Alta Mesa Resources, Inc. (ticker: AMR) and its wholly owned subsidiaries, Alta Mesa Holdings, LP (AMHLP) and Kingfisher Midstream, LLC, have released financial results, CapEx guidance and other updates.

2018 CapEx

Alta Mesa’s total capital expenditures for 2018 are expected to range from $725 million to $800 million. Capital will be allocated primarily to Alta Mesa’s upstream STACK area, $550 million to $580 million, with the remaining balance being allocated to Kingfisher, $175 million to $220 million.

Q4/FY 2017 financial and production results

Alta Mesa reported a net loss from continuing operations for Q4 2017 of $40.8 million. Net loss from continuing operations for full-year 2017 was $56.3 million.

Total production volumes from continuing operations in the fourth quarter of 2017 totaled 2.3 MMBOE, or an average of 24.6 MBOEPD. Total production volumes from continuing operations for full-year 2017 totaled 8.6 MMBOE, or an average of 23.5 MBOEPD.

The increase in production is primarily a result of the continued development of Alta Mesa’s STACK play in Kingfisher County, Oklahoma, Alta Mesa said. Total production in 2017 was comprised of 49% oil, 35% natural gas and 16% NGLs.

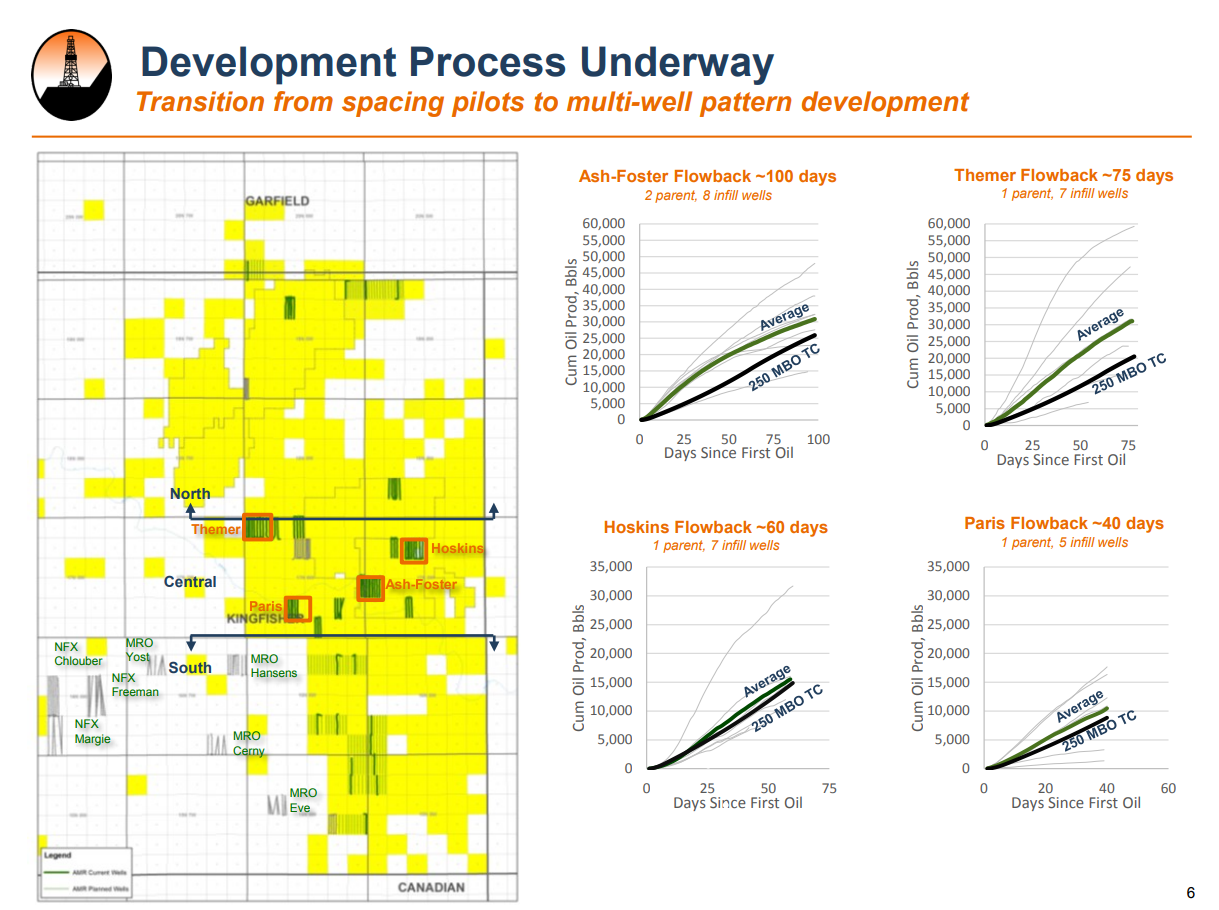

In Alta Mesa’s STACK play, the company has assembled a highly contiguous leasehold position of over 130,000 net acres. In the fourth quarter of 2017, Alta Mesa completed 36 horizontal wells in the Osage and Meramec formations. Alta Mesa had 43 horizontal wells in progress as of the end of the fourth quarter, 22 of which were on production subsequent to the end of the quarter.

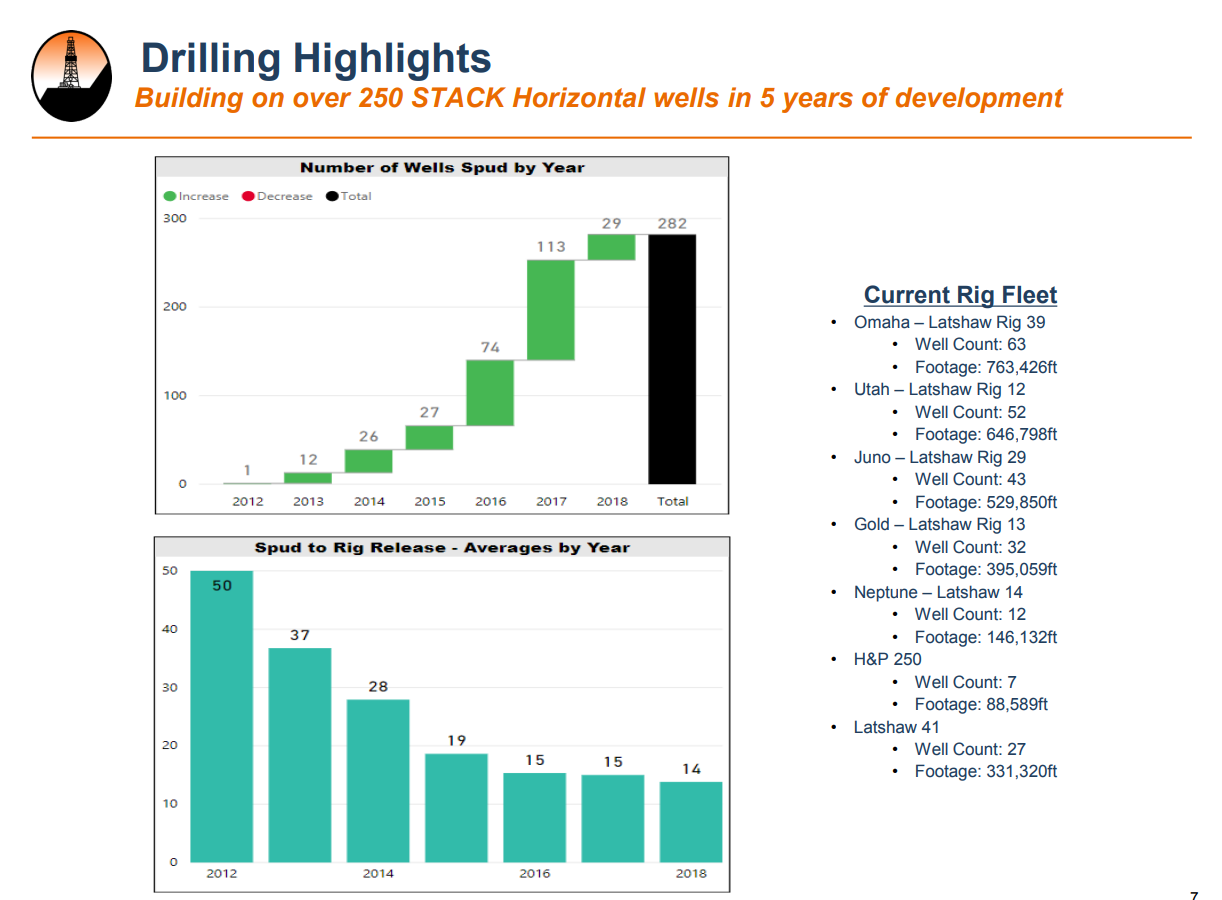

The company drilled and completed 134 gross wells in the STACK in 2017, of which 37 gross wells were funded by the joint development agreement with Bayou City Energy.

Total production costs from continuing operations, which includes lease operating expense, marketing and transportation costs, production and ad valorem taxes and workover expenses, in the fourth quarter of 2017 were $27.1 million, or $11.99 per BOE. For the full year 2017, production costs were $104.5 million, or $12.19 per BOE.

2018

Alta Mesa currently has seven rigs operating in the STACK play, with a contracted eighth rig arriving in April and plans to maintain this level for the balance of 2018. In total, Alta Mesa plans to drill between 170 and 180 gross wells during the year. The company expects drilling and completion costs on these wells to average $3.8 million and the type curve has been approximately 650 MBOE per well. Additionally, the company intends to deploy approximately $25 million in early 2018 to expand its fresh water supply system.

Alta Mesa’s year-end 2017 proved reserves in the STACK were 176.2 MMBOE, an increase of 46.6 MMBOE, or 36% over year-end 2016. Production for 2018 is expected to average between 33 and 38 MBOEPD.

Kingfisher Midstream

The initial Kingfisher 60 MMcf per plant has been operating at capacity since late 2017 and the 200 MMcf/d plant expansion is now mechanically complete, Alta Mesa said, with the cryogenic plant operation set to begin in April.

Once the expansion plant is fully operational, Kingfisher’s operated inlet capacity will be 260 MMcf/d, bringing the total system capacity to 350 MMcf/d when including the additional 90 MMcf/d of additional contracted offtake and processing capacity.

Currently, Kingfisher has more than 300 miles of low-pressure crude and gas gathering lines, approximately 125 miles of high pressure gas transportation pipelines and a 50,000-barrel crude storage capacity with six truck loading LACTS along with three 90,000-gallon bullet tanks for NGL storage.

Kingfisher’s 2018 projected net income is expected to be $81.2-$96.2 million, and capital expenditures are expected to range from $175 million to $215 million.