Anadarko Petroleum Corporation (ticker: APC) reported fourth quarter of 2017 net income attributable to common stockholders of $976 million, or $1.80 per share (diluted).

Net cash provided by operating activities in the fourth quarter of 2017 was $1.4 billion.

For the year ended December 31, 2017, Anadarko reported a net loss attributable to common stockholders of $456 million, or ($0.85) per share (diluted). Full-year 2017 net cash provided by operating activities totaled $4.0 billion.

“Given the significant volatility the energy sector faced in 2017, we continued to focus on capital efficiency throughout the year by investing upstream capital within discretionary cash flow, while materially improving margins per barrel – an approach that produced very encouraging results as we concluded the year,” said Anadarko Chairman, President and CEO Al Walker.

245 MMBOE sold in 2017, updated reserves

Anadarko’s full-year sales volumes of oil, natural gas and NGLs totaled 245 MMBOE, or an average of 672,000 BOEPD. Fourth-quarter 2017 sales volumes of oil, natural gas and NGLs averaged approximately 637,000 BOEPD.

In 2017, Anadarko added 244 MMBOE of proved reserves before the effects of price revisions. Anadarko’s costs incurred were $4.1 billion. The company’s oil and natural gas exploration and development costs were $4.2 billion.

The company estimates its proved reserves at year-end 2017 totaled 1.44 billion BOE, with 78% of its reserves categorized as proved developed. At year-end 2017, Anadarko’s proved reserves were comprised of 63% liquids and 37% natural gas.

Sales by region

By year-end 2017, oil sales volumes in the Delaware Basin of West Texas surpassed 50,000 BOPD, representing a 69% increase over the fourth quarter of 2016. The company also made significant progress toward full development mode as it successfully concluded its drilling program to capture 70% operatorship across its 240,000-net-acre position.

In the DJ Basin of northeast Colorado, Anadarko had record sales volumes of more than 254,000 BOEPD. Oil sales volumes surpassed 100,000 BOPD in December, driving an increase of almost 20% over the previous quarter. In addition, the company’s new completion design implemented in 2017 increased its EUR to 690,000 BOE per well in the contiguous core, representing an increase of more than 20% over the previous type curve.

Gulf of Mexico sales volumes averaged 143,000 BOEPD in the fourth quarter, representing a 35% increase over the fourth quarter of 2016. Oil sales volumes for the quarter averaged 120,000 BOPD, a 48% increase over the fourth quarter of 2016, while also reflecting the impact of Hurricane Nate and the prolonged shutdown at the third-party-operated Enchilada platform.

Anadarko’s international and frontier operations averaged 94,000 BOPD during the fourth quarter of 2017, representing an 18% decrease relative to the fourth quarter of 2016, which was largely driven by statutory maintenance on the El Merk facility in Algeria and the timing and size of tanker liftings.

Additionally, during the fourth quarter, the company made progress with its Mozambique LNG project by beginning the resettlement process to prepare the onshore location for the future LNG park.

2018 CapEx and sales guidance

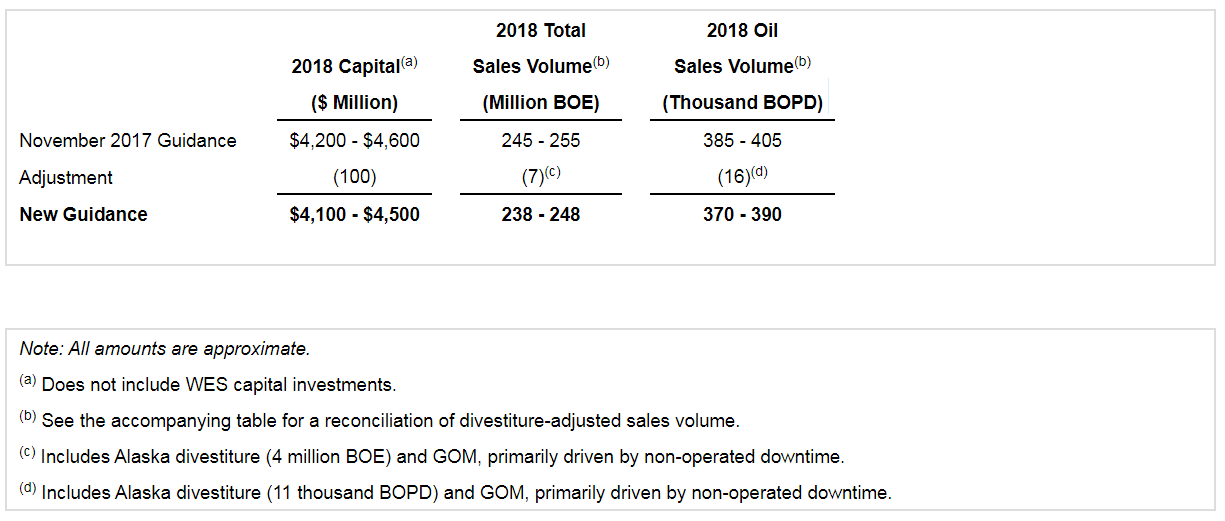

Anadarko’s 2018 guidance has been adjusted from its November 2017 news release for the divestiture of its Alaska assets and anticipated production impacts related to non-operated downtime in the Gulf of Mexico.

The company expects full-year capital investments in the range of $4.1 to $4.5 billion, not including capital investments made by Western Gas Partners, LP (ticker: WES).

Anadarko 2018 CapEx and Sales Guidance, Feb. 2018

Financials

During the year, Anadarko generated $4.0 billion of net cash provided by operating activities while investing $3.8 billion on upstream exploration and development activities. The company ended 2017 with $4.6 billion of cash on hand and closed asset divestitures totaling more than $4.0 billion during the year. Subsequent to year end, Anadarko divested its non-operated interest in its Alaska assets for approximately $400 million.

During the fourth quarter, approximately $1.1 billion of the company’s previously announced $2.5 billion share-repurchase program was executed under an accelerated share repurchase (ASR) agreement and through open-market purchases. In February 2018, Anadarko completed a repurchase of 8.5 million shares for $500 million (average price of $58.82 per share) under an additional ASR agreement. To date, the company has completed $1.6 billion of repurchases under the program, totaling 30.4 million shares at an average price of $51.27 per share.

Subsequent to year end, the company amended both its $3.0 billion, five-year credit facility to extend the maturity date to January 2022 and its $2.0 billion, 364-day credit facility to extend the maturity date to January 2019.