In recent years there has become an acute awareness of the importance of energy security around the world, particularly in Japan. In 2011 a powerful tsunami from the Pacific knocked the Fukushima Daiichi nuclear power station offline, and led to Japan’s decision to close the rest of Japan’s 54 nuclear reactors.

Japan, being the world’s third largest economy, was left without the power it needed to fuel its economy. Tankers full of natural gas eventually got the country up and running again, and in the following year Japan consumed 37% of the world’s liquefied natural gas (LNG) in order to support its energy needs, reports Business Insider.

As news came yesterday that Japan’s economy shrank an annualized 1.6% after a 7.3% slide in Q2, causing the country to slip into recession, it is becoming increasingly clear that Japan needs a cheap and reliable source of energy.

Returning to Nuclear Power?

In the past two weeks, Japan’s Kagoshima prefecture approved a decision to restart two reactors operated by Kyushu Electric Power Co., which is the first sign that Japan might return to nuclear power which was its primary source before Fukushima. Abe administration officials called nuclear power “essential.”

This week, the International Energy Agency chief asked Japan to return to nuclear power to cut its carbon dioxide emissions, which it says have grown since the country shut down its nuclear plants and turned primarily to coal and natural gas to generate electricity.

In the Philippines, First Gen (ticker: FGEN) is re-assessing its plans for LNG investments in its 414-MW Sta. Maria and San Gabriel plants. The plants would supply energy markets in the Philippines, but rising costs of producing domestically have some concerned.

In an interview with reporters, First Gen chairman Federico R. Lopez indicated that they are keeping track of developments as to how gas prices will shape in the Asian market following the signing of the most recent gas deal between Russian and China. This deal, along with various geopolitical factors, have First Gen worried there could be a “price pull down,” in line with the falling prices of gas being seen globally, that would make it difficult for them to compete in the market, reports Yahoo.

U.S. LNG for Japan

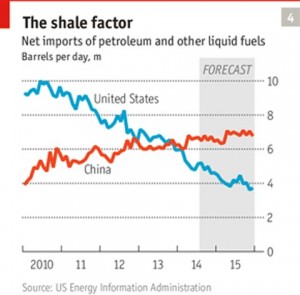

But the increasing demand for LNG, along with uncertainties around the market in Asia and the Pacific has left the door open for producers like the U.S. and Canada to take center stage. Japan’s demand for LNG jumped 33% from 2011 to 2012, according to the EIA. America, which used to be the world’s largest net oil importer, ceded that spot to China in 2013. Now, thanks to shale oil and gas, America is set to become the world’s biggest producer of oil and LNG, according to Business Insider.

Currently dry gas in America costs $4-5 per MBTU. Even allowing for another $6 or so to liquefy the gas and transport it to Asia, the price would still be a lot lower than the $15-18 per MBTUs that LNG currently fetches in Japan. Being able to import LNG from America could help with Japan’s struggling economy, and offer new markets for U.S. shale gas.

U.S. LNG Export Capacity is Ramping Up

With an announcement today that the federal government has approved another LNG plant in Texas for exports, the U.S. is finding ways to meet the growing demand in markets like Japan. In Freeport, Texas, construction is slated to start in December on a LNG export facility with a combined 1.8 billion cubic feet a day (Bcf/day) of capacity that is earmarked, in large part, for Japan.

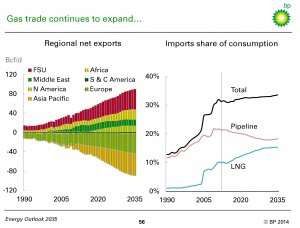

With LNG’s share of traded gas rising to 32% in 2012, and projected to go above 46% by 2035, according to BP’s 2014 Annual Energy Outlook, the U.S. is looking to meet as much of the demand as possible. In addition to the LNG plant that received approval in Freeport, Texas, there are several others that are looking to begin exporting in the near future.

Sabine Pass LNG Terminal

Cheniere Energy’s (ticker: LNG) Sabine Pass is set to commence construction of its terminal expansion at the end of this year. The plant has an export license that received final approval Aug. 7, 2012, to export 2.2 billion cubic feet per day; pending application for additional 520 million cf/day. The current terminal, which consists of 4 LNG trains, is expected to produce starting late 2015.

Cove Point LNG

Dominion Resources Inc. (ticker:D) received permission from the Federal Energy Regulatory Commission (FERC) on September 29, 2014, to build its Cove Point LNG project in Calvert County, Maryland. The plant will export 770 million cf/day, with operations expected to start in late 2017s.

Lake Charles LNG

BG Group (ticker: BG) and Energy Transfer Equity (ticker: ETE) and Energy Transfer Partners (ticker: ETP) are on the Lake Charles LNG project. The project, which has conditional approval to export 2 Bcf/day, expects its first exports to start in 2019.

Cameron LNG

Cameron LNG received authorization for construction from the FERC in June 2014, and began construction in October. Commercial operations are expected for 2018, with a production capacity of approximately 1.7 Bcf/day.

Jordan Cove LNG

Veresen Inc.’s (ticker: VSN) Jordan Cove LNG project hopes to export from the West Coast to customers in Asia by 2019, but is still in the process of receiving authorization. The project requires the construction of a 230-mile pipeline, and environmental opposition in the Pacific Northwest could be significant. On November 7, 2014, the FERC issued a draft Environmental Impact Statement that concluded that project implementation would result in limited adverse environmental impacts. The plant has conditional approval to export 1.2 Bcf/day.

Combined, these plants represent nearly 10 Bcf/day of LNG export capacity. These plants, along with a $5.3 billion expansion of the Panama Canal, which will make the canal big enough to accommodate nine-tenths of the world’s LNG fleet, will help the U.S. match the demand of countries like Japan well into the future.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.