-

Haynes and Boone Releases Fall 2015 Borrowing Base Survey Results: “Time for Action” View Replaces Spring’s “Wait and See” Attitude

-

New York City Financing Event Will Provide Color, Discuss Financing Options

-

Farmouts of Proven but Undeveloped Assets could be Solution for Many Producers

In an environment of continually falling commodity prices, things can get dicey for E&Ps. At today’s sub-$45 oil price, a driller/producer is forced to sell his product for half of what it sold for a year ago. The producers’ sales dollars are cut in half, well economics go south, cash flow dives and margins head toward negative territory.

At $5 million or $10 million per well, drilling and completing horizontal shale wells is a heavily capital intensive business proposition. Developing shale beds costs many millions of dollars before you realize the first dime of revenue. Companies need access to capital – a lot of capital. To drill and complete 50 new wells in the Bakken or Permian, even at today’s reduced service prices, you’ll need a bank account that’s north of half a billion dollars. If a company’s borrowing base was set last year at $500 million when oil was selling for $100 per barrel, at today’s price of $45 per barrel for WTI, companies’ reserves across the board are losing value.

At $5 million or $10 million per well, drilling and completing horizontal shale wells is a heavily capital intensive business proposition. Developing shale beds costs many millions of dollars before you realize the first dime of revenue. Companies need access to capital – a lot of capital. To drill and complete 50 new wells in the Bakken or Permian, even at today’s reduced service prices, you’ll need a bank account that’s north of half a billion dollars. If a company’s borrowing base was set last year at $500 million when oil was selling for $100 per barrel, at today’s price of $45 per barrel for WTI, companies’ reserves across the board are losing value.

The billion barrels of reserves in the ground that you booked last year at a value of $90 billion, are only worth $40 billion today—or less. Reserves in some plays have dropped in value to the point of being considered not economic to extract at today’s prices; i.e., they no longer qualify as ‘reserves’. If resources formerly defined as reserves are removed from a company’s reserves base, lenders follow suit by reducing a company’s capacity to borrow against the remaining reserves.

What are lenders and producers expecting from this fall’s upcoming borrowing base redeterminations?

Haynes and Boone, LLP, conducted two proprietary surveys in 2015 of oil and gas industry and financial executives, to measure the market place expectations of the fall 2015 borrowing base redeterminations. Haynes and Boone is a nationally ranked Texas-based law firm with a large oil and gas finance practice with numerous members in Texas, Washington D.C., Colorado, New York, Illinois, California, Shanghai and Mexico City.

A Look at the Haynes and Boone Survey Results

Fall Borrowing Base survey respondents predict 79% of companies will see a decrease in borrowing base by an average of 39%

The firm conducted its survey in advance of borrowing base redetermination season, both for the spring and fall, in two separate surveys. Results provide an indication of expectations from borrowers and lenders across the oil and gas spectrum:

H&B SURVEY: What percentage of borrowers do you anticipate will see a decrease in their Spring/Fall 2015 borrowing base redeterminations?

Last spring’s respondents said they expected 68% of borrowers to see a decrease in the upcoming borrowing bases, while the just completed fall survey respondents said they expected 79% would see a decrease in borrowing base.

H&B SURVEY: What is the average amount that you anticipate borrowing bases will be decreased this spring/fall?

Respondents said they believed there would be an average 25% decrease in the spring and 39% decrease from the fall redeterminations.

H&B SURVEY: What percentage of reserve-based loans do you anticipate will skip this spring’s borrowing base redetermination?

Respondents said an average of 19% will skip.

H&B SURVEY: (ASKED OF SPRING SURVEY RESPONDENTS) How much below this spring’s borrowing bases do you anticipate fall borrowing bases to be?

Spring respondents thought fall borrowing bases would be 31% below spring.

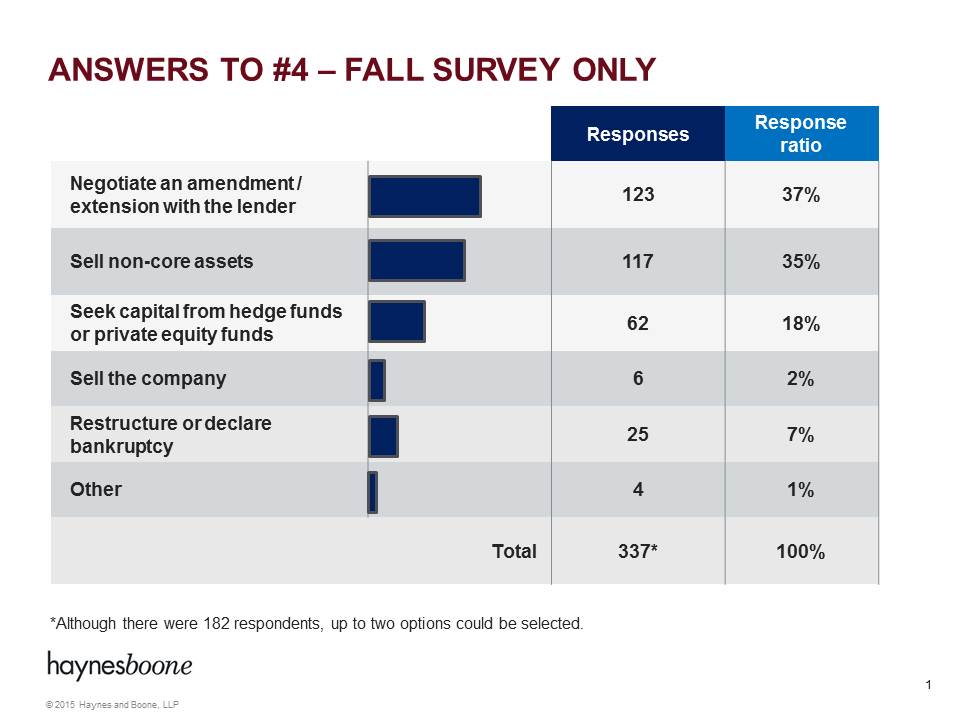

H&B SURVEY: (ASKED OF FALL SURVEY RESPONDENTS) Which one or two of the following options below do you think will be the most likely path that lenders and borrowers will take when faced with a borrowing base deficiency?

A Conversation With Jeff Nichols, Haynes and Boone Energy Finance Group

Oil & Gas 360® spoke with the head of the Haynes and Boone Energy Finance Group, Jeff Nichols, who provided some insight into the firm’s borrowing base expectations survey results.

O&G360: What was the thought behind these surveys – what was your objective?

H&B: Our objective was to gain quantifiable insight into how the oil and gas industry, financers and producers alike, are reacting to the decline in oil and gas prices.

O&G360: You surveyed lenders, producers (borrowers) and professional services providers and others; are the bulk of the respondents execs at E&Ps, oilfield services companies, midstream companies, financial officers, operations staff, commercial bankers, investment banks, private equity directors …what is the mix in general terms?

H&B: The mix in general terms is 40% executives at oil and gas companies (includes upstream, midstream, and oilfield services at majors and independent E&Ps), 40% financiers (commercial and investment banks) and private equity firms, and 20% professional services companies/others.

O&G360: What stood out to you in these survey results?

H&B: What really stood out to us was the contrast between the results of the spring and fall survey. In the spring, it looked like the response was a “wait and see” mentality. But with fall approaching, the “wait and see” mentality seems to have passed and there is a recognition that more action is likely to be taken by companies, or needs to be taken, to reduce debt through equity investment, restructuring or even declaring bankruptcy.

We saw 19% of respondents to the spring survey were looking to skip the next borrowing base redetermination. It was our experience in the spring that many lenders, instead of skipping the borrowing base redetermination, were able to reaffirm the borrowing base value. In comparison to what happened in the spring, the new responses regarding the fall redetermination shows that more folks in the industry expect lenders to take action this fall and decrease borrowing base amounts.

O&G360: When borrowing base redeterminations are in full swing, what do you think will happen on the M&A front in the next 6-12 months?

H&B: For those producers that experience decreased borrowing bases, their options will be fairly limited:

-

sell non-core assets to raise cash (which will further reduce their borrowing base);

-

seek junior debt or equity dollars (which will come at a high price); or

-

seek to merge with a stronger producer.

Without availability under their borrowing base, if a producer’s borrowing base is reduced this fall, their ability to stay in the game will be seriously hampered. They will have to do something and there will be plenty of producers and other capital sources with dry powder ready to merge or acquire these companies.

O&G360: With the commodities price environment we have today—roughly 50% below last year–and some banks calling for more significant commodity price declines (Goldman is saying we could see $20 oil), companies’ reserves will begin to reflect decreases following next reserve reconciliations— what advice would you give North American producers right now?

H&B: Most producers have already begun to reduce discretionary capital expenses and negotiate with their oilfield service providers. Until prices rebound, producers will need to live within cash flow. If that means farming out or selling undeveloped acreage that’s better than letting it expire for lack of operations.

Producers can begin considering alternative means of revenue and cash flow outside of their producing reserves. Producers can look to other assets that they may own that do not contribute to their borrowing base such as drilling and production equipment, midstream assets, and undeveloped reserves. These assets can be monetized through a variety of transactions such as a sale and leaseback or farmout agreements.

O&G360: As a leading international energy/oil and gas law practice with expertise in onshore, offshore, domestic, international, Mexican energy reform, EPA regulations, M&A, debt and equity deals, contracts, taxation— What do you think is the most significant issue that the North American oil and gas industry is facing right now? What can they do about it?

H&B: The most important issue is how to get through this price decline without negating everything that has been built up in the last decade in the oil and gas industry.

Understanding that the ups and downs in oil and gas prices are cyclical, the industry needs to react knowing that this period will pass. We don’t know how long it will take, but we do know that at some point, prices will rise and the industry will bounce back along with the prices.

Bank regulators are pressuring banks to clean up their energy portfolios, and they should be taking this into consideration. If financiers have confidence in the rise in oil and gas prices, they should be providing financing to producers for bottom dollar now with confidence that they will come out on top.

O&G360: What are some of the most attractive opportunities in the oil and gas industry right now, in your view?

H&B: What we’re seeing is that one of most attractive opportunities is farming out the drilling of proven but undeveloped properties. The capital for this activity is provided by a financier who ends up owning an interest in the wells upon completion. Both the producer and financier benefit from this farmout structure because the financier ends up with an interest in the wells for the remaining life of the well and the producer was able to drill the unproven properties at almost no cost to them. These producers will also gain properties that provide revenue and may be credited towards their borrowing base value.

New York City Financing Event

Haynes and Boone is hosting an event this week in New York City to be held on Thursday Sept. 17, entitled: “Oil & Gas Financing and Investment Series – Recent Developments in Second Lien Financings, Restructurings and Bankruptcies in the Oil Patch.”

At the event, legal experts in energy finance will discuss implications of commodities prices on upcoming borrowing base redeterminations and related topics, including:

-

Market update and details from the fall 2015 borrowing base survey which will follow up analysis based on the prior survey last Spring, current bank regulatory environment and implications for administration of energy loans;

-

First and Second lien deals update–many deals in workout;

-

Uptiering Refinance deal case study–an option that one overleveraged company took; and

-

Update on current restructurings and bankruptcies in the oil and gas sector.

Buddy Clark, chair of Haynes and Boone’s Energy Practice Group is a featured speaker in New York City on Sept. 17.

Buddy Clark, chair of Haynes and Boone’s Energy Practice Group, will be a featured speaker at the event. Clark wrote an article for the State Bar of Texas Corporate Counsel Section in January 2015 entitled: “A Dozen Ways to Stretch Your Borrowing Base.” The article may be downloaded here.

The seminar is scheduled for Thursday, September 17, 2015, 12:00 p.m. – 1:30 p.m. The location is Haynes and Boone, LLP, 30 Rockefeller Plaza, 26th Floor, New York, NY 10112; advance registration is required: