Whiting Petroleum Corporation (ticker: WLL) is an independent oil and gas company that explores for, develops, acquires and produces crude oil, natural gas and natural gas liquids primarily in Williston Basin and Permian Basin regions of the United States. The Company’s largest projects are in the Bakken and Three Forks plays in North Dakota, Redtail Horizontal Niobrara development in the Denver Julesburg Basin in Colorado, and North Ward Estes, its enhanced oil recovery field in Ward and Winkler Counties, Texas.

Whiting’s liquids-focus fueled 2013 production totals to a yearly-best mark of 34.3 MMBOE (94.1 MBOEPD), an increase of 14% compared to 2012. Quarterly discretionary cash flow of $457.6 million also set a company record. Q4’13 production averaged 101 MBOEPD – 9% higher than Q3’13. Liquids accounted for 87% of the hydrocarbon makeup. Yearly production increased by 21% if the production drop-off associated with the $860 million sale of its Postle assets (7.64 MBOE, or roughly 8.4% of production) is disregarded. Total sales of non-core assets in 2013 equaled $917 million.

Whiting management said the company’s objective is to generate double-digit production growth while maintaining a healthy balance sheet. The company expects year-over-year production growth of 17% to 19% while using a 2014 capital budget of $2.7 billion.

WLL’s oil focus and its ability to implement new techniques supported the company’s cash flow per share at a yearly compound growth rate of 26% since 2009. Management’s midpoint guidance production for 2014 is 40.5 MMBOE, which would represent an 18% climb in production.

Building up Reserves

WLL reported 438.5 MMBOE of proved reserves, with roughly 254 MMBOE (58%) classified as proved developed at a PV-10 value of nearly $9 billion. Roughly 90% of reserves are classified as either oil or natural gas liquids. Reserve totals, excluding the Postle sale, rose year-over-year by 31%.

The company also holds a total of 365.3 MMBOE in 2P and 3P reserves for a total of roughly $3.62 billion in PV-10 value, increases of 38% and 28% compared to 2012 totals, respectively.

The reserve growth translates into an abundance of future drilling locations – an estimated 14,230 gross (7,479 net), in fact, which is 47% higher than year-end 2012. WLL plans to exploit its new potential wells by investing $2.4 billion (90%) of its 2014 capital budget solely to exploration and development activity. The expenditures are projected to drill 328 gross wells (249.4 net) through its 23 operated rigs.

Operations Review

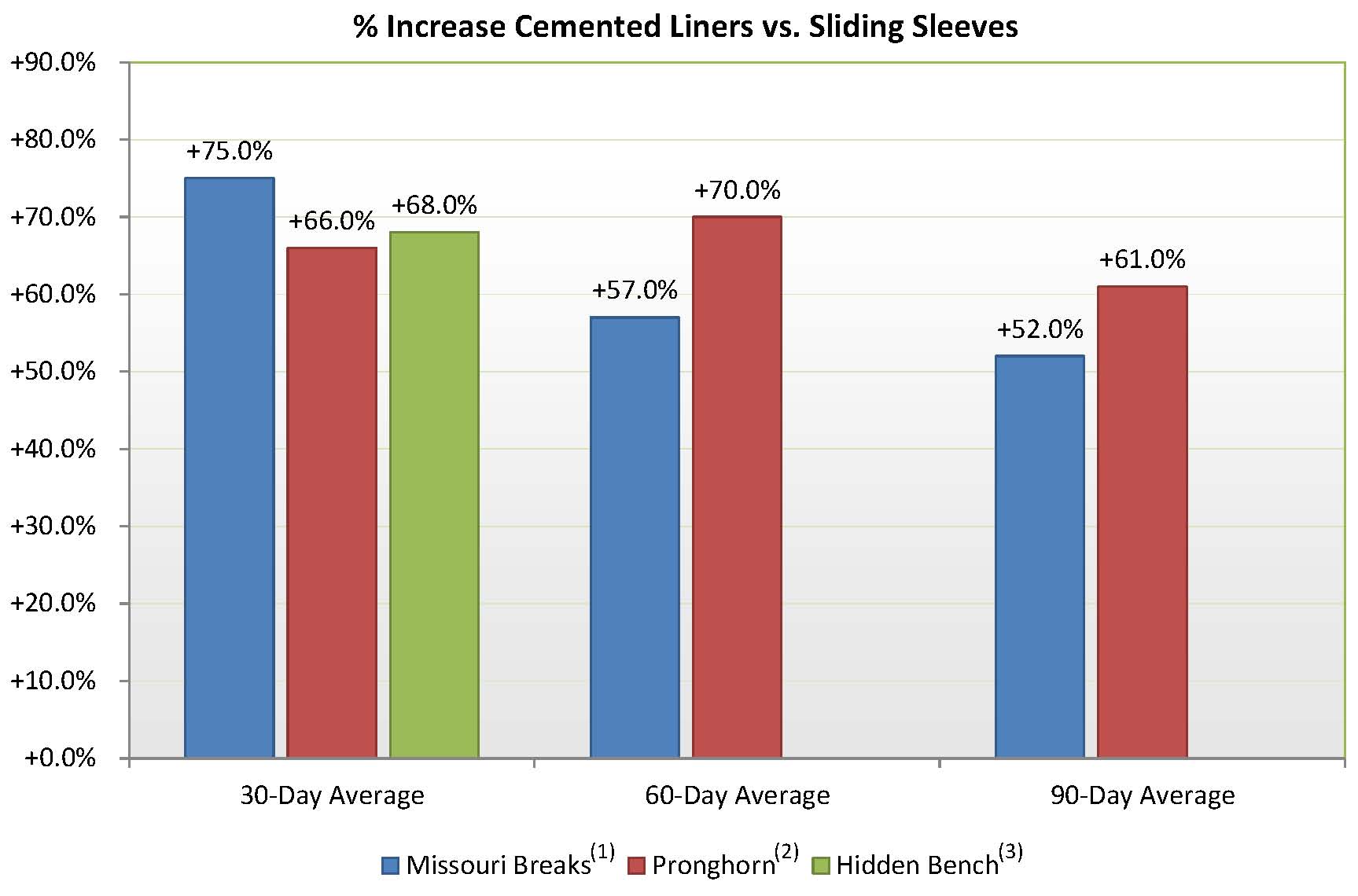

WLL owns roughly 204,000 gross (122,000 net) acres in the western Williston Basin with average production of 17.8 MBOEPD. The production was 30% greater than Q3’13 totals and was buoyed by exploiting infill wells in the Hidden Bench Field for an average production rate of 2.6 MBOEPD. New techniques on the wells exceeded the rate of traditional WLL wells by 53%. New completion designs in the nearby Missouri Breaks Field have also improved 90-day production rates by 52% on 31 completed wells.

The majority of WLL’s acreage exists in the Southern Williston Basin with 392,000 gross (263,000 net) acres. Production increased 6% on the quarter to reach an average of 15 MBOEPD, also as a result of improved completion techniques. The Obrigewitch 21-29PH well in the Pronghorn Field produced 50.8 MBOE in its first 60 days of production. Net production in the Sanish Field rose 10% and two infill wells nearly doubled production rates thanks to the improved completion methods.

The Williston Basin accounted for 73% of all WLL production.

- Source: WLL February 2014 Presentation

WLL’s Redtail Niobrara project, which holds 170,000 gross (122,000 net) acres, is still in the early stages but holds 3,310 gross (1,653 net) identified drilling locations on a 16-well per spacing unit pattern. The company will conduct a 32-well pattern test in Q2’14 and, if successful, will double the number of potential drilling locations. Management already predicts the area holds 28 years worth of inventory, and all wells drilled to date have exceeded a 400 MBOE type curve.

The company credits its use of cemented liners as a significant driver for increasing inventory and production. Its track record of delivering on wells is also a selling point: Overall, WLL drilled 419 gross (220 net) producing wells in 2013 with success rates of 98% and 96%, respectively.

WLL’s midstream infrastructure, spread across its three core locations with ownership ranging from 50% to 100%, holds a processing capacity of 117 gross MMcf/d of gas. The number is set to increase to 205 gross MMcf/d in the near future and will greatly aid Whiting’s forecasted increase in production.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.