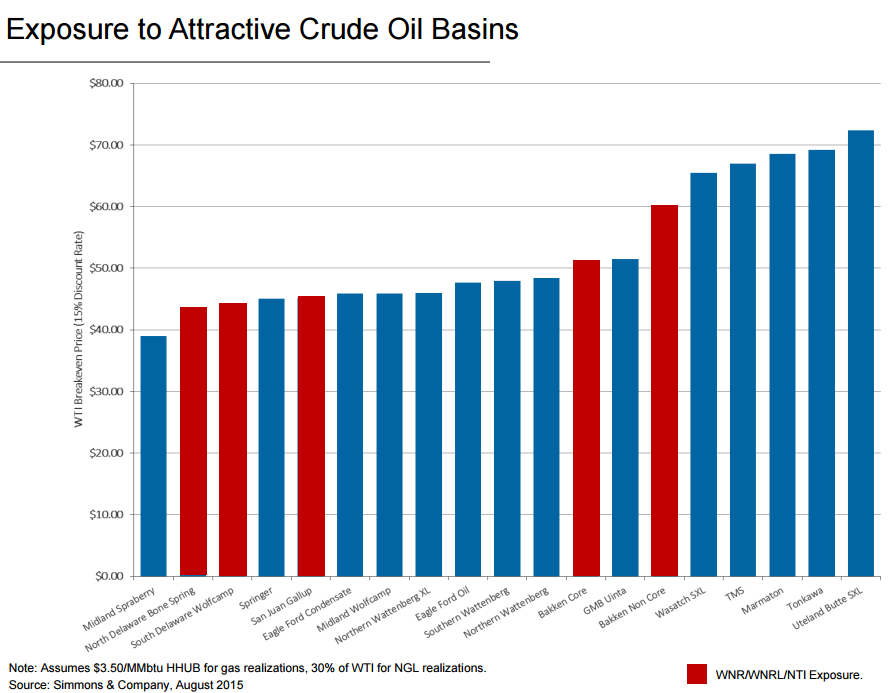

Western Refining operates refineries in El Paso, Texas, and Gallup, New Mexico, with retail businesses throughout Arizona, Colorado, New Mexico and Texas. WNR serves as the general partner of its master limited partnership, Western Refining Logistics, LP (ticker: WNRL), of which it has 66% ownership. WNRL entails terminals and storage facilities, in addition to approximately 300 miles of crude oil pipelines. NTI consists of downstream and retail businesses in Minnesota and Wisconsin.

WNR first purchased the 38% stake in NTI back in November 2013, for total consideration of $775 million. The purchase was made just one month after WNRL finalized its initial public offering, resulting in net proceeds of $325 million. The two subsidiaries have provided approximately $208 million in distributions to WNR since their first investments.

WNR reports NTI financials as one of four segments in its quarterly reports, and its Q2’15 operating income of $125.1 million accounted for nearly 40% of WNR’s total. The St. Paul Park Refinery is one of only four in Minnesota and is a major supplier to the Midwest region. For the first six months of 2015, the facility realized gross margins per throughput barrel of $21.39, an increase of nearly 30% compared to the first six months of 2014.

WNR Reasoning

WNR Reasoning

Jeff Stevens, President and Chief Executive Officer of Western Refining, said the proposed merger would “simplify our corporate structure and create a stronger, more diverse company with enhanced growth opportunities and greater access to capital.”

The two companies have discussed ways to diversity their respective businesses throughout the year, but did not outline general specifics aside from mentioning the collaborations in conference calls. In NTI’s Q2’15 conference call, David Lamp, President and Chief Executive Officer, mentioned the different methods to fuel the company’s future growth. “It’s top on our list to diversify our income stream and geographical concentration,” he said. “However, Western is mainly in the driver seat on that and you’d really have to talk to them about what their plans are.”

NTI Response

Northern Tier Energy issued a news release simultaneously with WNR, acknowledging it had received the bid. The proposal is subject to approval from the nine-seat WNR board, which currently holds three NTI directors, including the chairman. Planned actions from Northern Tier include enlisting independent advisors to evaluate the proposal but did not guarantee any definitive agreements. Shares of NTI closed approximately 8% above its opening price for October 26, 2015.

Tudor, Pickering & Holt believed the deal was “negative at first glance,” adding that the benefits outlined by Western Refining did not offer any incremental synergies.