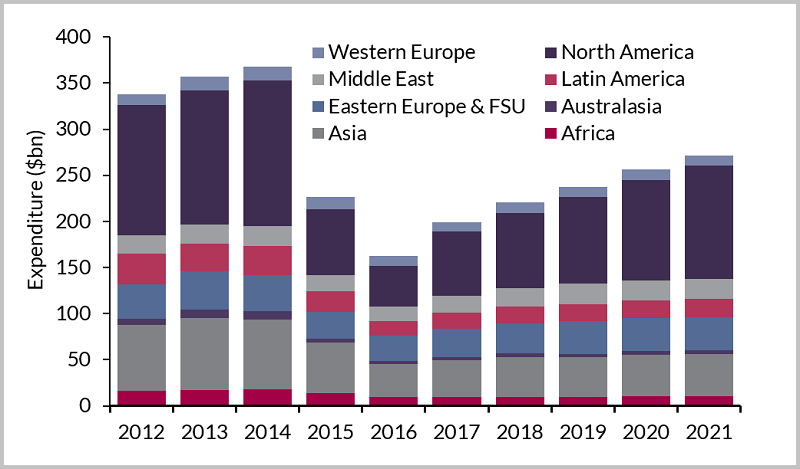

Firm predicts $1.2 trillion spend on drilling and well services from 2017-21

The oilfield service industry will begin to recover from the effects of the downturn in 2017, according to a note released by Douglas Westwood.

In total, $1,185 billion is expected to be spent on drilling and well services from 2017 to 2021. This forecast represents a 1.6% increase beyond the previous quarter’s estimate, reflecting increased activity.

U.S. onshore activity is recovering faster than expected, as higher prices drive shale producers to step on the gas again. In fact, it appears that growth in demand has outpaced growth in supply recently.

Some basins are seeing labor and equipment shortages. According to Westwood, while idle fleet reactivation and workforce size increases will eventually help the shortage, inflation pressures will not be alleviated over the near-term. In total, Westwood expects U.S. onshore service prices to increase by about 10% in 2017.

Offshore and international markets are another story. The price downturn has severely decreased international activity, and the OPEC and non-OPEC production cut has further pushed down new drilling. Westwood does not believe that expected activity increases will create any significant increase in oilfield service spending in the near to medium-term. Service companies will be able to take advantage of pricing increases, however, as oil prices rise through the next few years. Offshore companies will not experience this benefit, as mobile offshore drilling rigs have seen a sharp decrease in day rates due to oversupply.

Overall, Westwood predicts 10% CAGR in onshore oilfield services and 3% CAGR for offshore oilfield services. International onshore activity does not have a tremendously positive forecast, but it seems likely that 2017 will be the bottom for that market.