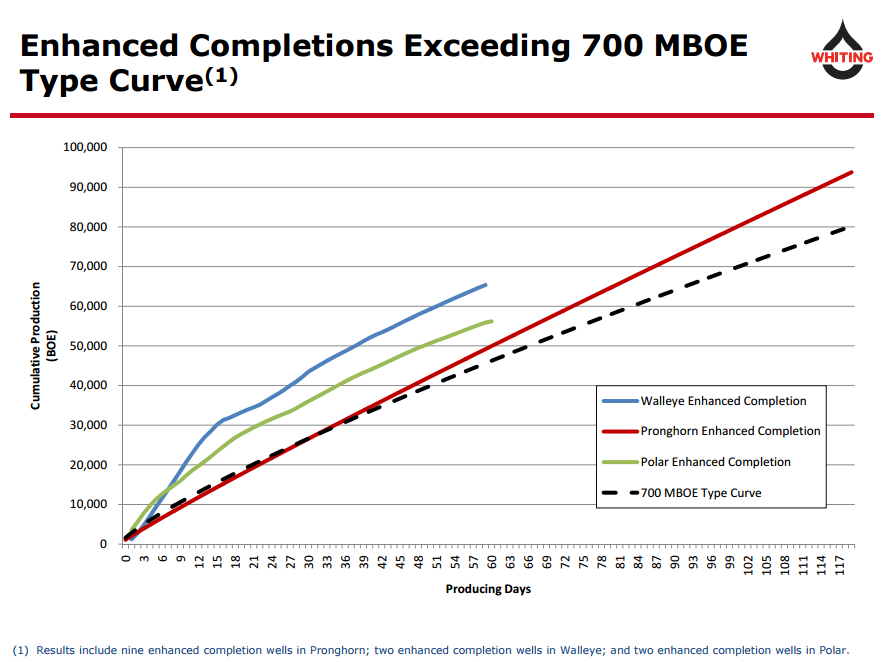

Production Uplifts of 40% to 50%

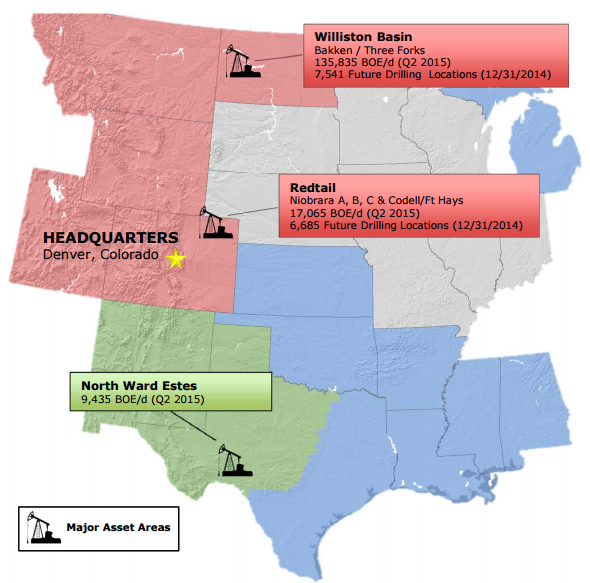

Whiting Petroleum (ticker: WLL), a Denver-based exploration and production company, set a personal record of 170,425 BOEPD (89% liquids) in its Q2’15 earnings release, issued on July 29, 2015. The volumes exceed the high end of guidance despite the sale of 8,300 BOEPD to date in 2015. Whiting generated $300 million in total proceeds from the asset sales, consisting of more mature properties that did not fit into the company’s growth model.

Its core properties consist of 736,999 net acres in the Williston Basin and another 128,447 net acres in the Denver Julesburg Basin. More than 12,000 estimated drilling locations remain. Enhanced completion wells in the Williston are beating original estimated ultimate recovery (EUR) type curves of 700 MBOE by as much as 50%, according to company estimates, even though completion costs rise by only 15%. Increased activity and efficiency in its DJ asset, known as the Redtail prospect, resulted in a 31% sequential production leap.

James Volker, president and chief executive officer of Whiting Petroleum, is scheduled to present at EnerCom’s The Oil & Gas Conference® 20 in Denver on August 17, 2015.

Operational Overview

Whiting’s industry-leading acreage position in the Williston Basin is backed by operational efficiencies that continue to increase. The larger volume tests range in cost from $6.5 to $7.5 million and are being used “virtually everywhere,” management said in a conference call following the earnings release. Volker said it may be possible to receive an 80% uplift in 12-month production from select areas, but management isn’t ready to boost its EUR just yet. “We’d like to have at least another six months of production, but the initial results are very good and very encouraging,” Volker added. In a note covering the release, KLR Group believes the enhanced recovery completions could yield more than 900 MBOE if they stay consistent with a typical Williston decline curve.

In the Redtail, a 32-well downspacing test is currently underway and the eight wells drilled to date all exceeded a 500 BOEPD average for the first seven days of production. A second phase of its gas plant is expected to be complete by the end of August and will expand inlet capacity to 50 MMcf/d in Q3’15, up 150% from current levels. Capacity is expected to increase to 70 MMcf/d by H1’16.

Fiscal 2015 production is forecasted to exceed 2014 levels by 7%.

Whiting in $50 Oil – CapEx, Cash Flow

In accordance with the release, WLL dialed back its 2015 capital expenditure plans to $2.15 billion from $2.30 billion and will run eight rigs for the remainder of the year – down from its initial plan of 11. Six of the rigs will run in the Bakken while the remaining two will work in the Redtail. An expected 40 to 50 wells will be completed in the Bakken while 25 will be completed in the Redtail, at total costs of about $550 million.

Whiting believes its revised expenditures will result in Q3’15 and Q4’15 volumes of 162,000 and 153,000 BOEPD, respectively, as the rig count declines. The company’s 2016 estimates include volumes of 147,000 BOEPD, not fully taking into account the effects of completion improvements. Management believes it can return 150,000 to 155,000 if the highlighted results in the press release can remain consistent. Rigs may also be added, but the company will wait until it sees $60 oil for roughly four months, as a general measuring stick.

Discretionary cash flow for 2016 projects to reach $1 billion at $50/barrel and $3/Mcf prices, essentially matching its capital budget. WLL management said the company realizes about $200 million of additional cash flow for each $5 increase in oil price.

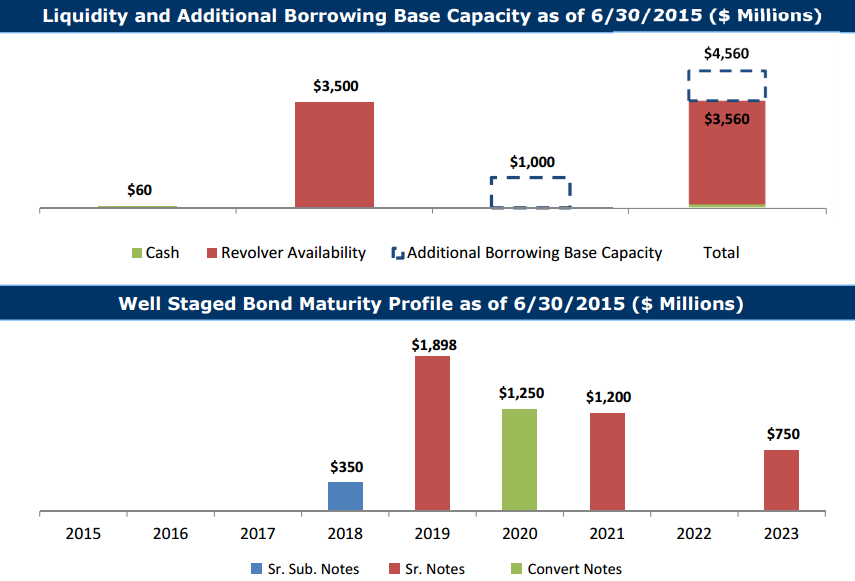

Nothing Drawn on Borrowing Base

The company expects additional non-core asset sales to occur throughout H2’15 and believes an additional $1.1 billion of sale opportunities exist. “If we sold even half of that, we’d come in at around $800 million,” said Volker, referencing the $300 million sold to date.

Whiting has nothing drawn on its $4.5 billion borrowing base and entered Q3’15 with $60 million in cash. The prudent approach is positioning Whiting for an oil price upturn. “If oil prices are higher than anticipated later this year, we can ramp up and deliver even greater growth,” said Volker in the call, adding that the company can add 4,000 to 5,000 BOEPD for each $100 million of additional spending.

KLR Group said the company’s “Improved LOE and capital productivity increased the company’s ’17 capital yield (cash recycle ratio) to ~130% (now above the group median of ~125%), up from ~120% previously.”