Whiting’s debt for equity swap puts $721 million in the bank; company looks to ramp Bakken development in 2017

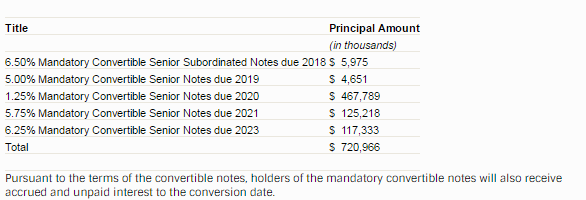

Whiting Petroleum Corp. (ticker: WLL) announced today that it gave notice to mandatorily convert $716.8 million of outstanding mandatory convertible notes into shares of common stock on December 19, 2016. Last Friday, the company’s stock traded above $8.75 per share for 20 of 30 days and forced the conversion of the debt, including some previously converted notes, into 77.6 million shares of WLL common stock.

“After the conversion and the sale of our North Dakota midstream assets for $375 million that we anticipate to close in early 2017, we will have reduced our debt by $2.3 billion or 41% since March 31, 2016, approximately equal to all the debt assumed in the Kodiak acquisition,” said Whiting’s Chairman, President and CEO James Volker in the company’s press release.

Greater financial flexibility will also help the company continue to improve its operations in the Bakken, where the company is already a top operator in terms of 90-day average production rates for operators with more than 10 wells, Volker said.

“Such results do not fully reflect the impact of our recent super, 10+ million pound sand volume completions where our initial Bakken / Three Forks wells are tracking at or above a 1.5 million BOE type curve for a completed well cost of only $7.5 million,” Volker added.

Starting the engine for top-tier Bakken development in 2017

“Having achieved this debt reduction target, our enhanced balance sheet and strong hedge position for 2017 should allow us to rapidly develop our top-tier properties and accelerate our growth.”

“We believe the debt reduction further improves the optics for WLL’s balance sheet. This should also add greater flexibility to an asset base showing strong improvements from a cost and productive standpoint,” a note from Stephens said Monday. A note from Wunderlich called the news “positive overall” although the added shares reduced the firm’s cash flow estimates.

Analyst Commentary

Stephens

The conversion

provides continued improvements to the balance sheet which has

seen a $2.3 bil. reduction in just a year from asset sales and

debt/equity exchanges. While we had anticipated the conversion

taking place by 1Q17 in our previously published estimates, we

believe the debt reduction further improves the optics for WLL's

balance sheet. This should also add greater flexibility to an asset

base showing strong improvements from a cost and productive

standpoint.

Wunderlich

WLL has been a pioneer in ramping up the size of its completions in

the Williston, and as such has been a first-mover in showing strong increases

in productivity and EURs. WLL has noted that recent wells with 10+ million

pound sand completions are tracking 1.5+ mmboe type curves at a cost of $7.5

million; which would put the finding and development costs in line with (or

better than) essentially any play in the U.S.