New incentives program designed to reward efficient drillers

Alberta’s provincial government has decided to leave royalty rates largely unchanged after the leadership ran on a platform that promised to change rates to ensure the province was receiving its fair share. Alberta Premier Rachel Notley said that if the review found the timing was wrong to raise royalty rates, her party would listen, but many in the oil and gas industry feared that royalty rates were set to rise.

With low oil prices putting pressure on margins, Notley conceded that “it is not the time to reach out and make a big money grab, because that is not going to help Albertans,” reports CBC.

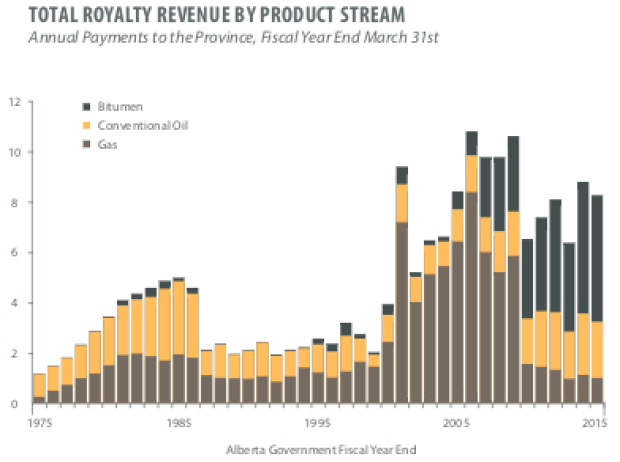

The $3 million, five-month review found that existing royalty rates in Alberta are comparable to other jurisdictions. In 2017, oil sands rates will not change and the new royalty structure for oil, liquids and natural gas will only apply to new wells, while old wells stay under the existing system for 10 years.

The key findings of the report are:

- Albertans are receiving their fair share.

- Oil sands royalties won’t change.

- Conventional oil and gas wells will pay a minimum royalty of five per cent of revenue until they have recovered costs.

- The system will reward the most efficient drillers.

- Alberta markets will be developed for the use of natural gas.

Drilling efficiencies to be rewarded by Alberta government

The royalty rate for wells being drilled in 2017 and forward will be 5% until the company has paid off the capital costs of drilling the new well, at which point a higher royalty rate will kick in. The hitch to this new program is that the capital cost for new wells will be decided using an industry average, meaning companies drilling at a higher than average cost will pay higher royalties before paying off new wells.

The hope is the new royalty program will encourage companies to drill more efficiently.

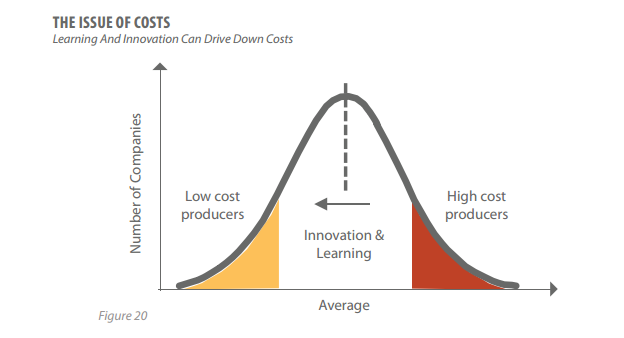

“We designed it so that it recognizes technological change, it’s not rigid or fixed. It rewards those who can get their costs down and compete,” said Peter Tertzakian, a Calgary energy economist, at a conference last month. Tertzakian was regarded as the key member of the government’s royalty review panel, who did much of the heavy lifting.

“I wanted the conditions to reward those producing a barrel of oil at a lower cost and conversely, if you don’t do that, sorry, you shouldn’t be competing,” he said.

In its report, here is how Alberta characterized the incentive concept:

“For Alberta to be successful in the future, the partnerships formed between our Province and energy companies need to be more aligned, more productive and more mutually beneficial than ever before. We need to partner with the best, most innovative and most cost-competitive producers. And we need to support all producers in becoming the very best, innovative and cost-competitive they can be because the lower their costs, the more value there will be for sharing.

“Understanding costs greatly influenced our Panel’s approach to Alberta’s royalty framework. Our Panel realized it would be a mistake to take a knee-jerk approach and lower royalty rates across the board based on a simplistic belief that it costs more to drill here. Doing so would remove the incentive to reduce costs and, at worst, prop up inefficient operations that are unable or unwilling to improve performance. The mantra that ‘Alberta is a high cost basin’ would become a self-fulfilling prophecy and in the long run we would make our province uncompetitive.

“Equally, our Panel recognized that raising royalty rates may shut in wells that contribute to the well-being of the province, especially in rural communities. As well, our Panel realized that many existing wells and potential wells can be the beneficiary of innovation and learning that reduces costs.

“Consequently, one of our Panel’s goals in optimizing the royalty framework was to seek ways to encourage and reward the efforts of producers to relentlessly innovate, lower their costs and improve their productivity. Over the long term, such encouragement can lower the average costs of producing and selling our oil and gas, increase the amount of value available for royalties, provide more buffer against low commodity prices, and position our industry to compete better on a world scale.”

The final report is available from Alberta here.