Oil prices coming in line with their historic levels during the past 41 years

As companies, analysts and others look at oil prices stabilizing in the $45-$50 range for U.S. crude oil benchmark WTI as a post-Thanksgiving 2014 “new normal,” Oil & Gas 360® along with EnerCom Analytics took a historic look at the price of oil and found the new normal may not be new at all.

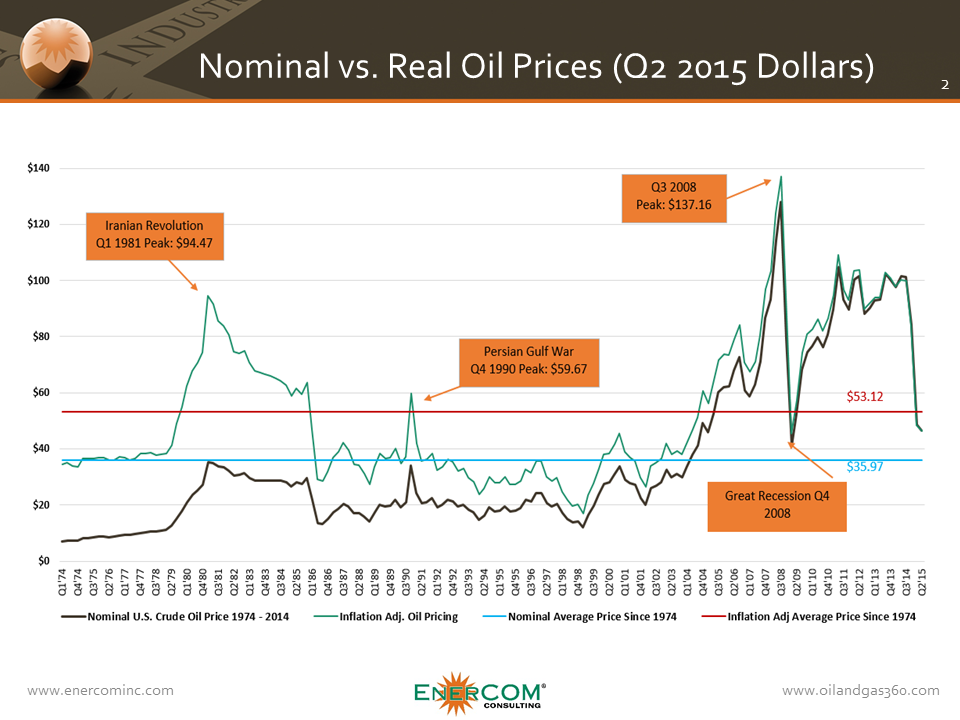

Looking at oil prices back to the first quarter of 1974 forward to Q2’2015, EnerCom found that the average nominal price for U.S. crude oil over the 41-year span was $35.97. Adjusting for inflation, that price comes to $53.12, well below the $100+ oil prices that were seen between 2010 and 2014..

Early concerns over peak oil, spikes of unrest in the Middle East, the decline in the value of the dollar and U.S. petroleum reserves, price speculation, and a number of events not directly related to oil (Hurricane Katrina, for example) all pushed oil prices significantly higher than the historical average.

The oil and gas industry in 2015 is struggling to deal with lower commodity prices than the $90+ per barrel years that opened up lending and fueled the shale boom, but $50 oil is hardly a new phenomenon. From a historical perspective, are things finally getting back to normal after a period of unusually high prices?

While not likely to be filed as “good” news by operators and service companies trying to get the 2015 economics to work, oil prices returning to their historic levels won’t stop efficiencies from increasing as oil and gas companies continue making adjustments to how they go about producing the energy that fuels the global economy. If the historic numbers don’t lie, maybe what we’re seeing is just a return back to “normal” for oil prices.