Oil markets are still adjusting to levels of oversupply, but the demand imbalance has become an old hat of sorts for the natural gas industry. El Nino is unlikely to do the gas market any favors in the upcoming winter season.

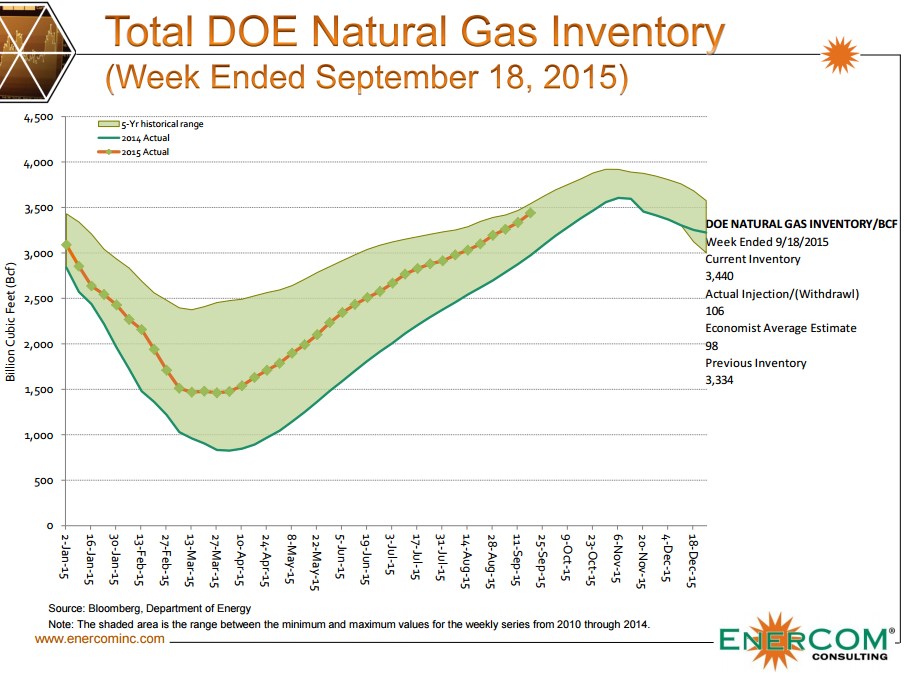

Natural gas inventories are nearing five year highs, as evidenced by EnerCom’s Natural Gas Roundup inventory report, and the Wall Street Journal expects large stockpile injections to continue in the coming weeks. The global average temperature set record highs at various points throughout the year, according to the National Oceanic and Atmospheric Administration (NOAA), and the warmer than normal temperatures are expected to continue through the winter season.

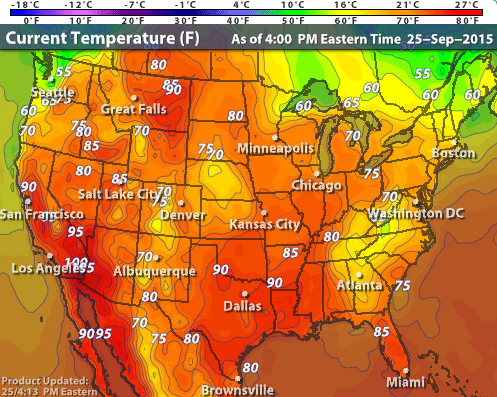

The forecasts are bearish news for natural gas – delivered prices for January 2016 are the lowest in 16 years. An oversupplied market combined with high temperatures throughout the country has the gas market preparing for a bumpy ride ahead. Today, Southern California topped 100 degrees and other states like Texas, Louisiana, Arizona and Montana (yes, Montana) all reached the 90s. Major hubs like Chicago and New York remained in the balmy 70 degree range.

The forecasts are bearish news for natural gas – delivered prices for January 2016 are the lowest in 16 years. An oversupplied market combined with high temperatures throughout the country has the gas market preparing for a bumpy ride ahead. Today, Southern California topped 100 degrees and other states like Texas, Louisiana, Arizona and Montana (yes, Montana) all reached the 90s. Major hubs like Chicago and New York remained in the balmy 70 degree range.

Commodity Weather Group LLC believes temperatures will be approximately 9% warmer than last year from November through March. “We haven’t gotten the heating demand yet, and we’re ending the cooling demand,” said Donald Morton, senior vice president at Herbert J. Sims & Co., in an interview with The Wall Street Journal. “You’re seeing natural gas production continuing to flood into storage.”

Production Remains High

As mentioned in previous reports this year, increased efficiency has mostly offset the rig count decline. Production from the Northeast set a record of 20.4 Bcf/d at the send of August – 8% higher compared to 2014 volumes. Prices in the Marcellus region at the Leidy Line has averaged a discount of $1.48/MMBtu to Henry Hub due to high production and restricted takeaway capacity.

As mentioned in previous reports this year, increased efficiency has mostly offset the rig count decline. Production from the Northeast set a record of 20.4 Bcf/d at the send of August – 8% higher compared to 2014 volumes. Prices in the Marcellus region at the Leidy Line has averaged a discount of $1.48/MMBtu to Henry Hub due to high production and restricted takeaway capacity.

Propane inventories set a new record earlier this week, thanks to flat demand and climbing storage options. KLR Group estimates a gas rig count of about 325 should “maintain mid-cycle market equilibrium,” while Global Hunter Securities says further mild weather may push inventories above its previous estimate of 3.9 Tcf. The National Weather Company believes demand will be 10% lower due to the warmer than usual temperatures.

The Energy Information Administration, meanwhile, expects marketed gas production to increase, on a year-over-year basis, by 4.2 Bcf/d and 1.7 Bcf/d in 2015 and 2016, respectively. Inventories are projected to be on the high end of the five year average by January 2016 and then be near the top of the same average by the beginning of 2017.