Gas Demand Growing as Coal Prices and Exports Heat Up

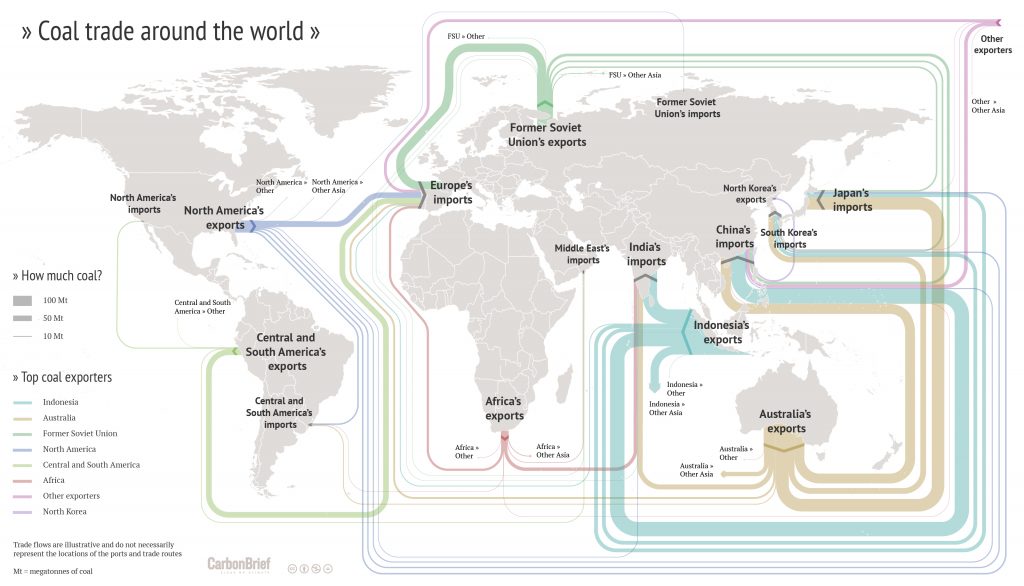

Henry Hub aside, the real hot commodity this summer has been coal, as spot prices for Australian thermal reached $100 per ton (ASD) in September for the first time since April, 2012. The country is the world’s second largest exporter of coal, behind Indonesia.

This price spike has been spurred by government-enforced domestic mining cuts in China that have required steel makers and electricity generators to make up for shortfalls by stepping up their coal imports. The world coal industry has been under stress since early 2012 due to oversupply and diminishing demand.

While this shift has taken the market by surprise, it remains to be seen when the supply response will come around. Many analysts are expecting prices to continue rising for the rest of the year and potentially into Q1 2017, although forward curves for physical coal prices in Australia and China show prices falling sharply later in the new year.

Sending it all Abroad

The sharp coal price rise has further pushed the issue of how Australia, one of the world’s largest exporters of coal and gas, can improve its energy security as it seeks to reduce its reliance on coal-fired electricity. In recent years, the government has flip-flopped on promoting policies favoring cleaner fuels. Coal and gas currently account for 36% and 21% of the country’s energy demand portfolio.

After a $200 billion investment binge and three newly built LNG plants beginning to export to Asia, Australia’s LNG output is set to rise to 3.69 Tcf in 2016 – 2017, compared with 2.88 Tcf in the previous fiscal year. The country is on track to surpass Qatar as the largest global LNG producer later this decade.

However, with so much gas being siphoned off for export, domestic gas prices have more than doubled over the previous year, as shown in the chart below. A recent report by the country’s Institute for Energy Economics and Financial Analysis states that Japanese companies are paying 40% less for Australian gas than domestic consumers.

Complicating matters is the fact that over 90% of Australia’s traditional gas resources, including the Gorgon project, are located on the continent’s harder-to-develop and distant Western slope: convenient for Asian markets, inconvenient for Australians.

With coal and domestic gas prices rising, some industry observers are wondering if the populous Eastern Australian states might have to consider importing LNG due to looming gas shortages. At current coal prices, why keep spending money on coal if LNG is cheaper? Is Australian natural gas is not yet reliable to make meaningful capital spending decisions to convert coal-fired plants to natural gas fired plants?