Acquisition of Yates increases number of EOG drilling locations with 30%+ IRRs by 40%

EOG Resources (ticker: EOG) announced today that it will acquire Yates Petroleum Corporation, a privately-owned E&P headquartered in Artesia, New Mexico, for total consideration of approximately $2.5 billion. Under the terms of the deal, EOG will issue 26.06 million shares of common stock valued at $2.3 billion and pay $37 million in cash, subject to certain closing adjustments and lock-up provisions. EOG will assume and repay at closing $245 million of Yates debt offset by $131 million of anticipated cash from Yates, the company said in a press release.

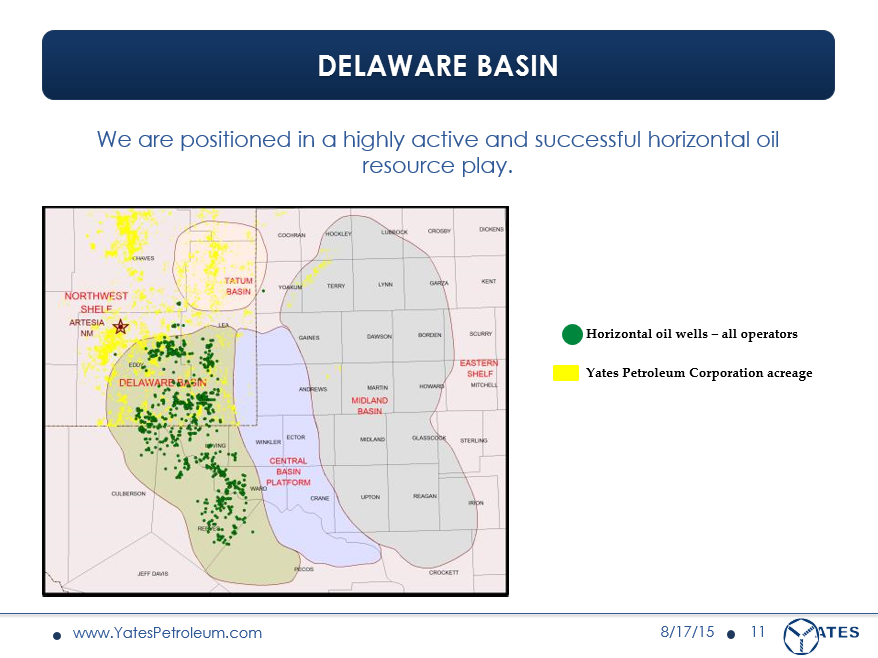

Yates currently holds 1.6 million net acres across the western United States, including 186,000 net acres in the Delaware Basin, 138,000 net acres in the Northwest Shelf, 200,000 acres in the Powder River Basin, and an additional 1.1 million net acres in New Mexico, Wyoming, Colorado, Montana, North Dakota, and Utah. The company’s production currently stands at 29.6 MBOEPD (48% crude oil). Assuming an approximately $30,000 per BOE production rate multiple, the acquisition equates to a “reasonable” $8,500 per acre valuation, net of production, a report from KLR said this morning.

The KLR report went on to say that the deal would have a negligible value impact on EOG as “the anticipated increase in drilling activity offsets the dilutive effect on the equity-financed acquisition.” Activity in the Delaware Basin continues to pick up as operators in the area, like WPX Energy (ticker: WPX), realize returns, even at today’s price. The Yates acquisition increases EOG’s position in the Delaware Basin by 78%, the company said in its press release.

“Our planned rig count in the Permian’s Delaware Basin continues to climb,” said WPX President and CEO Rick Muncrief. “We are now projecting five rigs in the basin by year-end.”

According to the press release announcing the deal Tuesday, Yates immediately adds an estimated 1,740 “premium” net drilling locations in the Delaware Basin and Powder River Basin to EOG’s inventory, a 40% increase. A “premium” drilling location is defined by EOG as a direct after-tax rate of return of at least 30% assuming a $40 flat crude oil price. EOG plans to commence drilling on the Yates acreage later this year, with additional rigs added in 2017.

Deal doubles EOG’s Powder River Basin acreage

In addition to the Delaware Basin acreage EOG picked up in the transaction, Yates’ assets will also double the acreage held by EOG in the Powder River Basin. The combination adds 81,000 net acres from Yates in the core development area of the Powder River Basin this is prospective for the Turner Oil play, EOG said in its release. The acquisition brings EOG’s total Powder River acreage to 400,000 with the addition of Yates.

Analyst Commentary

UBS 09.06.2016

EOG is one of the best run E&Ps with a greater focus (than peers) on ROCE, as well as a leader in shale development and advanced well completion techniques. However, it has been criticized for not having enough undeveloped resource for a company its size. But this deal boosts its unbooked resource-to-proved reserve ratio from 3.5x to 4.1x. More specifically, while it has become increasingly apparent that the Permian offers the best returns and longer term growth potential in the US, EOG's legacy 250,000 acre position was viewed as too small. Importantly, the Yates deal increases its Permian position by 130% to 574,000 acres, including 424,000 in the Delaware and 150,000 in the NW Shelf and doubles its premium inventory location count. Pro forma for this transaction, 58% of EOG's 6,000 premium drilling locations will be in the Permian.

Stephens 09.06.2016

This morning EOG announced it is acquiring privately-held Yates Petroleum for $2.5 billion to be funded by a 26.06 million share equity offering (~5% dilutive) and $37 million in cash. The assets include ~1.6 million net acres in the U.S., including ~524K net acres prospective for the Delaware, Northwest Shelf and Powder River Basin, as well as 29.6 Mboepd (48% oil) in current production. The Company appears to have obtained the assets at a favorable price, paying ~$3K/acre (assuming $30K/flowing) when only including acreage prospective for the Delaware, Northwest Shelf and Powder River Basin. The transaction is expected to close in early October, and EOG will be hosting a conference call today at 11 a.m. ET. We remain EW but are putting our price target and estimates under review.

KLR Group 09.06.2016

Our $117 per share EOG target price is unchanged as the largely equity-financed

Delaware/Powder River Basin acquisition is offset by incremental drilling activity.

We anticipate the company conducts a two to three-rig program on the acquired

acreage early next year. This year EOG plans to drill ~250 wells and complete

~350 wells. Accordingly, the company should exit the year with ~200 wells in

backlog. We expect EOG to normalize its remaining well backlog (~100 wells

WOC) next year.