A story of tremendous growth

In today’s oil price environment in particular, oil and gas companies are looking for ways to drive growth while at the same time becoming highly efficient at conducting their operations.

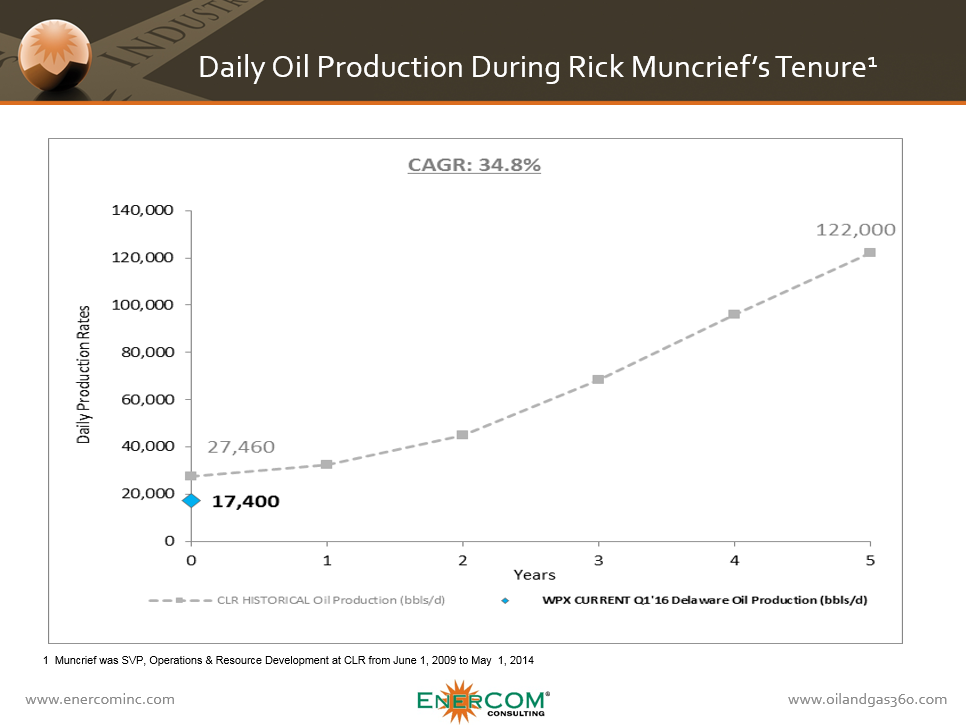

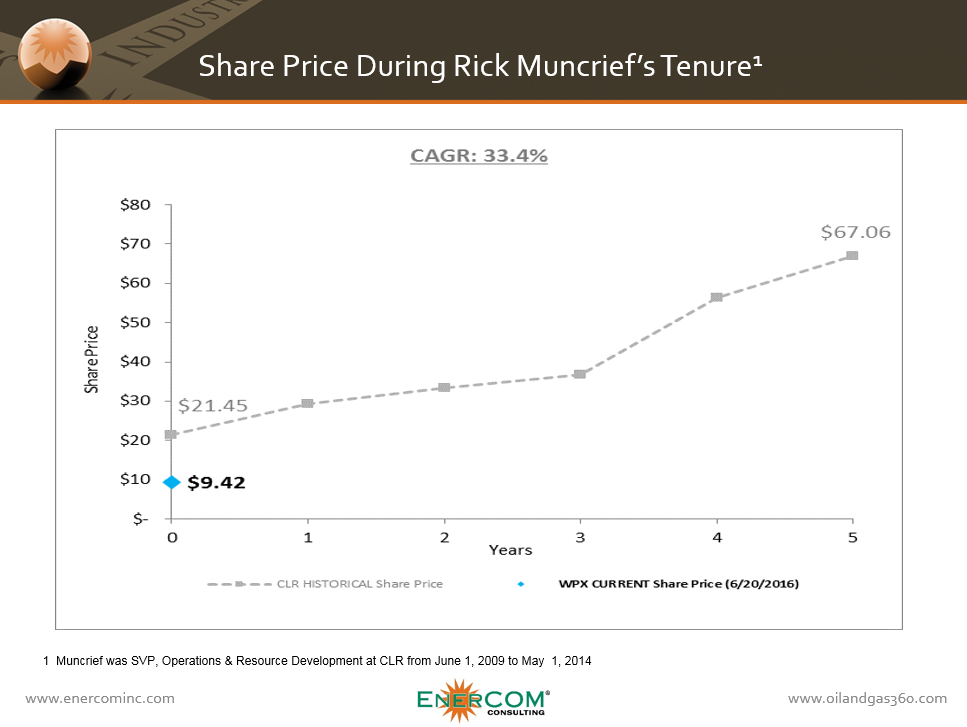

Few energy executives have been as successful accomplishing both goals as Continental Resources’ (ticker: CLR) then-Senior Vice President of Operations and Resource Development Rick Muncrief. Muncrief helped Continental increase its reserves and production by 1,093.8 MMBOE and 94.5 MBOPD, respectively, while lowering production expense by more than 15%. During Muncrief’s tenure at Continental—from June 2009, to May 2014—Continental’s share price grew by more than four-fold.

Immediately after leaving CLR in May 2014, Muncrief joined WPX Energy (ticker: WPX), taking the reins as the company’s president and CEO.

Here is the question everyone would like an answer to, though: will history repeat itself?

Muncrief was brought on at WPX to guide a growth story similar to the one he oversaw at Continental. His familiarity with the Williston and San Juan basins made him a natural fit for WPX’s existing operations.

“Rick has an accomplished record of sizing things up and driving plans that produce exceptional results, profitable growth and lower costs,” said WPX Chairman William G. Lowrie upon the announcement of Muncrief’s appointment. “He has prior experience in our growth areas, particularly the Williston and San Juan basins, and is ready to hit the ground running.”

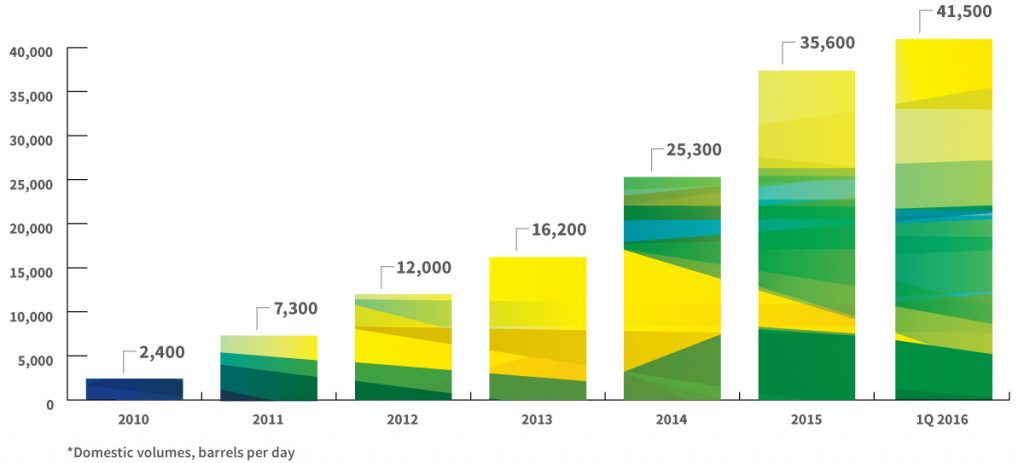

During Muncrief’s time at Continental, the growth came from the Bakken, a play where WPX holds 85,000 net acres with year-end 2015 proved reserves of 93 MMBOE. WPX continues to see the Bakken as an important part of its strategy, with oil production volumes increasing 12% in 2015 to average 21.8 MBOEPD, but the company believes that the real driver of its growth moving forward will not be in North Dakota, but rather in the stacked pay of the Delaware Basin in the Permian.

The company’s Permian assets include approximately 22 MBOEPD of existing production, approximately 92,000 net acres, more than 3,600 gross risked drilling locations, and more than 375 miles of scalable gas gathering and water infrastructure. WPX is also reporting EURs of 900 MBOE from its wells in the basin. The company plans to invest $175-$225 million in the basin in 2016 as it continues to grow its oil production.

A $5.5 billion transformation

The oil and gas M&A markets have been surprisingly quiet since the oil price downturn.

Many people who follow the industry expected a flurry of deals as companies consolidated or sold assets to stay afloat, but most companies have instead decided to cut back activity to the “core of the core” and avoid selling at the bottom of the market.

WPX stands in stark contrast to its peers, however; as the company took on, and successfully completed, a major transformation which began just months before oil prices fell from peak triple digit levels.

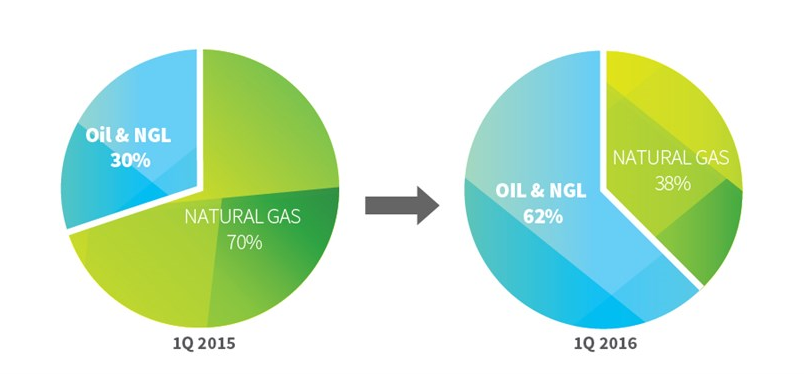

WPX has completed $5.5 billion in transactions since 2014. Its focus: become a more oily company. To that end, WPX purchased RKI Exploration & Production LLC in July 2015, giving the company a major presence in the Permian Basin. WPX followed up the RKI deal with nearly $1.5 billion in divestitures, including the sale of the Van Hook Gathering System in August 2015 for $185 million, $80 million in assets in the Powder River Basin, the sale of its San Juan Basins Gathering System for $309 million, and most recently, the sale of its Piceance Basin-focused subsidiary for close to a billion dollars to Terra Energy Partners LLC in February.

Highlighting the difficulty of this transformation were low oil prices and the uncertainty as to what the future would hold for the oil and gas industry.

“It was a challenging backdrop,” WPX President and CEO Rick Muncrief told Oil & Gas 360®, “but I’m pleased with how we’ve transformed the company.”

The transformation was about more than a switch in assets though, said Muncrief. “We have transformed the culture of our company. That transcends the deals and operations excellence. There’s an excitement in the company.”

That excitement and the confidence the team built up completing deals in a lower commodity price environment helped create a very capable team, Muncrief told Oil & Gas 360®.

“The strategy we laid out before the crash in [oil] prices has not changed. We were going to focus on improving our margins by increasing crude oil volumes, and we were going to focus on three basins. As we sit here today, that’s what we’re doing,” said WPX’s CEO. “We are a can-do shop. Whether it’s maximizing efficiencies, focusing on costs, or completing difficult transactions, we can do it.”

Commodity price downturn creates unique opportunities in new basins

One facet of WPX’s transformation that was affected by the downturn was the basins the company chose to focus on, said Muncrief. “An opportunity emerged for us to enter the Permian, and we decided to change our flagship basin from the Piceance to the heart of the Delaware,” he said. “We chose to be opportunistic, and it worked in our favor.”

Lessons from the Bakken

While working with CLR, Muncrief helped turn the Bakken into a major growth engine for the company, something he plans to replicate at WPX with the companies Delaware Basin assets.

While WPX does hold Bakken assets, Muncrief sees the real potential for growth in the Permian. In addition to having lower transportation costs to get production to market and a more favorable tax structure, the Permian holds more potential upside as a resource play, he said.

“The Permian and the Bakken are the top two oil plays in the country,” Muncrief said. “The Bakken helped to pioneer horizontal drilling and fracture stimulation. The Permian will be able to benefit from that, so the learning curve will be much shallower. It has more of a resource assessment flavor to it. There’s a lot more upside, we just need to get out there and try [to unlock it].”

Stacked Pay in the Delaware

The staked pay in the Delaware Basin offers the company several targets on its Permian assets. The basin is marked by vertical shales, siltstone and sands in layers, stacked on top of each other in 16 formations, according to WPX.

“The stratigraphic column of the Delaware Basin is rich with productive formations,” WPX Vice President of Geoscience Robert Revella said. “On our position, we see a 9,200-foot hydrocarbon-charged column with production already established from 10 benches or zones.”

Those include the Bell, Cherry and Brushy Canyon sands of the Delaware Mountain group, the upper and lower Avalon Shale, the second and third Bone Spring formations, and the Wolfcamp X-Y, A and C.

WPX has identified two of those areas – Wolfcamp and Bone Spring in Loving County, Texas – as the most economic in a challenged commodity price environment.

WPX takes aim at 20 Bakken DUCs in 2016

While the company expects the Permian to drive its future growth, WPX plans on completing its previously drilled/uncompleted wells in the Bakken in 2016.

“The Bakken is lower risk and has great economics,” Muncrief said, explaining why the basin remains an important part of the company’s strategy. “We have about 20 DUCs in the Bakken that we’ll go back to work on completing in the third quarter of this year, assuming prices remain in the $50 per barrel range, or better,” he said.

Currently, the company has one rig working in both the Bakken and the San Juan Basins, and it plans to maintain those rigs. The Permian currently has two rigs drilling, and will likely see a third added during the third quarter as WPX works on resource assessment, WPX said.

Focus on maintaining liquidity in a down market

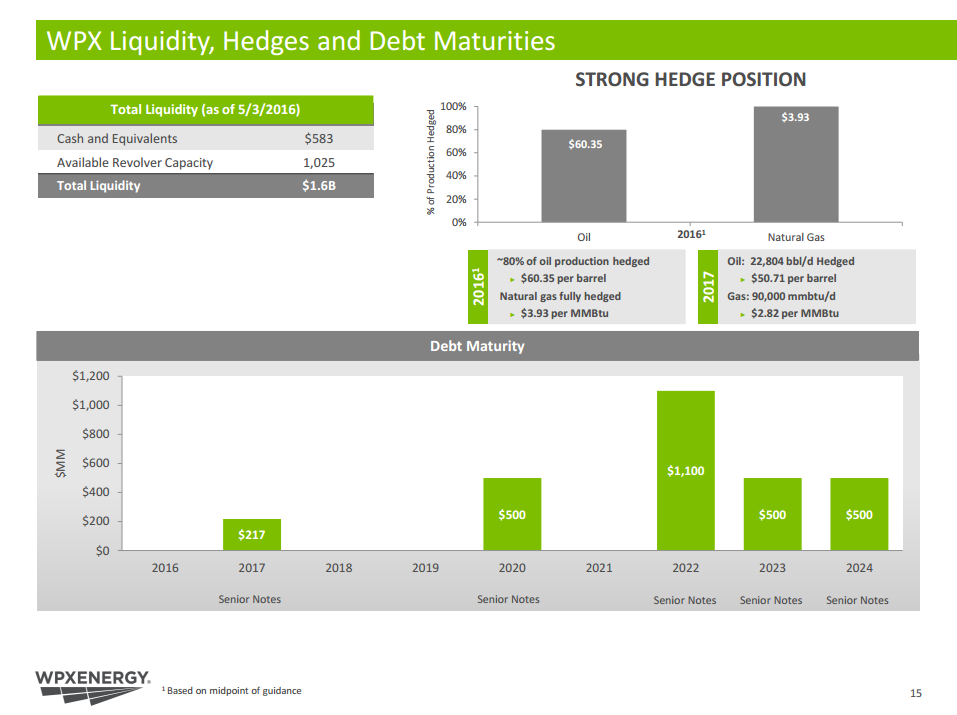

WPX has posted double-digit growth over the last four years, but the focus during a down-cycle is on a strong balance sheet, said the company’s CEO.

“Growth takes a back seat to making sure that you have good liquidity in a down market,” explained Muncrief. “A lot of companies took on debt to fuel growth,” leaving them in a tough position when prices nose-dived at the end of 2014.

“We took on some debt to get into the Permian, but it’s manageable, and the equity offering from earlier this month takes the near term pressure off,” he said, referencing a public offering with total gross proceeds of $540 million the company priced June 6th, 2016. “We’ve been focused on paying down debt before it comes due,” helping to keep the company’s balance sheet strong, and debt payments manageable.

“I think the market bet against us, but we were successful, and we did everything we said we would do.”

“As we get more active and add more rigs, we’ll layer on more hedges. We don’t set a hedge percentage, but in a normal environment, we’re around 50% hedged, and in this current environment, we’re closer to 75% hedged,” WPX executives told Oil & Gas 360®. “Over the next year or two, hedges will assure that we have cash flow to implement the program we want, while leaving the potential for upside as well.”

While predicting the future has proved to be a difficult task for the oil and gas industry, Rick Muncrief’s past performance at Continental and now leading WPX show that it is possible for energy companies to grow—despite a downturn in commodity prices.

WPX Senior Vice President and COO Clay Gaspar will be presenting WPX at EnerCom’s The Oil & Gas Conference 21® in Denver, Colorado, Tuesday, August 16, 2016. At the 2015 edition of the conference, EnerCom hosted more than 100 presenting companies and more than 2,000 institutional investors, energy research analysts, retail brokers, trust officers, bankers and energy industry professionals.