Are China’s reforms actual reforms?

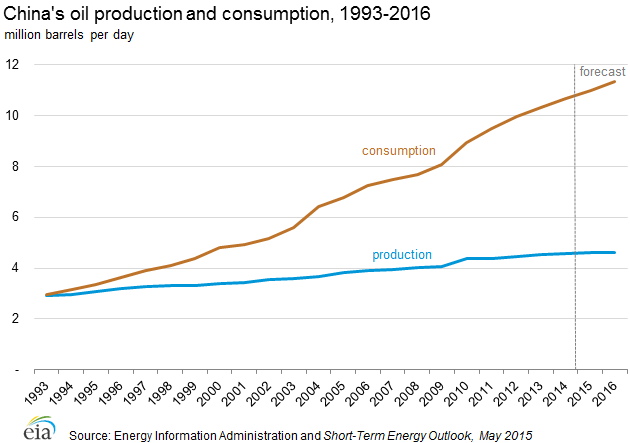

Since the turn of the century, China has increasingly come to the forefront of the world’s political and economic stages. The country’s demand growth for hydrocarbon fuels has made it particularly interesting to the oil and gas industry around the world. In 2011, China became the largest global energy consumer, and the world’s second-largest oil consumer behind the U.S.

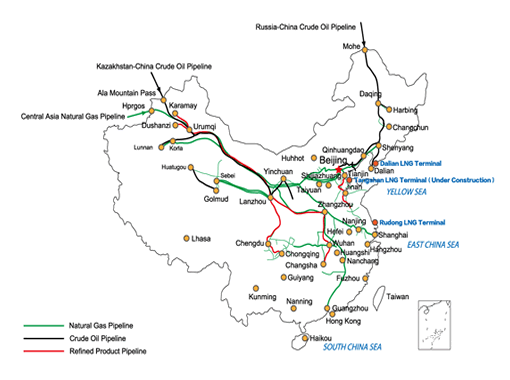

China has developed its own industry through several state-owned giants: China National Petroleum Corporation (CNPC), China National Offshore Oil Company (CNOOC) and China Petrochemical Corporation (Sinopec). CNPC is the leading upstream player in China and, along with its publicly listed arm, PetroChina, accounts for an estimated 54% and 77% of China’s crude oil and natural gas output, respectively, according to the Energy Information Administration (EIA).

Recently, however, China stated that it seeks to reform its oil and gas industry to make it more competitive globally. The Chinese government has been cracking down on corruption inside of state-run giants, and allowing independent “teapot” refiners, called such due to their relatively low throughput capacity, to import small quotas of crude oil.

Recently, however, China stated that it seeks to reform its oil and gas industry to make it more competitive globally. The Chinese government has been cracking down on corruption inside of state-run giants, and allowing independent “teapot” refiners, called such due to their relatively low throughput capacity, to import small quotas of crude oil.

These may be reforms in name only, though, according to Dr. Derek Scissors, who spoke to Oil & Gas 360® in an exclusive interview. “They are arresting some of the people in the oil firms for corruption. That opens the door, in theory, for reform,” said Scissors, a professor of economics at George Washington University and an expert on the Chinese economy. “But the reform they have been talking about is merging two of the three state-owned oil companies to make one of them even bigger. They are not looking for any meaningful change in state control of the sector,” he said.

Bigger doesn’t mean always better

“When prices are high, people fall in love with large, state-owned oil companies,” Scissors told Oil & Gas 360®. “They are still terrible when prices are high, but people like them. And when prices are low, people realize they are not nimble, they waste tons of resources and they don’t innovate. That’s the situation with China,” said Scissors.

The cumbersome size of China’s main oil and gas players, in addition to burdensome state-control of the industry makes it difficult for China’s oil and gas industry to react effectively to changing market dynamics.

PetroChina (ticker: PTR), the publicly traded arm of CNPC, has a market capitalization of $234.4 billion, according to Bloomberg data. For comparison, that’s larger than BP’s (ticker: BP) market cap of $110.7 billion, or Chevron’s (ticker: CVX) market cap of $178.7 billion, but smaller than ExxonMobil’s (ticker: XOM) market cap of $355.6 billion.

A Trendline Economic Model of Oil & Gas Company Management in China

The Chinese oil and gas industry operates on a simple model of trend-line extrapolation in order to justify the use of large sums of money, says Scissors. If prices are high, then Chinese companies invest in new fields to expend production. If prices are low, they begin purchasing crude to stockpile.

“The reason they do that is because the industry is so heavily politicized that you have to be able to defend your use of state money,” said Scissors. “That’s what we’re talking about here, these companies are using state funds; it doesn’t matter if they earned them themselves, they’re still state funds. They don’t belong to CNPC or Sinopec, they belong to the state.

“When you’re deploying those funds, you have to have a reason, and those reasons tend to be incredibly simplified,” he said. “The large decisions, the large financial allocations, or deciding not to allocate, all have to be cleared through the state. That makes these companies really, really slow.”

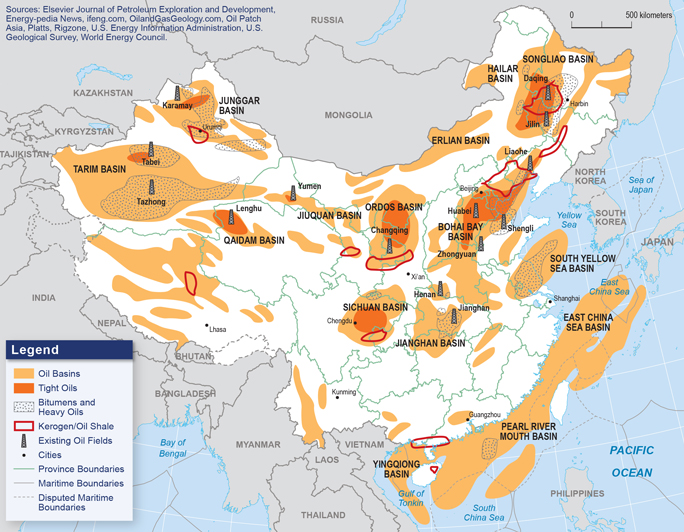

American technology doesn’t always translate to Chinese geology

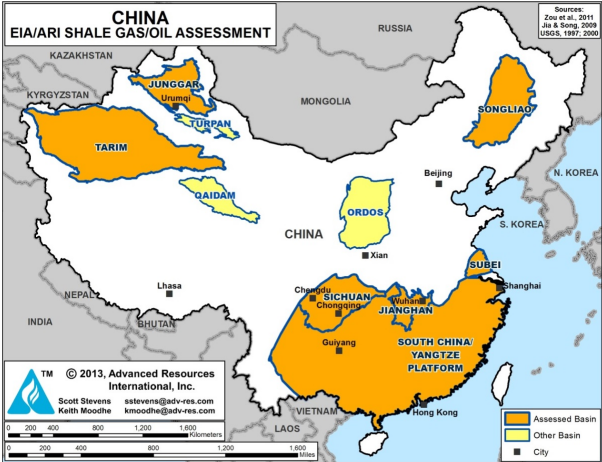

As the shale revolution pushes the U.S. to the top of the list for global oil production, many including China, have sought ways to generate their own shale boom. Chinese companies have invested $12-$14 billion in U.S. shale companies in order to access shale technology, said Scissors. “But American technology doesn’t translate to Chinese geology.

“Shale was not created by Exxon and Chevron; it was created by little American companies. [China] does not have those. And you don’t have land-rights, and you don’t have water,” Scissors said, tallying up a list of reasons he believes China will never experience a shale boom like the one seen in the U.S.

“[China] will continue to be involved in [shale], hoping there is some kind of technological breakthrough made elsewhere that does translate to China, but they are not going to have their own shale expansion. It would have to come from overseas, and it’s going to be very difficult because their market is so tightly controlled.

“Shale is a poster child for individual land-rights and small companies, neither of which China has,” said the George Washington professor.

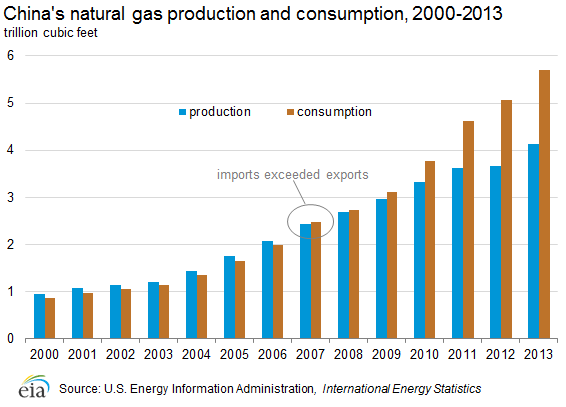

China’s demand for gas has also disappointed, leaving less demand for shale, said Scissors. “All these huge gas contracts that they signed—especially with the Australians a few years ago—they are all toast. What is happening is they are substituting for coal, and they do not need that much gas [now] because their economy is weak.

“I think what you’re going to get is one out of three contracts are actually going to be fulfilled, and it’s going to be whoever comes to them with the best terms, and there will probably be a political component involved in it as well.”

Russia will be left out in the cold: don’t be surprised if NONE of the gas-to-China shipments happen

This will likely leave countries like Russia out in the cold, said Scissors. On November 10, 2014, the two countries announced a landmark deal for Russia to supply 2 trillion cubic feet (Tcf) of natural gas to China over a 30 year period. The deal was touted by Russia as part of a strategic turn to the east as relationships with its traditional markets in Europe worsened, but experts told Oil & Gas 360® that the Russian pivot is not going to be as strong as the Russians hoped.

“The Russians are always hoping for pricing the Chinese don’t want to give them, especially in the current environment. No one should be surprised if none of the gas shipments materialize,” said Scissors. “In fact, the largest supplier of LPG to China is the U.S., so we’re much more competitive on price to China than the Russians are, in that sector at least.”

China left out of TPP

Despite its position as one of the world’s largest demand centers, China was excluded from the Trans-Pacific Partnership (TPP), a trade and business investment agreement that included the U.S. and 11 other Pacific Rim nations. The countries involved in the agreement represent $28 trillion, roughly 40% of global GDP, and one-third of world trade, according to the New York Times.

The reason for leaving out such a massive trade partner from the agreement, said Scissors, was precisely because the group that negotiated TPP hopes to circumvent China. “The Chinese are very difficult in trade negotiations,” said Scissors. Building a successful economic block without China would leave the members in TPP in a stronger bargaining position for future deals with China.

The problem, said Scissors, is that TPP has not passed yet. “There is not a TPP right now. There’s an agreement that has not been ratified by anyone.”

“No coherent long-term plan”

The biggest misconception about China’s oil and gas industry, according to Scissors, is the idea that the state-owned companies are being used by the government to further national goals.

“When people think of a state-owned energy company, they think it’s used for strategic purposes, but the strategic purpose is just to make the Party happy in the short-term. There’s no coherent long-term goal here,” he said.

In order to achieve that end, the Chinese government has focused on currency stability in the past in order to help the oil and gas industry in China maintain the status-quo. The recent devaluation of the yuan, according to Scissors, has not affected the Chinese oil and gas industry in any great way. It has hurt their purchasing power, but as Scissors points out, “they have paid much, much higher oil prices” before.

The size of the state monopoly in China, along with the restrictive nature of government policy, has left China’s oil and gas industry in a position where it can only respond to events as they happen, rather than trying to shape a path forward. Combined with a lack of innovation, China’s oil and gas industry is currently in a holding pattern until the next shift in the market.

“They are much better off with stable, low prices, even if it makes their bottom line look bad, than with unstable prices. They have no idea how to respond to that.”