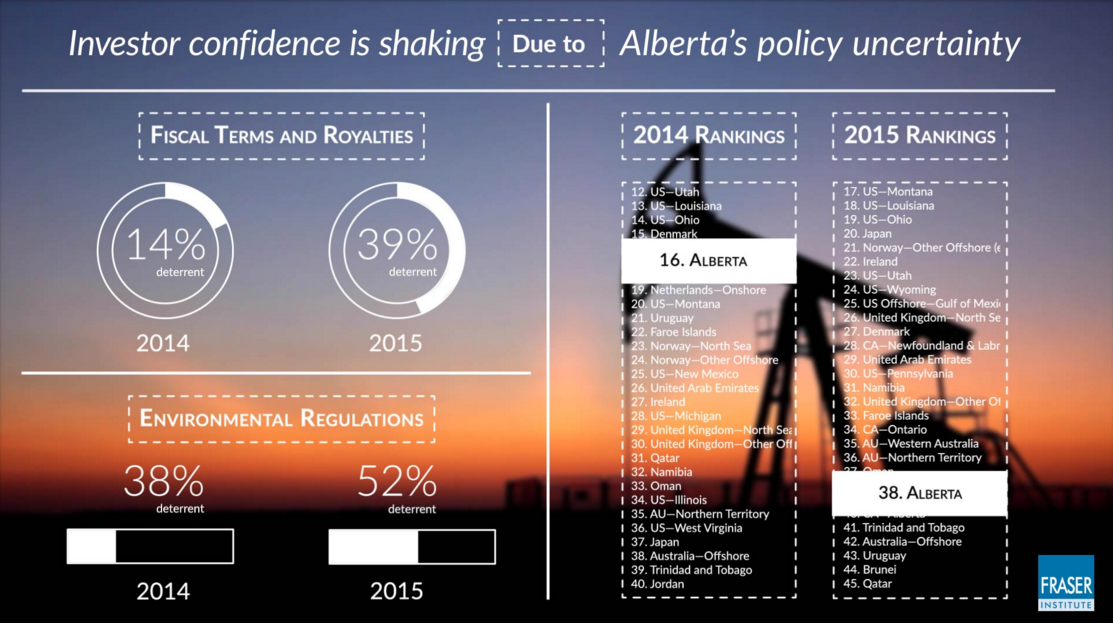

Alberta falls to 38th from 16th in just one year

Alberta is becoming a less attractive target for oil and gas investment, according to an annual study conducted by the Fraser Institute. The survey of petroleum executives, which ranks jurisdictions around the world based on how much government policy deters investment in oil and gas, listed Alberta as the 38th most attractive place to invest out of 126 jurisdictions, down 22 places from its spot at number 16 last year.

“Unfortunately, this was what we expected,” said Ken Green, senior director of natural resource studies at the free-market-oriented Fraser Institute and one of the survey’s authors.

“We see jurisdictions drop sharply within months of announcing a new policy, not years.”

Recently elected Alberta Premier Rachel Notley ran in part on a campaign to review the royalty structure in Alberta. Notley said that if the review found that increasing royalties could damage the industry, her administration would not raise them, but that a review could restore investor confidence in the industry.

The Fraser Institute found that political instability became a major factor in concerns in Alberta following Notley’s election, however. In last year’s survey, just 5% of respondents said political stability was a deterrent to investment in Alberta. That number increased by more than ten times in 2015, with 51% of respondents this year saying political stability was a concern for them. Likewise, only 14% of respondents thought Alberta’s fiscal terms (including royalties) were a deterrent to investment last year. The total jumped to 39% this year.

The study’s author noted that investors’ perceptions of Alberta took a dive compared to other provinces in 2007, the last time a review was undertaken. Alberta saw fewer investment dollars compared to British Columbia and Saskatchewan in that period, a trend that may repeat itself this year.

Saskatchewan ranked 8th in the policy survey this year, the highest ranking of any Canadian province, while British Columbia climbed 10 places to reach 50th in the list.

Green notes that the primary reason for lower investment is low oil prices, and not government policy, but concerns over Notley’s new course could have longer-term implications as investors look for the best places to invest.

Canadian economy grows in Q3, but energy sector still hurting

After two consecutive quarters of decline, Canada’s real GDP grew by 0.6% in the third quarter, according to Statistics Canada. The improved overall economic health was driven by a 2.3% growth in exports of goods and services, following a 0.5% increase in the second quarter.

“Expressed at an annualized rate, real GDP expanded 2.3 per cent in the third quarter. By comparison, real GDP in the United States rose 2.1 per cent,” said the federal agency.

The growth was curtailed in September, however, as weakness in the mining sector pulled down real GDP 0.5% in the month. The agency reported the output of goods-producing industries fell 1.5% – largely due to a 5.1% decline in mining, quarrying, and oil and gas extraction, along with a smaller (0.6%) drop in manufacturing.

“Oil and gas extraction fell 5.5 per cent in September, mainly as a result of a large decrease in non-conventional oil extraction,” said Statistics Canada. “Support activities for mining and oil and gas extraction fell 13 per cent in September, because of a drop in both drilling and rigging services. The output of the support activities for mining and oil and gas extraction industry has decreased for five consecutive quarters, down 49 per cent from September 2014 levels.”

While the mining sector still has a long road ahead of it, with prices expected to remain low, the overall Canadian economy is expected to continue growing, although at a moderated pace.

“There is good reason to believe that the relatively strong growth of the third quarter will not be repeated,” said Brian DePratto, economist with TD Economics. “Momentum appears weaker heading into the fourth quarter, even abstracting from the noise in the oil and gas sector, with growth currently tracking close to 0.8 per cent. Looking into 2016 and beyond, we continue to expect moderate growth of around two per cent per year.”