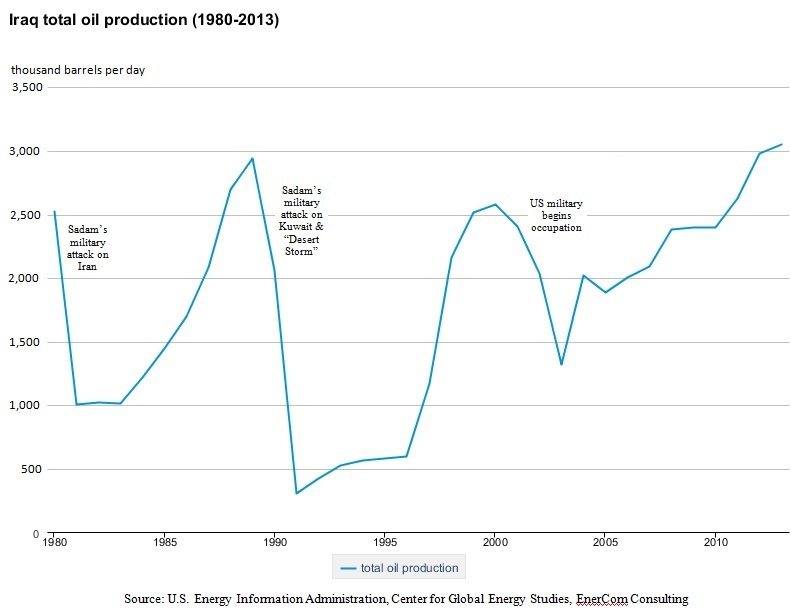

In a research note issued June 16, Raymond James Equity Research Analysts Pavel Molchanov and Marshall Adkins said: “Given Iraq’s status as OPEC’s second-largest oil producer and fastest-growing oil producer outside the U.S., anything that runs the risk of disrupting the flow of Iraqi barrels is a big deal for the oil market. Last week’s sharp escalation of the crisis involving the ultra-violent group ISIS [the Islamic State in Iraq and Syria] certainly falls into this category.”

The rapid advancement of the ISIS militant group in a sustained, fast moving charge through Iraq has launched global questions about the stability of Iraq’s new government, its ability to maintain stability and to defend itself and its assets against continued aggression.

The Associated Press reported today that the United States plans to send up to 275 troops to protect the U.S. embassy and other personnel in Baghdad, and Reuters reported the shutdown of Baiji, Iraq’s largest refinery today. “Baiji, has been shut down and its foreign staff evacuated, refinery officials said on Tuesday, adding that local staff remain in place and the military is still in control of the facility. Baiji is one of three oil refineries in Iraq and only processes oil from the north. The other two are located in Baghdad and the south and are firmly under government control and operational.”

The Associated Press reported today that the United States plans to send up to 275 troops to protect the U.S. embassy and other personnel in Baghdad, and Reuters reported the shutdown of Baiji, Iraq’s largest refinery today. “Baiji, has been shut down and its foreign staff evacuated, refinery officials said on Tuesday, adding that local staff remain in place and the military is still in control of the facility. Baiji is one of three oil refineries in Iraq and only processes oil from the north. The other two are located in Baghdad and the south and are firmly under government control and operational.”

How will the continued movement of ISIS, which was characterized by House Intelligence Committee Chairman Mike Rogers on “Fox News Sunday,” as “… sophisticated, command and controlled, seasoned combat veterans …,” and other groups fighting for territory in Iraq affect Iraq’s oil production? And how will the situation in Iraq affect commodity prices and the global oil and gas industry in general?

According to a Reuters analysis, “Iraq’s oil growth targets look increasingly at risk, the International Energy Agency said, highlighting the threat to supplies from political instability and violence. The loss of one third of total Iraqi oil production, along with rising demand in the second half of 2014, may slash global spare capacity and generate a price increase of up to $40 per barrel, according to a report released by Securing America’s Future Energy on Tuesday. Iraq will need to import about half its oil product needs, more than 300,000 barrels per day, said Adnan al-Janabi, a senior Iraqi oil official.”

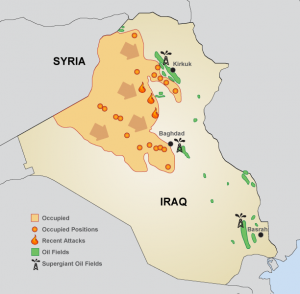

The analysts at Raymond James point at three possible scenarios. In one (to which they give 60% odds) Iraq is able to stop ISIS from spreading, oil prices stabilize and things return to status quo. In their bearish scenario (30% odds), Iraq defeats and expels ISIS from Iraq, cooling off oil prices. In their bullish price scenario, if ISIS continues to gain momentum and attacks and captures Iraq’s oil-rich southern region, home to more than two-thirds of the country’s oil production (they give this below 10% odds), Brent crude could reach $130 per barrel or above. This is their “Black Swan” scenario.

The analysts at Raymond James point at three possible scenarios. In one (to which they give 60% odds) Iraq is able to stop ISIS from spreading, oil prices stabilize and things return to status quo. In their bearish scenario (30% odds), Iraq defeats and expels ISIS from Iraq, cooling off oil prices. In their bullish price scenario, if ISIS continues to gain momentum and attacks and captures Iraq’s oil-rich southern region, home to more than two-thirds of the country’s oil production (they give this below 10% odds), Brent crude could reach $130 per barrel or above. This is their “Black Swan” scenario.

Oil & Gas 360® spoke to Marshall Adkins today about the developing situation in Iraq. Adkins believes if ISIS takes the southern oil producing regions and the oil “just changes hands and they keep on producing,” the effect on commodity prices would be minimal. But if a takeover of Iraq’s southern oil fields leads to a supply interruption, “Brent goes to $130 to $150 per barrel or higher.”

As to the effect of OPEC in today’s situation, Adkins believes the power of OPEC has been diminished for quite a while with respect to the amount of true excess capacity under its control. “If you were to see two million barrels go offline from Iraq, neither Saudi nor U.S. production would be able to make it up, other than possibly with the SPR (the United States’ Strategic Petroleum Reserve), and that would be a temporary solution.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.