On November 20, Apache Corp. (ticker: APA) announced its intentions to sell non-core assets in southern Louisiana and certain parts of the Anadarko Basin for approximately $1.4 billion in two separate deals with unnamed buyers.

In southern Louisiana, Apache agreed to sell its working interest in approximately 90,000 net acres. These mature fields, which are characterized by high decline rates and short reserve lives, produced approximately 21,000 BOEPD (62% gas and NGLs) net to Apache during Q3 2014. Apache will retain its 275,000 mineral acres in South Louisiana.

In a separate transaction in the Anadarko Basin, Apache agreed to sell approximately 115,000 net acres in a portion of its Stiles Ranch field in Wheeler County, Texas, and in its Mocane-Laverne and Verden fields in western Oklahoma. Net production from these properties averaged 26,000 BOEPD (83% gas and NGLs) during Q3 2014.

Both transactions have an effective date of October 1, 2014, and are expected to close before the end of the year.

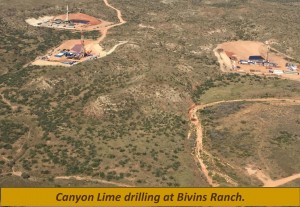

While Apache has been selling off non-core assets, it has also picked up an additional 300,000 acres of leasehold in its key plays. The company reported that it increased its drilling inventory in the Eagle Ford and Canyon Lime plays of Texas to more than 3,000 and 800 locations, respectively.

G. Steven Farris, Apache’s chairman, chief executive officer and president, said: “We have made great progress in strategically positioning our North American onshore portfolio for high growth and high returns. We continue to focus on growing liquids production from our deep inventory of North American resource locations. Proceeds from today’s [Nov. 20] asset sales will be used primarily to fund our 2014 leasehold acquisition program, which has added significant acreage within our primary focus areas.”

Apache forecasts 2015 North American onshore liquids growth of 12% to 16% when adjusted for 2014 asset sales. On a BOE basis, the company projects 2015 North American onshore production growth of 8% to 12%. The forecast assumes a preliminary North American onshore exploration and production capital budget of approximately $4 billion.

Apache has an enterprise value of $41.1 billion, and a trailing twelve month production rate of 650.2 MBOED. The company’s 2013 proved reserves are 2.6 MMBOE, 46% gas and 54% oil. The company’s debt as of the quarter ending Sep. 30, 2014 was $10.9 billion.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.