This week marked the latest step in returning energy relationships to normal between Russia and Ukraine. On Tuesday, Ukraine’s Naftogaz made its first debt payment of $1.45 billion to Russia’s state owned Gazprom (ticker: OGZD) for natural gas supplied to Ukraine during November and December 2013, Gazprom confirmed.

This first payment is part of a winter gas package that was agreed on by Russia and Ukraine, and brokered by the European Union, which will supply gas to Ukraine through March of 2015. The new deal will supply Russian gas to Ukraine at $378 per 1,000 cubic meters ($10.70 Mcf), a discount of $100 per 1,000 cubic meter, ITAR-TASS reported. Gazprom has already issued a bill for prepayment in November for 2 billion cubic meters (70.63 Bcf) of natural gas. Naftogaz commented Thursday that they had no approved schedule for prepayment for Gazprom’s gas supplies, however.

Ukraine will also be required to pay off $3.1 billion for past deliveries by the end of the year, or supplies will cease for 2015, The Moscow Times reported. In return for this stipulation, Gazprom agreed not to use a contractual “take-or-pay” clause in the new deal that would have required Ukraine to pay fines if it took less gas than specified in the long-term contract.

The deal also allows Ukraine to tap a variety of different aid pools in order to pay its debt. The EU has provided €760 million ($950 million) and the International Monetary Fund will provide $1.4 billion. Kiev will also be able to use its own income from the sale of gas and from pipeline transit fees paid by Russia in order to pay off its debt.

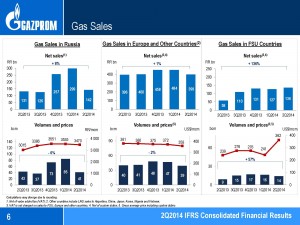

Despite all the unrest in the region, Gazprom has still reported growth for the six months ended June 30, 2014. Its total revenue was $84.5 billion (4 trillion rubles), up from $76.4 billion (3.6 trillion rubles) for the same period last year. Of that, natural gas accounted for $7.1 billion (337.4 million rubles) in 2014.

All of this appears to be promising news, but this might be a temporary lull in the conflict over gas between Russia and Ukraine. Both Naftogaz and Gazprom have lodged cases with the Arbitration Institute of the Stockholm Chamber of Commerce regarding Ukraine’s gas debt to Russia, according to Moscow Times. Naftogaz hopes to recover $6 billion in alleged over-payments, while Gazprom wants to recover $4.5 billion in debt. The Arbitration Institute’s decision could spark new disagreements, but more pressing is the fear that problems might arise early next year. A decision is expected to come sometime next year.

With border tensions still high and no agreement on summer prices for gas, there are still many hurdles to overcome before the issue can be considered closed.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.