Nine Energy Service, Inc. (ticker: NINE) has announced an initial public offering of its common stock.

The offering will consist of 7,000,000 shares of common stock. In addition the company intends to grant the underwriters a 30-day option to purchase up to an additional 1,050,000 shares of common stock at the initial public offering price, less underwriting discounts and commissions.

The current expected initial offering price is between $20.00 and $23.00 per share. The shares have been authorized for listing on the New York Stock Exchange under the ticker symbol “NINE.”

J.P. Morgan, Goldman Sachs & Co. LLC and Wells Fargo Securities are acting as joint book-running managers and as representatives of the underwriters for the offering. BofA Merrill Lynch and Credit Suisse are also acting as joint book-running managers for the offering.

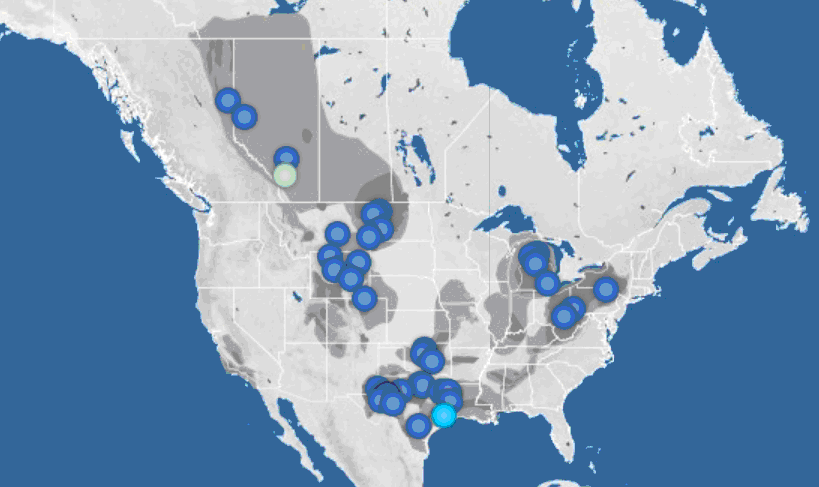

Nine Energy is a North American onshore completion and production services provider that targets unconventional oil and gas resource development. It is based in Houston with operating facilities in the Permian, Eagle Ford, MidCon, Barnett, Bakken, Rockies, Marcellus, Utica and throughout Canada

According to the company’s S-1 registration statement, proceeds from the IPO would go to fully repay the outstanding indebtedness under its two credit facilities, general corporate purposes which may include the acquisition of additional equipment and complementary businesses.”

Nine Energy, was formed as a combination of nine oilfield services and technology providers. It designs and deploys downhole solutions and technology to prepare horizontal, multistage wells for production.

Nine Energy is led by President and CEO Ann G. Fox.