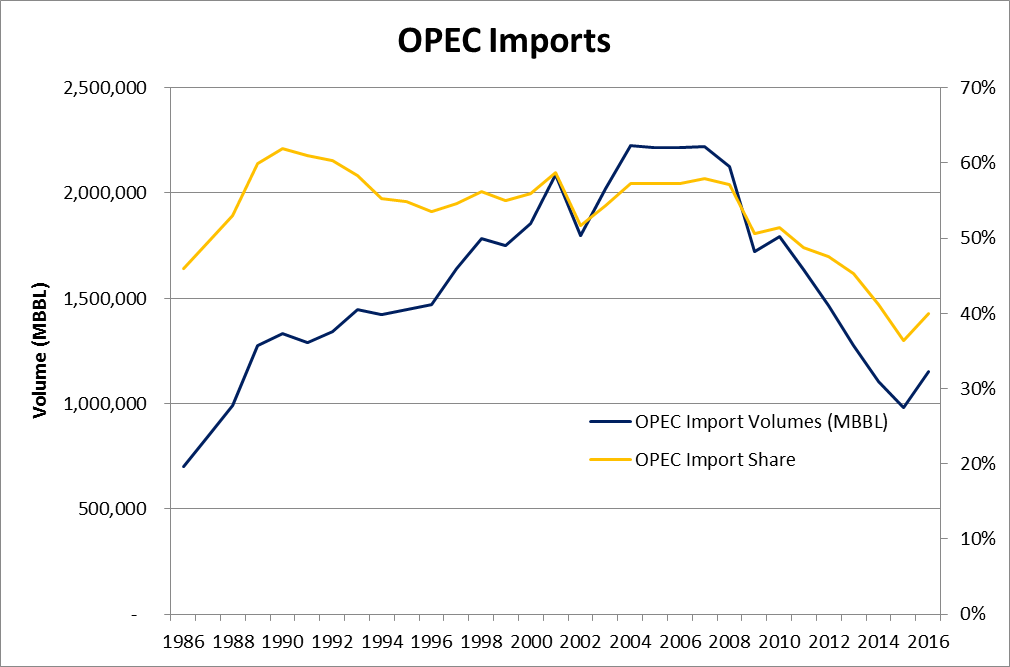

Only 40% of imported crude came from OPEC in 2016

OPEC’s share of U.S. oil imports has been declining, and has dropped sharply over the last few years. In 1990, OPEC supplied 62% of all crude imported into the U.S. This share gradually declined until 2008, as Canadian output grew and displaced imports from overseas.

After 2008, the combination of the financial crisis and booming U.S. shale output caused OPEC’s global market share to decline sharply, falling to 36% in 2015. Decreased domestic production in 2016 led the U.S. to import more from OPEC in 2016, but at 40%, OPEC’s share of U.S. crude oil imports is the second-lowest on record.

After discovering that its strategy to push out U.S. shale producers with low oil prices didn’t work, OPEC‘s efforts to stabilize the global oil market have been a popular news subject in recent months. Production cut extensions aim to reduce global inventories, but have not been as successful as hoped. And recent reports suggest that Saudi Arabia may specifically cut oil shipments to the U.S. in an attempt to improve inventory data.

The EIA has kept thorough records on all oil imports into the U.S. since 1986, compiling data on all 91.2 billion barrels of oil the U.S. has imported in the last 31 years.

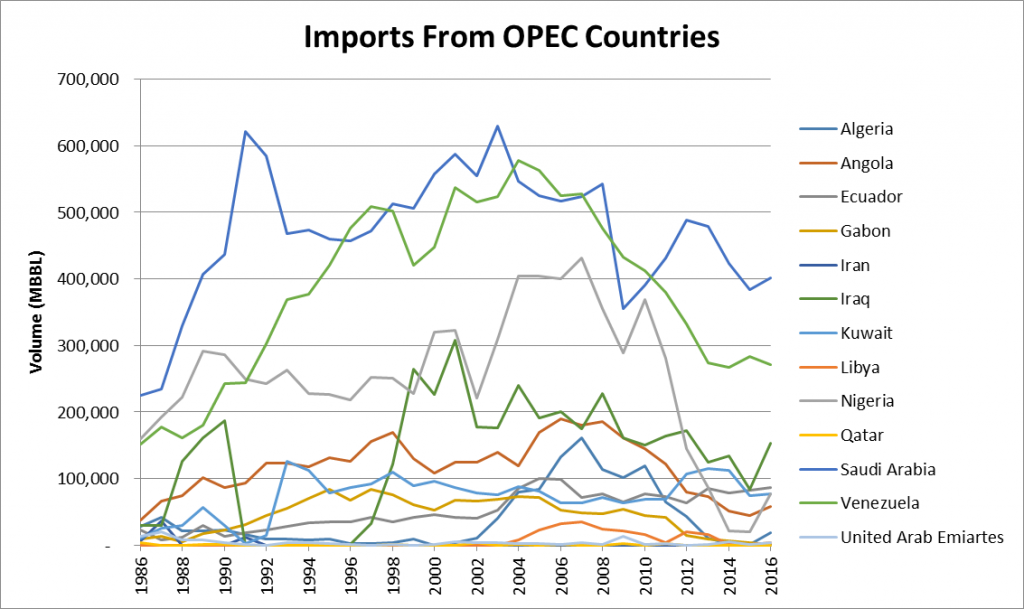

Imports from individual nations declining

Saudi Arabia is the largest OPEC supplier of oil to the U.S., shipping a total of 14.5 billion barrels of oil since 1986.

The Kingdom has been the U.S.’s foremost oil supplier, among OPEC nations, in 23 of the past 31 years. Imports from the country have recently been in decline, however, as rising domestic production reduces the need for imports. In 2016, the U.S. imported just over 400 million barrels of crude from Saudi Arabia.

Venezuela is the second-most important provider of OPEC crude to the U.S., with 11.9 billion barrels sent to the U.S. over the past 31 years. Venezuela’s heavy oil is in decline, likely being displaced by similarly heavy oil from Canada. Venezuela provided the U.S. with about 271 million barrels of oil in 2016.

Nigeria is third-largest among OPEC crude import partners, and has shipped a total of 7.8 billion barrels of crude oil since 1986. Once the once the second-largest provider of oil to the U.S., imports from Nigeria are typically lighter crude, similar in grade to the oil produced in U.S. shale operations. The shale boom and domestic unrest quickly forced Nigeria out of the U.S. oil trade. In 2010 the U.S. imported 983 MBOPD of oil from Nigeria. Only four years later, though, this value had fallen to merely 58 MBOPD, a drop of 94%.

Only two OPEC countries provide heavy oil

The types of crude imported from OPEC varies widely among the different countries in the group. Oil with an API gravity lower than 25 is often defined as “heavy oil,” while oil between 25 and 35 is “medium” and oil with an API gravity above 35 it typically called “light oil.”

Venezuela provides the heaviest oil of any of the U.S.’s major trading partners, averaging around 20°API. Ecuador is the only other OPEC member that exports heavy oil to the U.S., providing about one tenth of the oil that Venezuela does. Unlike almost every other OPEC country, U.S. oil imports from Ecuador have gradually increased in recent years.

The U.S. needs heavy oil like Venezuela produces because its refineries are not set up to process the grades of oil that are produced from shale formations. Most American refineries were set up to process heavy crude before the shale boom began, and have not changed since unconventional oil began to enter the market.

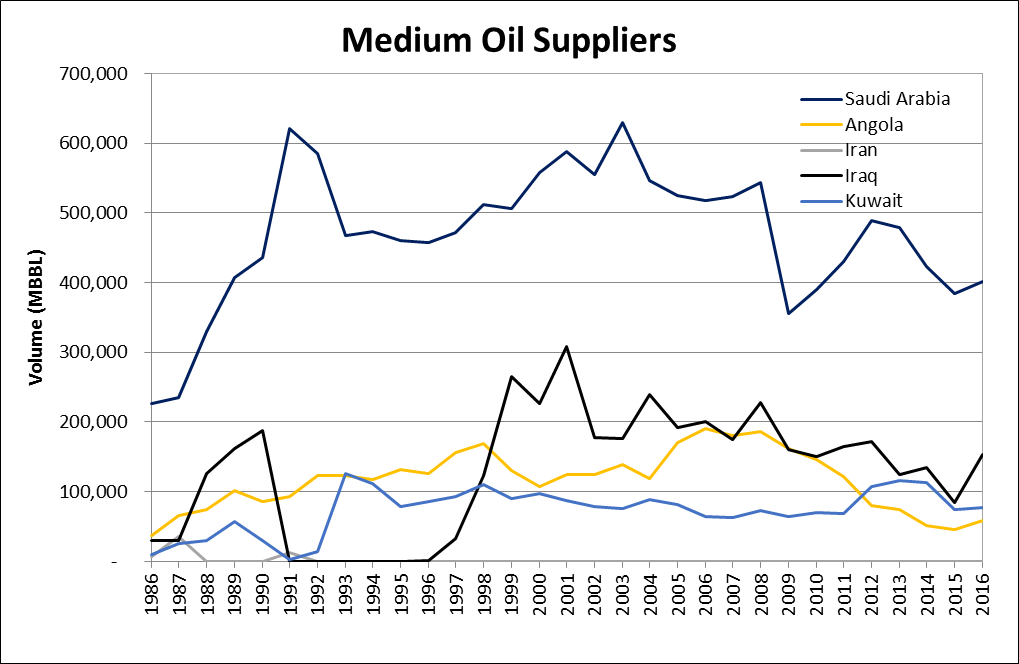

Most OPEC oil is medium-grade

Medium grade crude dominates imports from OPEC members, with Saudi Arabia, Iraq, Angola, Kuwait and Iran suppling medium oil.

Saudi Arabian crude, for the most part, comes from the titanic Ghawar field and a few other large deposits, meaning imports from the Kingdom are relatively consistent in grade. Most imports from the country are between 25° and 40°API, averaging just under 32°API.

Iraq is the second-largest OPEC supplier of medium oil. U.S. imports from Iraq were cut off entirely in 1991, a result of the first Gulf War. This ban was maintained until 1997, when imports from the country resumed.

Imports from Angola have gradually declined since peaking in 2006, and are currently less than one third of peak levels. Unlike most OPEC countries, imports of oil from Kuwait have been relatively flat in the past decade.

Imports from Iran are very small, consisting of only a few shipments, all before 1992. Geopolitical tensions and sanctions mean Iran has shipped the second-smallest amount of oil to the U.S. of any OPEC country.

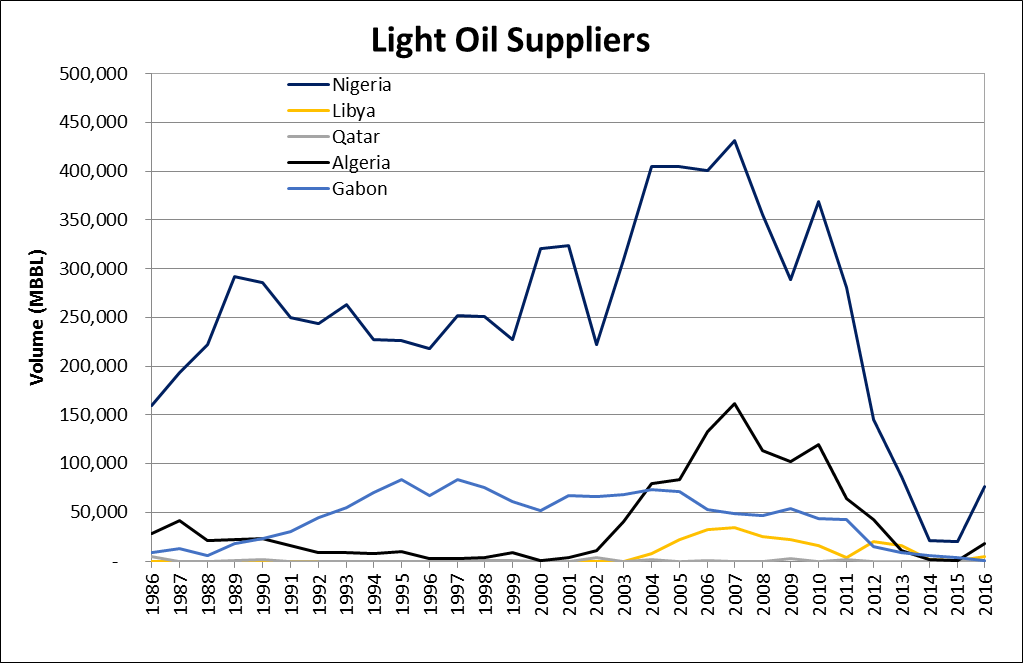

Light oil being squeezed out

Imports of light oil from different OPEC members almost all follow the same story. While Nigeria is by far the most prominent supplier of light oil, Algeria, Libya, Gabon and Qatar also produce light oil for export to the U.S. Imports from most of these countries peaked around 2007, before the U.S. shale oil boom really took off. Production from fields like the Bakken and Permian quickly made light oil imports unnecessary, and none of these countries are major suppliers of oil to the U.S. anymore.

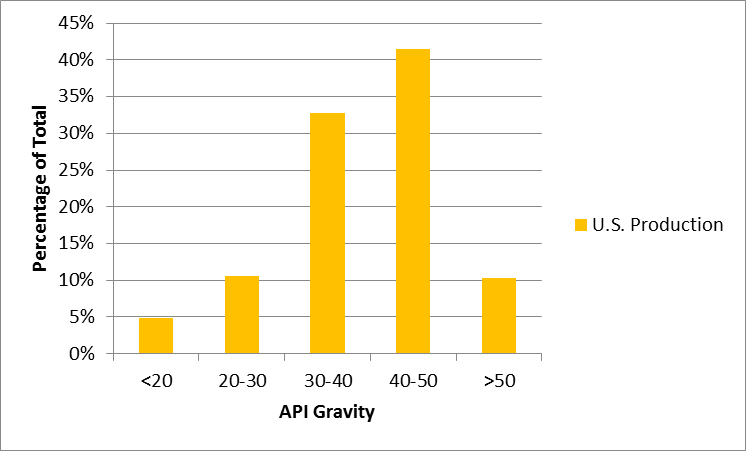

U.S. shale producers pump very light oil

U.S. production, by contrast, represents a wide variety of crude oil grades. California and GOM production provides heavy oil, and imported oil from Canada oilsands is heavy oil. Unconventional production, on the other hand, is almost exclusively light oil.