Anadarko Earnings Miss On Divestitures

Anadarko Petroleum (ticker: APC) announced fourth quarter results today, showing a larger-than-predicted loss. Net loss was $515 million, or $0.94 per share, making full year results a loss of $3.07 billion, or $5.90 per share. Fourth quarter results were brought down by several charges the company described as “items typically excluded by the investment community in published estimates.” These included losses on divestitures, restructuring charges, and charges due to the early termination of a rig. After adjusting for these items, Anadarko’s net loss was $272 million, or $0.50 per share.

Asset divestitures planned for Q1 2017

The company plans to continue its divestitures by closing the sale of its operations in the Marcellus to Alta Resources for $1.24 billion and closing the sale of its Eagle Ford assets to Sanchez Energy for $2.3 billion. Both deals are expected to close in Q1 2017. These divestitures add to the $2.4 billion of divestitures closed in 2016. Anadarko has described this program as an effort to “create a higher-quality, concentrated U.S. onshore asset footprint with a higher-margin, oil-weighted production mix.”

Increased activity planned for Delaware, DJ, deepwater GOM

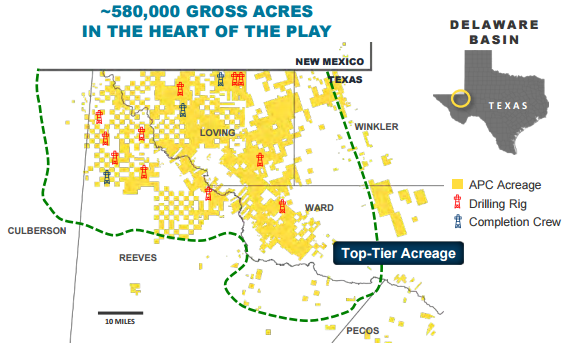

Anadarko expects to continue to increase its operations in the Delaware basin, where the company owns 580,000 acres. Two rigs have been added to the basin this month with another three planned to be added in this quarter, bringing the total to 14 operated rigs and four non-operated rigs. Several efficiency improvements were achieved in the last year, including decreasing facilities costs by 30% per well and decreasing drilling cost per foot by 29%.

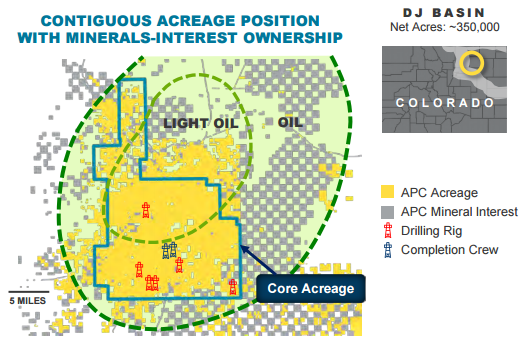

Activity in the DJ basin is also expected to increase. The company operated an average of 1.75 rigs in the basin in 2016, but has brought several in to bring the current rig count to six. Efforts to bring lease operating expenses down have paid off, with expenses dropping by 28% below levels seen in 2015 and 50% below those seen in 2013.

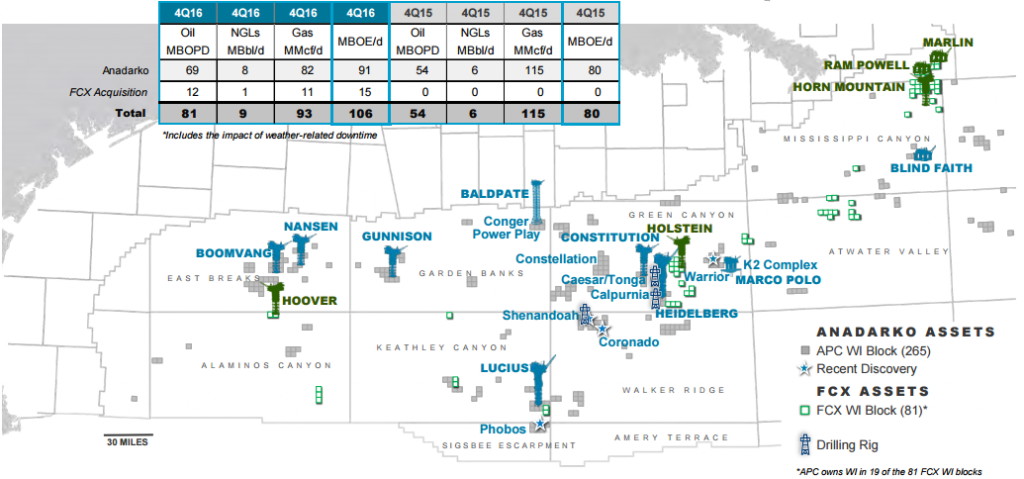

Deepwater GOM activity is also expected to increase, with several plays in development. FCX’s assets in the Gulf were acquired in December, adding to the company’s acreage and facilities inventory. The Horn Mountain Deep discovery, one of the assets acquired from FCX, is expected to begin drilling in Q1 2017, with additional drilling operations planned for 2017. The Caesar/Tonga and Heidelberg plays are currently being ramped up, with additional development expected to be brought on line this year. Several other FCX acquisitions, including the Holstein and Constellation plays are also expected to begin drilling in mid-2017.

Operations in Ghana and Colombia proceeding

Several important international operations are also proceeding on schedule. The TEN complex, producing from offshore fields in Ghana, continues to come online with first sales achieved in Q4 2016. In offshore Colombia the Purple Angel-1 exploration well was spud in Q4 2016. This well is intended to follow up on Anadarko’s 2015 Kronos discovery. The recently completed Esmeralda 3D seismic survey identified several potential development prospects, with first exploratory operations planned for 2018.

Q&A from APC Q4 conference call

Q: You emphasize Gulf of Mexico Deepwater, but you didn’t talk about international portfolio management. Can you just address, are you signaling at ex-U.S. generally, meaning ex-Gulf of Mexico, the other parts of the asset base are not core because that would be new news, I guess?

APC IR Director Robin H. Fielder: No. I wouldn’t take it quite that way, Doug. I back and appreciate, why you’re asking the question, I mean the lion share of what we will be talking about March will be – capital being allocated to the Delaware, the DJ and the Gulf of Mexico. I think long-term, we see those are the places we’re going to invest capital. Certainly, in the short run, if we try to stay closer to cash flow with CapEx that’s particularly important. It doesn’t mean that other parts of the portfolio, as you know it today will be start to cannibalize, but I think it relates to some other things, as it relates to the Gulf of Mexico, I think, Darrell and Danny Brown will be giving you more than sufficient color in March. But I think for as bigger company as we are, one of the things we feel very strongly about is our ability to give clarity around exactly this direction of where most of the capital will be spent in 2017 that is short-cycle oil with very good wellhead margins and I think, as you can see from results in 2016 we’ve done a very good job on the efficiency front and lowering the cost associated with delivering that revenue.

Q: Maybe one follow-up on the Permian first, you have mentioned various times kind of the shift from delineation to development at some point. Can you talk about the key things you are still trying to figure out on the appraisal side and kind of key stuff that would allow you to move to a full development and what are you still testing over the course of 2017 both in and outside of the Wolfcamp.

Robin H. Fielder: Well, I think one of the things you can understand and appreciate about where we are currently in the appraisal portion of this play development is that we are aggressively drilling, where we can in order to achieve operatorship. We believe as an operator, we will be able to do a lot of things that are newer to the benefit of our company over time. As operator we understand, how we will want to pace that development and that drilling activity and completion activity and be able to sync it up midstream spend. At the same time, as Brad and those that worked for Darrel that are day-to-day in this asset, we continue to have a better understanding of the rock properties that we’re dealing with that are in this appraisal portion. So that when Brad is prepared to move into full development. We know how to best optimize the development and the completion techniques associated with those rocks.

I don’t think it’s any more complicated than that. But I think those who have worked the Delaware, will tell you that Wolfcamp is an incredible rock and it is giving us opportunities, frankly, we’ve not seen in very many places in North America. And it gives us a lot of understanding, but having said that we are still trying to best understand, how we would in fact go into a full development mode and Darrell you might talk just a little about that.

APC Operations Director Darrell E. Hollek: I think, the thing that’s unique about [this] is, it’s just the extensive position we have and it varies across that positions what we’re finding. And so it’s all very encouraging, but before we go in that development mode, we really want to have a good handle on it, that also helps us understand how we want to position our midstream.

And so, the fact that we’re able to have more activity today than maybe we were looking at two quarters to three quarters ago was helpful in terms of trying to get us in the development mode. And so, it’s our hope that by the end of this year, we should hopefully start moving down that path and we should see a lot of synergies.

So we’re trying to get there as quick as we can. Obviously, the Wolfcamp A is probably the biggest target for us. But there is still a lot of opportunity inside the Wolfcamp B and the Bone Springs as we see yet to not to mention the Avalon in certain parts of this field.

So just a lot of opportunities here to make sure, we understand it before we get in that development mode. But I’ll tell you I’m encourage that we’ll get there sooner than later at the pace we’re going right now.

Q: Are we going to see some Bone Spring wells over the course of 2017?

Darrell E. Hollek: I think, you’re able to see a couple. We’re still focused largely on the Wolfcamp at this point, being the deeper horizon.

Analyst Commentary

From KLR:

We are increasing our APC target price $3 to $98 per share due to modestly higher U.S. liquids price realizations and slightly lower production tax expense. Our composite weighted average cost-of-capital values the midstream business at ~11x next year’s cash generation (Western Gas Equity Partners (WGP, $44.87, NR)/Western Gas Partners (WES, $61.38, NR) valuation) and the mineral royalties at ~20x cash generation. Anadarko’s mid-cycle capital yield of ~150% is modestly above the industry median cash recycle ratio of ~140%.

Focus assets sequential production change

In the fourth quarter, the Delaware Basin increased ~2% q/q (~1 Mboepd), the Wattenberg Field decreased ~2% q/q (~4 Mboepd) and the GOM increased ~26% q/q (~22 Mboepd) predominantly due to the December acquisition.

Wolfcamp/Wattenberg/GOM – value/growth drivers

Wolfcamp: Anadarko is increasing activity in the Delaware Basin to 14 rigs. We anticipate the company drills ~200 wells in ’17, mainly targeting the Upper Wolfcamp. Anadarko has 60+ DUCs at YE’16. Upper Wolfcamp wells (~8,500’ laterals) should recover approximately 1,100 MBoe (~55% oil, ~20% NGLs, ~25% gas) for a cost of $7+ million.

Wattenberg: The company has increased activity in the Wattenberg field to six rigs. We anticipate Anadarko drills ~225 wells in ’17 (two-thirds Niobrara/one-third Codell). The company has 60+ DUCs at YE’16. Niobrara/Codell wells commence at 700+ Boepd and should recover ~350 Mboe (~60% liquids) for a cost of ~$2.1 million.

Deepwater GOM: Anadarko tied-back two wells respectively at Caesar/Tonga and Heidelberg and one well at Lucius last year. The company has over 40 tie-back opportunities. Anadarko is drilling the Shenandoah-6 appraisal to determine the oil-water contact on the eastern flank of the field. A Phobos appraisal encountered 90’ of net oil pay in a Pliocene-aged reservoir and 130’ of net oil pay in a deeper Wilcox-aged reservoir. The Phobos discovery is a potential tie-back to the Lucius production facility. The company is drilling the Calpurnia exploration prospect in the vicinity of Caesar-Tonga and Heidelberg fields.

Contingent value – deepwater exploration/Mozambique LNG

Deepwater exploration/appraisal success beyond sanctioned projects and the evolution of Mozambique LNG development present substantive upside to our target price. A sanctioned Shenandoah development constitutes approximately $5 per share of incremental fair value. Preliminary analysis suggests a 10-train Mozambique LNG development commencing in ’21 and sequencing one train per year the next ten years would increase our target price $10-$12/share assuming a FOB LNG price of ~$6/Mmbtu.

From Capital One:

• Positive. Quiet release as expected, but it included solid 4Q beats on oil and oil-equivalent production, as well as CFPS & EBITDA. We think ’17/’18 Street/COS ests are likely biased higher as analysts dial in higher base 4Q16 production volumes.

• More updates to come on March 8 investor call, including ’17 guidance and activity plans in Delaware Basin, DJ Basin, and deepwater. No new asset sales/monetizations disclosed, beyond the $7.5B that have closed or been announced. No change in plans to ramp to 14/6 rigs in Delaware/DJ by end of 1Q17. No deepwater well results, as Calpurnia (GOM), Shenandoah-6 appraisal (GOM), and Purple Angel (Colombia) are all still turning to the right.

• 4Q EPS & CFPS: EPS -50c vs -45c/-32c Street/COS. CFPS $1.93 vs $1.56c/$1.79c Street/COS. The CFPS beat vs COS was primarily driven by better oil and NGL production and higher realized oil and NGL pricing. EPS fell short as a heavy exploration expense and low tax rate more than offset these factors.

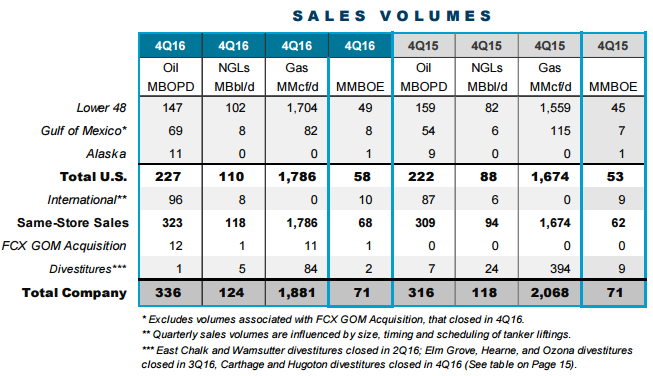

• 4Q production: Total production of 774 Mboe/d was +7%/+1% above Street/COS ests. The Street est may not be comparable, depending on how some treated asset acquisitions (FCX) and sales (Carthage and Hugoton). Either way, “same-store sales” volumes of 739 Mboe/d were well above expectations and 3% above the high end of APC’s 696 - 717 Mboe/d guidance range. Oil production was +6%/+4% above Street/COS ests. On a “same-store sales” basis, oil production of 323 Mbbl/d significantly exceeded forecasts and was 3% above the high end of APC’s 307 - 314 Mbbl/d guidance range.

• 4Q CAPEX: All-in CAPEX of $993MM including WES was -2% below our est but +6% above Street. Again, the Street est is probably not comparable, as some likely exclude WES spending. APC noted its CAPEX ex WES was below the low end of the guidance range.