Drilling and completion activities resume

Permian operator Approach Resources (ticker: AREX) reported fourth quarter results and reserves March 9, showing a net loss of $13.5 million, or ($0.32) per share. Net results for 2016 are a loss of $52.2 million, or ($1.26) per share. After adjusting for commodity derivative results, net fourth quarter and full year losses are ($0.27) and ($1.07) per share, respectively.

Approach reserves are down by about 6% to 156.4 MMBOE, from 166.6 MMBOE last year. Most of this decrease is due to proved undeveloped reserves being reclassified to probable reserves. Approach’s reserves are almost evenly split by commodity, with oil making up 32%, NGLs making up 30%, and natural gas the remaining 38%. The company reports a total 2016 reserve replacement ratio of 350%.

CapEx triples in 2017

Approach predicts 2017 CapEx to range from$50-$70 million, far above the $19.8 spent in 2016. First quarter production is estimated to be an inflection point, at around 11.3 MBOEPD. This is due to a lack of new wells completed in Q4 2016 and expected pipeline issues. The company expects to resume quarterly production growth starting in Q2 2017, with average 2017 production of 11.4-12.2 MBOEPD.

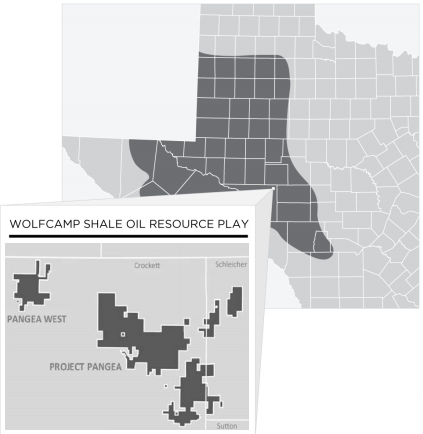

Approach owns 123,000 net acres in the Permian basin, where the company is targeting the Wolfcamp for development. The Wolfcamp A, B and C benches offer more than 1,600 undrilled locations, based on the company’s estimates. Approach has seen significant cost improvements in the last year, with D&C costs dropping by more than 20% from 2015 to 2016. Similarly, Approach’s LOE has dropped by 37.5% in the last year.

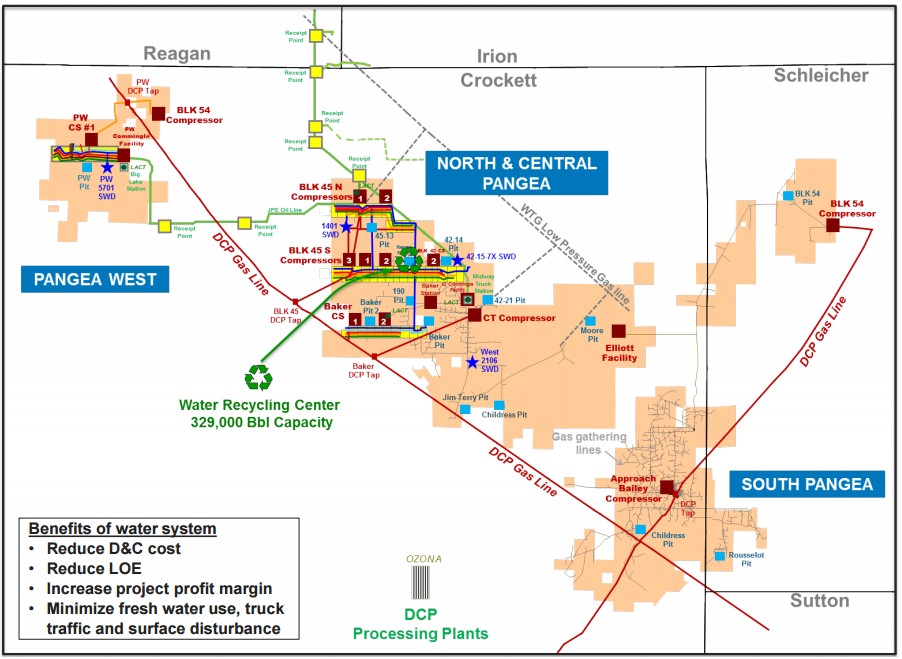

Water recycling plant generates savings

Some of this decrease in costs is due to the water recycling plant in the middle of the company’s acreage. With a treatment capacity of 329,000 barrels, this plant is being used to recycle water for use in frac treatments.

According to AREX President and COO Qingming Yang this plant has allowed the company to save about $400,000 to $600,000 per well. The company will restart this center as drilling and completion activities resume in the basin this year. Several other nearby operators have also expressed interest in using this facility, which would further enhance its utility to Approach.

Q&A from AREX Q4 conference call

Q: On the newer designs, obviously you’re tightening up that stage spacing, but can you give some more specifics on exactly what that spacing is looking like, what type of loadings you’re putting away, et cetera?

AREX Chairman and CEO J. Ross Craft: What we’ve been focusing on since the mid-2015 is reducing stage spacing. We started up our new completions in 2015 at around 200 feet and then we’ve gradually decreased to roughly 20 feet to 30 feet at time. With our latest well, we were down around 150 feet that we completed. So, what we’re looking at on sand loading is, somewhere right now around 1,600 pounds per foot in the average over the last five wells, but we’re steadily moving up to that 1,800 pounds and 1,900 pounds. And we think that right now will be appropriate level, but more importantly I think is the combination of our sand sizes we’re running. We’re also running a 100 mesh fairly large chunk, 55% of our sand loading is 100 mesh. But we ramp up pretty high. We ramped up to 2.5 pound per gallon, followed by a stage flush and then we started our 40 feet, 70 feet and we bring that up to a high concentration at 2.5 pounds per gallon as well.

We think that does a lot for the micro fractures and we think that’s giving us some positive results as well. So, going forward, I would say that our stage spacing is going to average somewhere between 150 feet and 175 feet on these wells. We think that’s going to give us an optimal position.

We’re also looking at playing with the initial fluid loadings, the pad stage and possibly running some different types of sand particles starting in the beginning of the pad, but that’s kind of the outline.

I think it mirrors what a lot of folks are doing in the industry, we’re seeing positive results from it. And one thing to point out during this downturn, even though we have decreased our stage spacing, which result in more stages, we had been able to keep the cost of these wells pretty flat, and I think that shows improvement in our operating structure and our ability to significantly negotiate contracts. And so from that – that’s kind of how we’re looking at it going forward.

Q: It seems like you guys are highlighting the water recycling center a little bit more in this presentation. Sort of an emergent theme of frac water, maybe not shortages, but maybe bottlenecks at least from a logistical standpoint. Are you guys – is that the rationale behind that water recycling plant and can you remind us if you do any third-party work with that plant?

AREX President and COO Qingming Yang: Initially, when we designed the recycling center, really sort of to address three issues you just mentioned. The first issue is really to address the shortage of frac water supply given significant ramp up of activities in Permian Basin.

Second, it’s also to reduce drilling and completion costs and also lease operating costs as well. We have used at the recycling center, we have recycled 2.2 million barrels of water which helped us to save our drilling and completion costs in 2015, $400,000 to $600,000 per well and during this downturn, we actually utilized the recycle center as a buffer zone and also to continue to reduce our lease operating cost. Now in our acreages we’re able to send our produced water directly to the recycle center and then distribute it to the SWD directly.

Going forward as we resume drilling and completion activities, we’re right now thinking about restarting the recycle center to not only get the benefit of reducing cost, but also get the benefit of using the processed water to frac our wells and we think use those water to frac our wells, our wells are actually performing better. So, this recycle center is working out very well for us and we’re also exploring the possibilities to partner with some of our offset operators and to fully utilize this recycle center to help them reduce drilling and completion costs and also lease operating cost as well and to sort of get the benefit what Approach has been getting and also enhance the value of this recycle center.

Q: So, along the line of your hedging situation, is there any reason why you didn’thedge your oil?

J. Ross Craft: If you look at the oil prices for 2016, since about I guess September of 2016, oil prices have been rocking anywhere between the high 40s and the low 50s, $53, $54 at one point. We don’t see – we think we have a built-in floor out there on oil prices. It could temporarily drop down, but we want to leave ourselves plenty of flexibility. If you look at our economics and what we feel we need to really get this machine back up and running, we want to see oil prices up north of the $55 mark.

And so, what we’re trying to do is, since we think we have a semi-floor on oil prices, we think there could be some upside potential at mid-year to lock-in some more hedges and some attractive numbers. We’re just kind of looking at it from the standpoint of risk to reward. We didn’t feel like locking in oil right now was a proper thing to do just yet. We felt like natural gas was an area that was very attractive, so we locked in. We felt like NGL is being close to the end of 2014 levels was very attractive as well, but we’ll keep a close eye on the oil and once we see a position we like, we’ll layer in some oil as well.