State’s Permanent Fund Pays Annual Cash Dividend to All Residents

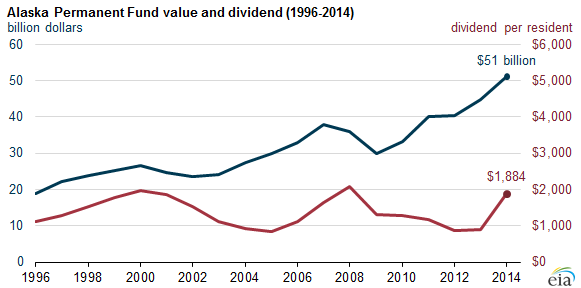

The 49th state has its perks. All Alaskans get an annual dividend check from the state. In 2014 their checks were $16 shy of $1,900 per resident.

Residents can thank their state for the royalties generated by oil and gas production on state lands that go into The Alaska Permanent Fund, established in 1976.

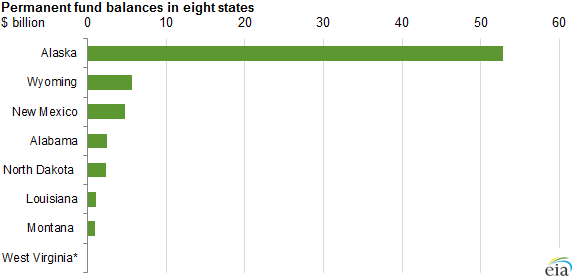

By retaining at least 25% of the royalties that energy companies pay to produce oil and natural gas on leased state lands, the Alaska Permanent Fund is now worth more than $51 billion, making it the largest trust fund in the United States, according to the EIA.

So the only state that can boast that it has neither a state income tax nor a state sales tax pays an annual cash dividend to all residents, making it unique among natural resource permanent funds in the United States.

The report says that the 2014 annual dividend check to Alaskans of $1,884 per resident was more than double the 2013 dividend and the highest since 2008. The annual dividend is calculated on a five-year average of investment earnings. Under Alaska law, the fund’s principal cannot be spent. When first issued in 1982, the annual dividend provided $1,000 for each Alaskan resident. Since then, the annual dividend has varied from a few hundred dollars to more than $2,000 per person.

Production and income taxes on the crude oil and natural gas industry have provided as much as 90% of Alaska’s general fund revenues and more than half of its total state revenues from all sources, including federal programs, the EIA estimates.

“Alaska’s fossil energy production has been declining as major producing areas on the North Slope age,” the EIA report said. The agency puts Alaska’s highest crude oil output at 738 million barrels in 1988, and says that by 2013 production was down to 188 million barrels and that natural gas in Alaska hit its highest marketed production levels in 1994 at 555 Bcf and came in at 338 Bcf in 2013.

“Alaska’s fossil energy production has been declining as major producing areas on the North Slope age,” the EIA report said. The agency puts Alaska’s highest crude oil output at 738 million barrels in 1988, and says that by 2013 production was down to 188 million barrels and that natural gas in Alaska hit its highest marketed production levels in 1994 at 555 Bcf and came in at 338 Bcf in 2013.

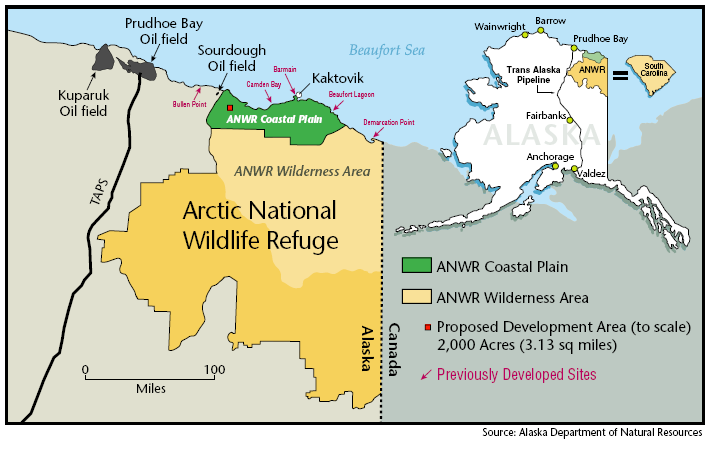

Alaska Governor Bill Walker is well aware of the state’s dependence on oil and gas revenues and he knows just what to do to begin to reverse the production down trend. In an exclusive interview with Oil & Gas 360®, Walker said the key is going to be attracting the independent exploration and production companies to the state to develop Alaska’s estimated remaining 50 billion barrels of reserves. Walker wants to aggressively develop ANWR and he wants to make some permitting changes.

“When I look at other states such as North Dakota, New Mexico, Texas, Wyoming, and I look at their permitting processes and how long it takes to get a permit to explore for oil, it’s rather shocking how quickly they can [issue drilling permits] versus how long it takes us. Much of our land–62% of our land–is federal land in Alaska, and the permitting process is multiple years. Whereas in other locales, it’s a matter of weeks and in some cases days for permits to be issued. So … we’re working on ways of bringing down the cost of doing business in Alaska on the oil exploration side.”

“I will be very aggressive on being able to develop portions of the ANWR–the Arctic National Wildlife Refuge–that has specifically been set aside for exploration. So what’s frustrating for me a bit, is that Wyoming is the same approximate size as the North Slope of Alaska, and Wyoming has drilled I believe 19,000 wells, and we’ve drilled about 600.

“I will be very aggressive on being able to develop portions of the ANWR–the Arctic National Wildlife Refuge–that has specifically been set aside for exploration. So what’s frustrating for me a bit, is that Wyoming is the same approximate size as the North Slope of Alaska, and Wyoming has drilled I believe 19,000 wells, and we’ve drilled about 600.

“We know that there are lots of development opportunities–lots of oil exploration opportunities on the north slope. We just need to make sure that we provide the appropriate infrastructure to assist those, so that the next wave of companies coming into Alaska–they are coming in–the independents–so it shortens the time between their acquisition of leases and being able to drill. It also brings their costs more in line with the opportunity.”

The full interview with Gov. Walker is available here.

Alaska’s next upcoming state lease sale is next week, with sealed bids due Monday, May 4. The Alaska Peninsula portion of the sale includes 4 million onshore acres and 1.75 million acres of offshore state waters, with 1,047 tracts ranging in size from 640 to 5,760 acres. The Cook Inlet portion encompasses approximately 4.2 million gross acres divided into 815 tracts ranging in size from 640 to 5,760 acres. The current Alaska Lease Sale announcement is available here. Future state lease sale information is available here.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

How Native Americans Benefit from Alaska's Permanent Fund

The EIA Reports:

Native Americans in Alaska, in addition to their permanent fund dividend, have another unique system for sharing energy royalties from tribal lands. The 1971 Alaska Native Claims Settlement Act (ANCSA), enacted by Congress to resolve conflicting land claims and to encourage energy development, established 12 regional tribal corporations to take ownership of tribal lands, which total 44 million acres, or about 12% of Alaska.

When energy resources are developed on tribal lands, under ANCSA, 30% of royalties go to the corporation holding the land and 70% is shared with the other tribal corporations. Although crude oil and natural gas development is concentrated along the northern and southern coasts, more than $1 billion in royalties shared over the years has provided investment capital for all 12 regional corporations to build diversified businesses, expanding into areas such as energy field services, real estate, and construction. All 12 regional corporations were ranked among Alaska's 50 largest businesses by Alaska Business Monthly in 2014.