Oil & Gas 360 Publishers Note: We have been covering the accuracy of DUC counts for a long time. This is an interesting piece by JD Suppa

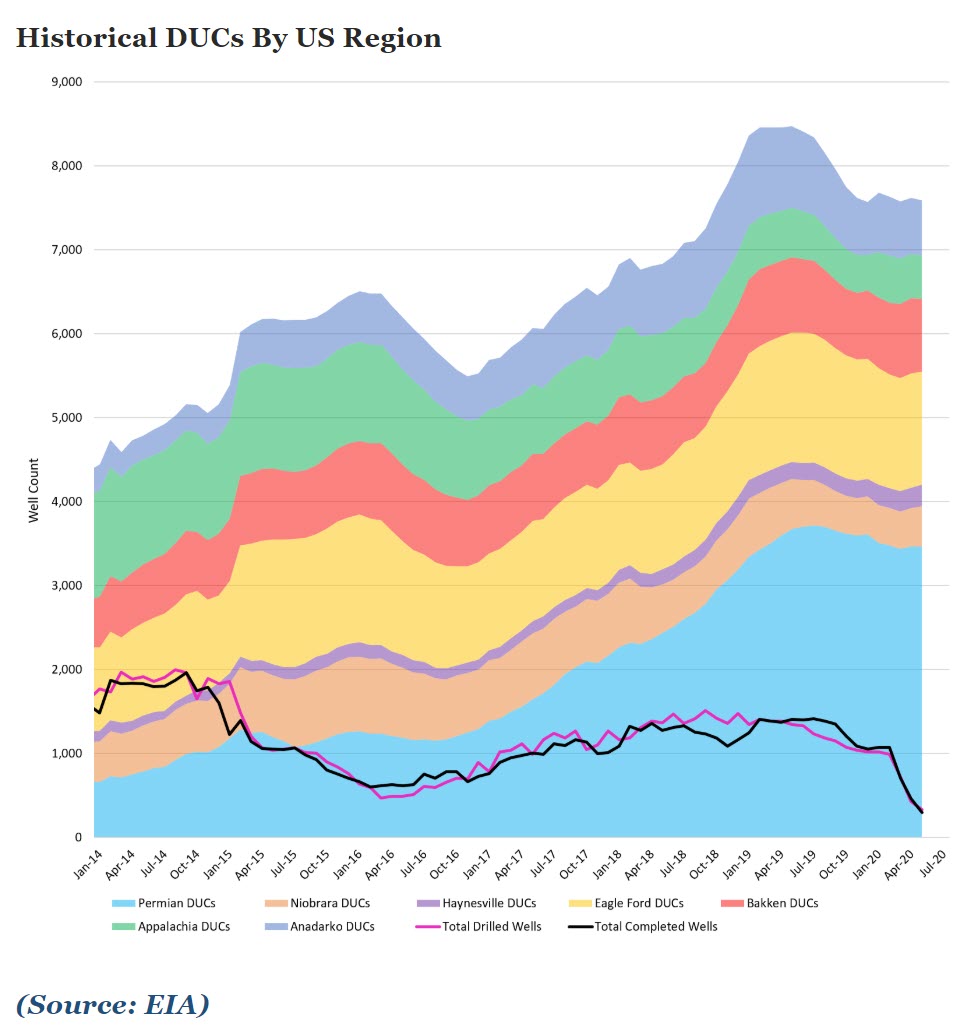

In thinking about the factors that might impact the supply/demand balance and influence prices, one that often comes up is the large U.S. inventory of drilled but uncompleted wells (DUCs). The U.S. Energy Information Administration (EIA) regularly tracks DUC counts in major unconventional regions. Over the years, however, I’ve developed concerns about the quality of the EIA’s estimates, partly because it’s hard for me to believe that operators would drill that many wells and not complete them.

While I can understand how delays in lining up frac crews might result in a DUC inventory build, or changing economics or poor offset results might lead to a decision to not complete some wells that were drilled, most operators strive to complete wells as quickly as possible to recover as much of their investment that they can (and hold leases). Typically, the point-forward economics of a completion decision are quite good.

I looked closely at the documentation the EIA provides on the website regarding their DUC count methodology and I think there are some weaknesses, particularly in Texas where oil wells are reported on a lease basis. The two regions the EIA tracks that are in Texas (Permian and Eagle Ford) account for about 60% of the DUC count. Here are my concerns:

Wells Drilled – The EIA uses a drilling rig productivity model and public data from Enverus (formerly Drillinginfo), which seems like a good starting point. Enverus, however, doesn’t distinguish between well spuds that result in only the top section of the hole being drilled and those that are drilled to TD (total depth). It may be picking up wells that really aren’t fully drilled and shouldn’t be in the drilled well count.

Wells Completed – This is a bigger concern. Because oil well production in Texas is reported on a lease basis, there’s no easy way to identify when a new well is completed unless it’s the first well on the lease. Subsequent wells will have completion reports filed with the state, but those are often filed many months later, they’re time-consuming to research and it’s not clear the EIA is actually looking for these. The number of active wells on a lease is only reported annually and represents the status as of the reporting month. In my personal experience, well status from public sources (particularly in Texas) is often inaccurate.

The EIA has done a good job documenting their process, but to address these pitfalls they should disclose exactly which wells they’re counting as DUCs by API number. This would give operators and others the opportunity to double-check their conclusions, provide feedback and improve the accuracy of the data.