Alaska determined to be an LNG exporter even when the oil and gas companies have bailed

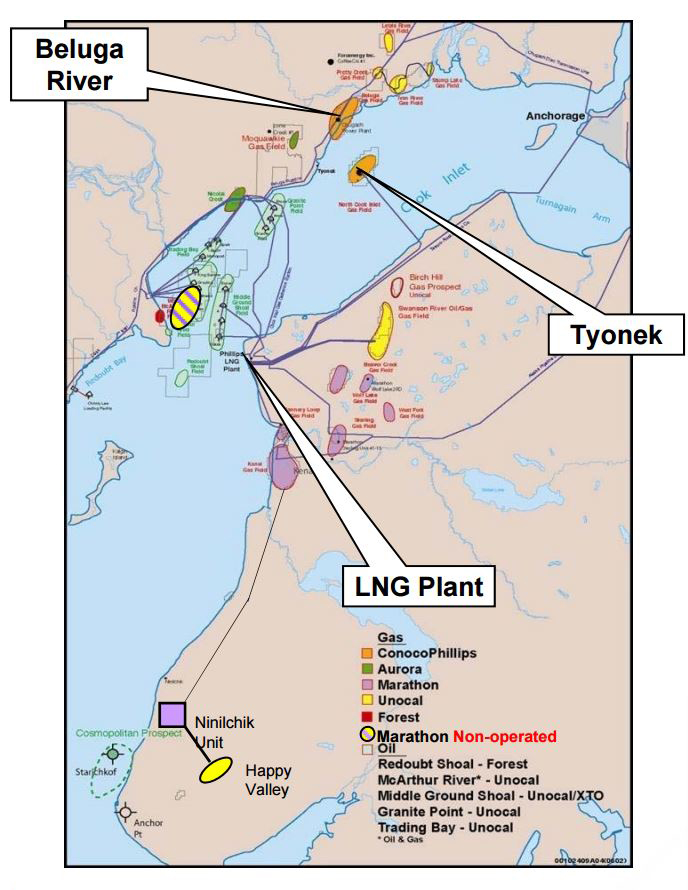

Alaska’s KTVA11 reported last night that the Alaska Gasline Development Corporation (AGDC) said in a presentation before the Senate Resources Committee on Monday that it is in discussions with ConocoPhillips (ticker: COP) about purchasing its liquefaction plant in Nikiski.

Rosetta Alcantra, an AGDC spokeswoman, told KTVA the ConocoPhillips facility could potentially replace a larger LNG facility that would have to be built under original Alaska LNG pipeline (AKLNG) project plans, for which AGDC is the sole remaining applicant. Alcantra said she didn’t have information regarding how much the ConocoPhillips plant would cost or where money for the purchase would come from.

“That’s a detail that would need to be ironed out,” she said. “It would be something, maybe there would be opportunities through other partnerships that would make it more realistic.”

Alaska Gasline Development Corporation is last applicant standing in $45-$65 billion AKLNG project

The news about the possible purchase of the Kikiski liquefaction facility is woven in with the proposed Alaska LNG project developments.

Alaska LNG had been described as a “gigaproject” by those involved, with an estimated price tag of $45 to $65 billion. The Alaska LNG project until Jan. 1, 2017, involved a partnership of energy majors including BP (ticker: BP), ExxonMobil (ticker: XOM) and ConocoPhillips (ticker: COP), and TransCanada (ticker: TRP).

On its project website, AGDC summarizes the project as follows: “[It] will move North Slope natural gas through the resource-rich center of Alaska providing clean-burning natural gas to fuel local markets, mining, and industrial needs. A new liquefaction facility built in Nikiski (North America’s longest serving LNG export location) will provide access to the expanding LNG market.

“The Prudhoe Bay and Point Thomson fields anchor the project on the North Slope. These fields will produce, on average, about 3.5 billion cubic feet of gas per day with approximately 75 percent from the Prudhoe Bay field and 25 percent from the Point Thomson field.

“This integrated natural gas project is one of the most important projects being built in the United States. It is Alaska’s priority project and has been widely studied by stakeholders, federal agencies, and State regulators.”

AGDC announced in 2015 that it would buy out TransCanada Alaska’s portion of the project, and the former partner group referenced that change in composition of applicants to FERC in March of last year. A November 2015 press release by the State of Alaska announced its purchase of TransCanada’s share of the Alaska LNG project for approximately $64.6 million, according to Alaska Governor Bill Walker. The decision required the backing of the Alaskan legislature, which authorized an appropriation allowing the state to purchase TransCanada’s 25% share of the project.

Then on Dec. 30, 2016, Alaska LNG became Alaska Gasline Development Corporation’s project, according to a press release from AGDC.

The Alaska Gasline Development Corporation (AGDC) and affiliates of ExxonMobil, BP and ConocoPhillips have concluded agreements that will enhance AGDC’s ability to progress an Alaska liquefied natural gas export project to commercialize Alaska’s North Slope natural gas resources, AGDC said.

Under a Pre-FEED Joint Venture Agreement (JVA), the parties completed all of the Pre-FEED deliverables and the Federal Energy Regulatory Commission (FERC) draft environmental and socioeconomic resource reports. Upon conclusion of the Pre-FEED activities, the parties have spent more than $500 million on an Alaska LNG project. AGDC will now assume the responsibility for the technical and regulatory activities associated with the project.

AGDC said it plans on completing the Federal Energy Regulatory Commission (FERC) pre-filing process, building upon the draft environmental and socioeconomic resource reports prepared by the parties during Pre-FEED.

“The Alaska LNG Project proposed facilities include a liquefaction facility in the Nikiski area on the Kenai Peninsula, an 800-mile large diameter pipeline, up to eight compression stations, at least five take-off points for in-state gas delivery, a gas treatment plant located on the North Slope and transmission lines to transport gas from Prudhoe Bay and Point Thomson to the gas treatment plant. The project is designed to export up to 20 million metric tons of liquefied natural gas per year,” according to the press release, referring to the original AKLNG proposal.

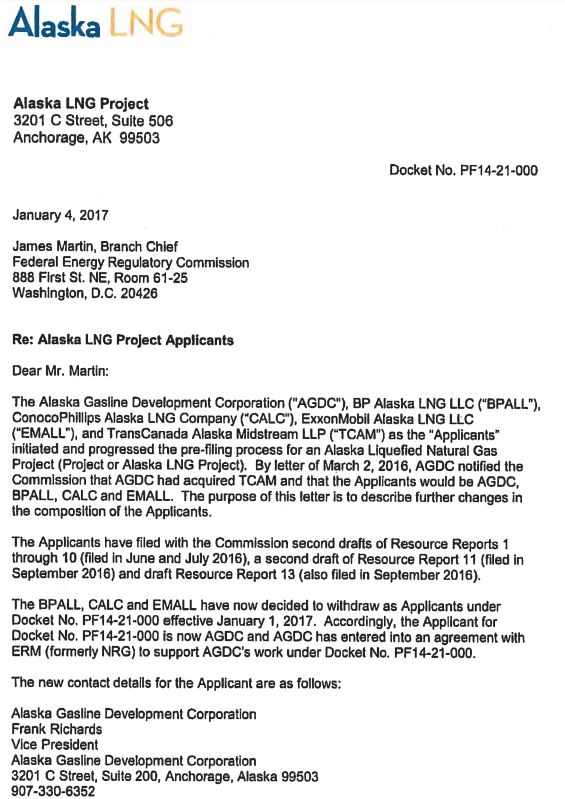

On January 4, 2017, the Alaska LNG Project applicants filed a letter with the Federal Energy Regulatory Commission (FERC-Docket No. PF14-21-000) stating that BP Alaska, ConocoPhillips Alaska and ExxonMobil Alaska had decided to withdraw as applicants effective Jan. 1, 2017. Today, AGDC is the sole remaining Alaska LNG Project applicant.

AGDC has $104 million left in funding for AKLNG project

Frank Richards, vice president of AGDC, told lawmakers the corporation has $104 million left in funding for AKLNG, KTVA reported.

COP’s Kenai LNG Plant

The Kenai LNG Plant, located in Nikiski on the Kenai Peninsula, was the world’s largest plant when built in 1969, according to information from ConocoPhillips, and it was the first to serve the Asia-Pacific market. Nearly all LNG produced at the plant has been sold via contracts with two Japanese utilities.

Major gas discoveries in the late 1950s and early 1960s in the Cook Inlet Area of Alaska, coupled with a lack of local demand for the product, led Phillips Petroleum and partner companies to consider international LNG projects. ConocoPhillips said that Japan was well located to Alaska and just beginning to consider the value of LNG in helping to reduce Japan’s air pollution problems while providing needed energy.

The Kenai LNG Plant complex includes docking and loading facilities to transport LNG to customers by tanker. The ConocoPhillips plant was once the only commercial exporter of LNG from the United States. But in the summer of 2016 Cheniere Energy’s Sabine Pass plant in Louisiana began shipping its own LNG cargos abroad. The Conoco Phillips Nikiski LNG plant has shipped LNG primarily to Japan – more than 1,300 loads – during the past four-plus decades, the company said on its website.

On March 31, 2013 the Kenai LNG Plant export license expired. Due to a change in market conditions, including additional gas supplies in the basin, and with the encouragement of various stakeholders, ConocoPhillips Alaska pursued a new license which was granted on April 14, 2014. The authorization from the United States Department of Energy allows export of the equivalent of 40 BCF of LNG over a two-year period, the company said in a fact sheet about the project.

But the company did not export LNG from Kenai at all in 2016, and in November 2016, ConocoPhillips said it was interested in selling the Kenai LNG plant.

“Due to market conditions, ConocoPhillips did not conduct an export program in 2016,” the company said in a statement. “The Kenai LNG Plant remains operational and ready to resume exports.” About 23 people are currently employed at the plant, a spokeswoman with ConocoPhillips told ADN News at the time.

Dive in commodities prices killing projects

Low prices for LNG have reversed interest in building the Alaska LNG project.

Forbes reported last fall that the Alaska LNG project proposal was conceived “in happier days” for global oil and gas producers, “when LNG prices in Asia breached $20 per million British thermal units (MMBtu) in February 2014. … LNG prices for November 2016 delivery in Asia, which accounts for around two-thirds of global LNG demand-though that demand growth is slowing, are trading just over $5/MMBtu,” Forbes reported in September in a story entitled, “$65 Billion Alaska LNG Project Crashes and Burns.”

Alaska Gov. Bill Walker said in a release following a hearing about the AKLNG project that the state is looking at alternatives to continue the project because “the most common denominator for every growing economy is low-cost energy. Monetizing our gas on the world market makes it possible to deliver low-cost energy to Alaskan homes and businesses and to create thousands of construction and long-term operation jobs,” the Alaska Journal of Commerce reported last August. He also emphasized once again that the Permanent Fund will not be part of a state-led Alaska LNG Project.

“Let me be clear, a project that is not economically viable will not be built. If economically viable, it will be financed by long-term purchase contracts secured before the first piece of pipe is laid, not by the Permanent Fund,” the governor said. “This is how projects around the world are financed and Alaska’s will be no exception,”the Journal reported.

BP back to help

On Jan. 23, 2017, AGDC announced in a press release that it has entered into a cooperation agreement with BP to collaborate in the development of the financial and tolling structure intended to advance the Alaska gasline and LNG project. This agreement is intended to assist in developing a commercial structure of the project to enable project financing. BP will contribute staff, resources, and selection of third-party contractors, AGDC said.

The stated objectives of the agreement are:

- To progress the effort to utilize third-party infrastructure funding sources as a means to reduce the cost of service on the Project infrastructure.

- Refine understanding of tolling structures to identify a viable and competitive structure for Alaska or identify alternative structures that may be viable.

- Map out an agreement framework and phasing required to successfully execute and operate the Project.

- Assist AGDC in developing the Project on an expeditious timeline within AGDC’s target in-service date of 2023-25.

- Identify likely funding sources for FEED and confirm need for new equity investors.

- Introduce common language for discussing risk allocation in commercial structure.

- Identify possible long-term financing structures to reduce project cost of supply.

“AGDC is pleased to have the continued support of BP in advancing Alaska’s major gas infrastructure project,” said Keith Meyer, President of AGDC. “As we turn our attention in 2017 to the areas of commercial, financial structuring, and regulatory, BP’s input will be invaluable.”

The question remains, however, as to whether the State of Alaska can make a profitable go of an LNG export venture in an environment when legacy oil and gas companies, who gauge every project by its potential profitability, have virtually all abandoned ship.