Cardinal acquires 5,000 BOEPD of production

Apache Corp. (ticker: APA) announced the sale of Canadian light oil assets today in a C$330 million ($244 million) cash deal with Cardinal Energy (ticker: CJ). Unlike many recent Canadian oil and gas property sales, these properties are not unconventional Montney or oil sands, but instead are conventional light oil.

~300 drilling locations available, 6% decline rate

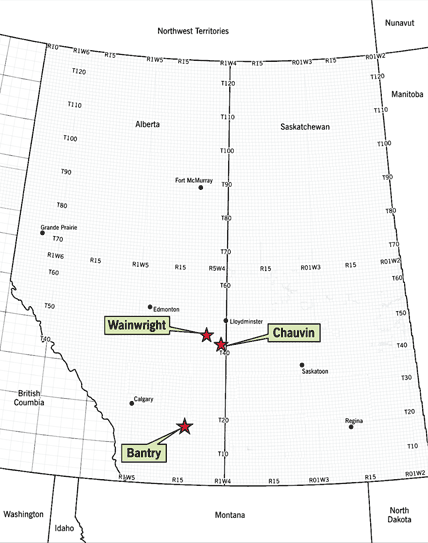

The assets sold are in two locations, one in central Alberta in the House Mountain area, and the second in the Weyburn/Midale area of southeast Saskatchewan.

According to Cardinal, the properties will add about 5,000 BOEPD of production, with oil and NGL making up all production. In total, the assets account for 21.9 MMBOE proved developed producing reserves.

The Alberta assets are about 30 miles from existing Cardinal properties, and are currently producing 2,150 BOEPD from the Beaverhill Lake formation. Anticipated future development involves fracturing existing wells and developing the 50 identified drilling locations.

The Saskatchewan assets are under CO2 and water floods to enhance recovery, and currently have a very low 6% decline rate. Cardinal plans to expand EOR operations and conduct infill drilling on the 250 potential well locations identified.

Funding from credit facility, share sale

Cardinal will fund the acquisition with its credit facility and a financing agreement. This agreement involves selling C$170 million in shares to a syndicate of banks, which will then be sold to the public. The credit facility will cover the remaining $160 million.

To reduce the cost of the transaction, Cardinal anticipates selling off royalty interests and fee title lands associated with the properties by the end of the year. The proceeds from this sale will be used to pay down the debt portion of the acquisition cost.

Apache refocusing on Permian

Apache is selling these assets to focus on its Permian assets, as the overall Permian basin will receive nearly two-thirds of the company’s budget this year. Apache is targeting significant growth from the Permian, where the company owns about 1,570,000 acres. Current production from the area is about 150 MBOPD, but Apache plans to nearly double this by Q4 2018.

Cardinal focuses on low-decline oil fields

Cardinal Energy is a Canadian E&P that focuses on developing oil-producing properties. Cardinal owns several properties in Alberta, the result of previous acquisitions. The company’s holdings are all conventional oil fields with very low decline rates, so this current transaction will be very similar.