Anadarko Petroleum (ticker: APC) is among the world’s largest independent oil and natural gas exploration and production companies, with 2.79 billion BOE of proved reserves at year-end 2013. The company’s portfolio of assets encompasses premier positions in the Rocky Mountains region, the southern United States and the Appalachian Basin. The company also is among the largest operators in the deepwater Gulf of Mexico, and has production in Alaska, Algeria and Ghana with additional exploration opportunities in West Africa, Mozambique, Kenya, South Africa, Colombia, Guyana, New Zealand and China.

Anadarko’s final 2013 proved reserves (2.79 billion BOE) is an increase of 9% compared to 2012, according to APC’s fiscal 2013 earnings release on March 4, 2014. Net income was $801 million ($1.58 per share) and full-year cash flow from operating activities was approximately $8.9 billion. The large cash flow amounts will take considerable effect on the company’s net debt to adjusted capital, which is expected to drop to 22% in 2014 – down from 31% in 2013 and 34% in 2012.

Analyst Day Sheds Light on 2014

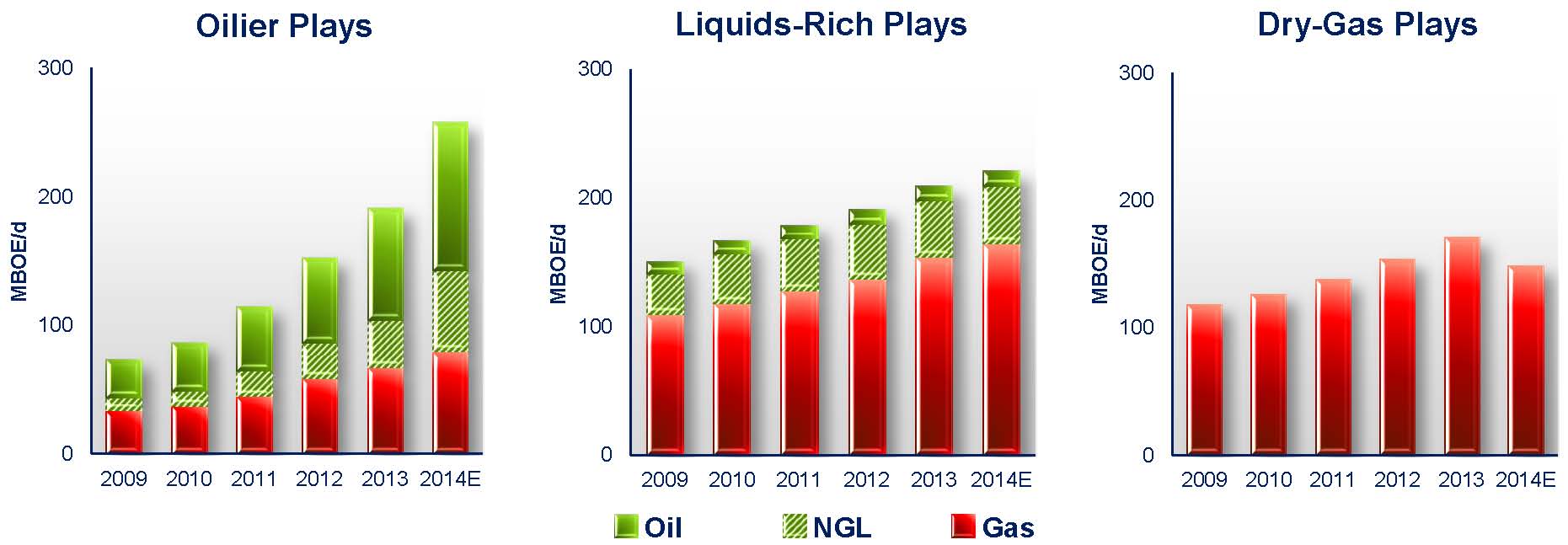

In an analyst day on March 4, 2014, APC forecasts production to increase at a compound annual growth rate of 5% to 7% through the year 2020. During that time, the company expects liquids to increase to 60% from 44% of the stream. Production will be fueled heavily by its onshore United States acreage, but its offshore and international properties are expected to grow during that time.

Management has allotted roughly $8.1 billion to $8.5 billion for 2014 expenditures, with 80% dedicated to exploiting its oily opportunities. The program will be fully funded by APC’s free cash flow. As noted by the chart below, APC’s oil-focus will commence in the immediate year. The growth is expected to add an extra 50 MBO to its production mix, with the majority coming from the company’s onshore plays. A total of 70% ($5.5 billion) of 2014 capital expenditures will be spent on its core U.S. acreage, especially in the continued development of the Wolfcamp, Eagle Ford and Wattenberg.

Source: Anadarko March 2014 Presentation

U.S. Operations

The Wattenberg Field. Production is slated to rise with 13 rigs drilling more than 360 wells. The activity jump will remain consistent through 2018 as APC ramps up its horizontal program. The field’s current resource estimate of up to 1.5 billion BOE is expected to lead to a compound annual growth rate of 20%. Downspacing may add up to another 0.5 billion BOE. The company is expected to double its oil takeaway capacity as early as 2015 to meet its rising production.

The Eagle Ford. Recognized as one of the world’s top emerging plays, APC says its activity in the region is just beginning. Ten rigs are projected to drill more than 400 wells in 2014, with an average of more than one rig being placed online each day. More than 1,000 wells have been drilled to date and an additional 2,500 well locations have been identified. APC’s rapid development of the play has resulted in virtually no sales in 2009 to an estimated 69.5 (midpoint) MBOEPD in sales volumes for the upcoming year.

Wolfcamp. Recently emerging as a world class play, APC has spent previous operations de-risking its acreage. Now that more than 1,000 locations have been de-risked, APC is prepared to run between eight and ten rigs in 2014 and expects to drill more than 80 wells. Initial estimates on the area include ultimate recovery of 500 – 600 MBOE per well, with liquids consisting of roughly 85% of the stream.

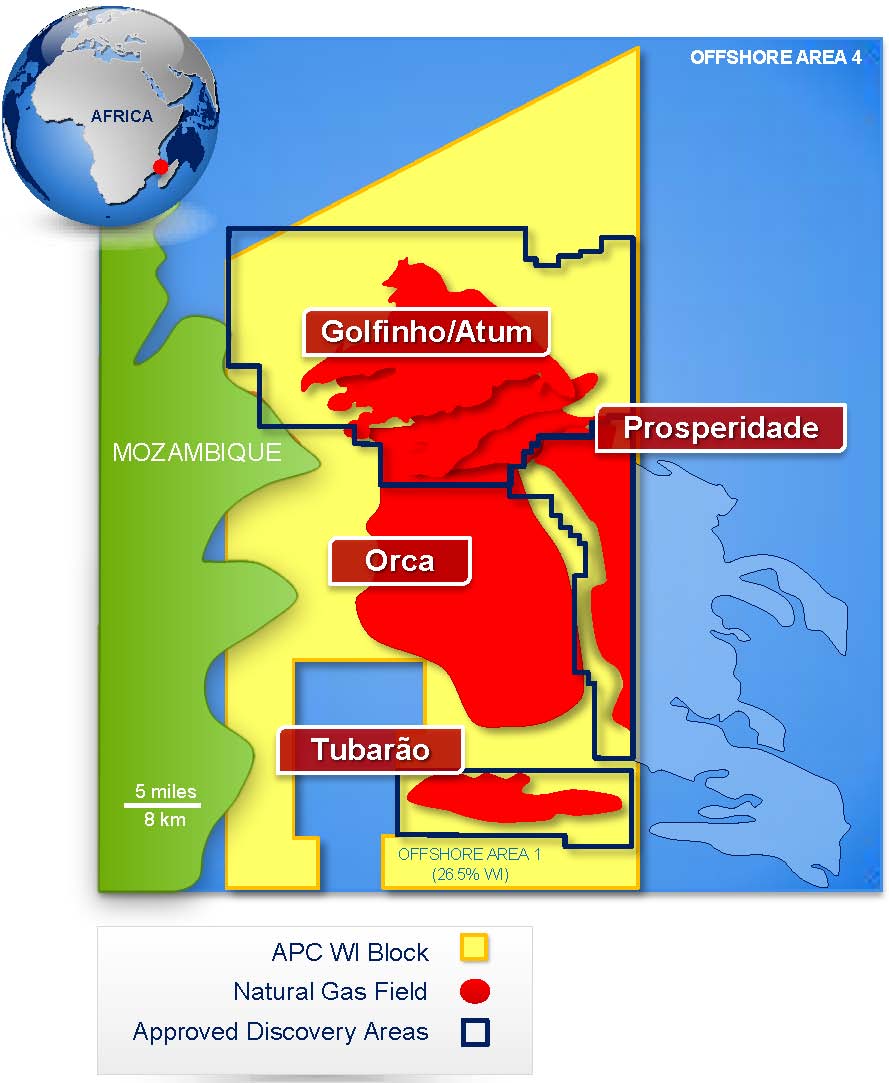

Need LNG? Mozambique is the Spot, Says APC

The EIA projects natural gas to account for 25% of worldwide energy consumption by 2035, with energy-constrained countries in Southeast Asia leading the demand. APC is tending to future needs by holding a 17,000 acre position offshore Mozambique. The area is believed to hold between 45 Tcf and 70 Tcf of recoverable resources – takeaway capacity that is exceeded only by Australia and Qatar. APC has also been very efficient in its offshore exploration and has achieved a 67% success rate in appraisals – tops in the industry. APC plans to kick off operations by drilling seven to eight wells in the upcoming year, and the first LNG cargoes are scheduled for 2018. APC holds roughly a 25% stake in the project after selling a 10% stake for $2.64 billion in 2013 in order to expedite production in the United States.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.