Pawnee Terminal offers connection into Pony Express Pipeline to Cushing

Arc Logistics (ticker: ARCX) announced today the $76.6 million acquisition of all the limited liability company interest of UET Midstream from United Energy Trading and Hawkeye Midstream. The consideration for the acquisition was made up of approximately $4.3 million in cash and approximately $32.3 million common units (approximately 1.746 million units at a price of $18.50 per unit), according to a company press release. Arc expects an additional $11 million in capital expenditures related to the deal.

The cash portion of the deal was financed with borrowings under the company’s revolving credit facility, which was upsized to $300 million to provide Arc with additional liquidity.

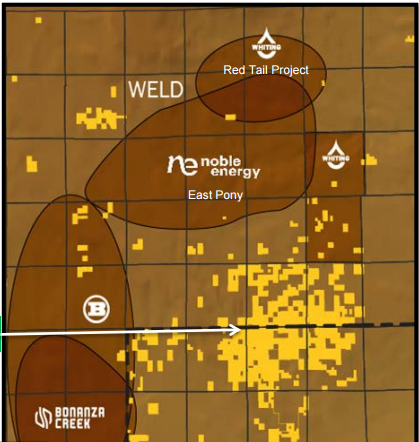

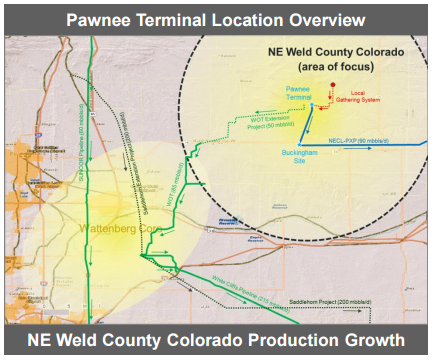

The principle asset acquired in the deal was UET’s Pawnee Terminal, a newly constructed crude oil terminal located in northeastern Weld County, Colorado. The Pawnee Terminal serves as the primary injection point on the Northeast Colorado Lateral of the Pony Express Pipeline, providing Pawnee Terminal customers with ultimate service to Cushing, Oklahoma.

The Pawnee Terminal has approximately 200 MBO of commingled storage capacity with room for additional storage, and is capable of receiving crude oil via truck unloading stations and connections to local crude oil gathering systems. At closing, the terminal was servicing several third-party contracts with a weighted average contract life of approximately five years, with aggregate take-or-pay volume commitments increasing 7% each year during the five-year period.

The terminal is expected to immediately contribute an estimated initial minimum contracted EBITDA of $9.0 to $9.5 million on an annualized basis, representing a 9.5x acquisition multiple using the mid-point of projected first year EBITDA. Increasing volume commitments and associated revenues will reduce acquisition multiple to less than 8.0x in 2018E, according to a company presentation. The deal is expected to be immediately accretive to Arc’s distributable cash flow per unit.

The nearby development property is being permitted to build a potential new crude injection terminal that would have the ability to provide additional unloading capacity and tankage, and allow incremental volumes to be delivered to the Northeast Colorado Lateral. Initial permits are for the construction of a 100 MBO terminal located 11.5 miles south of the Pawnee Terminal.

“[The terminal] was developed to handle the growing crude oil production transportation needs in the region, and its contract portfolio reflects that anticipated growth with built-in increases in customer take-or-pay volume commitments and associated revenues for [Arc],” said Vince Cubbage, Chairman and CEO of Arc Logistics. Arc anticipates crude oil production to grow at a rate of approximately 9% year-over-year through 2025, reaching approximately 363 MBOPD.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.