Cabot Oil & Gas shares like the news

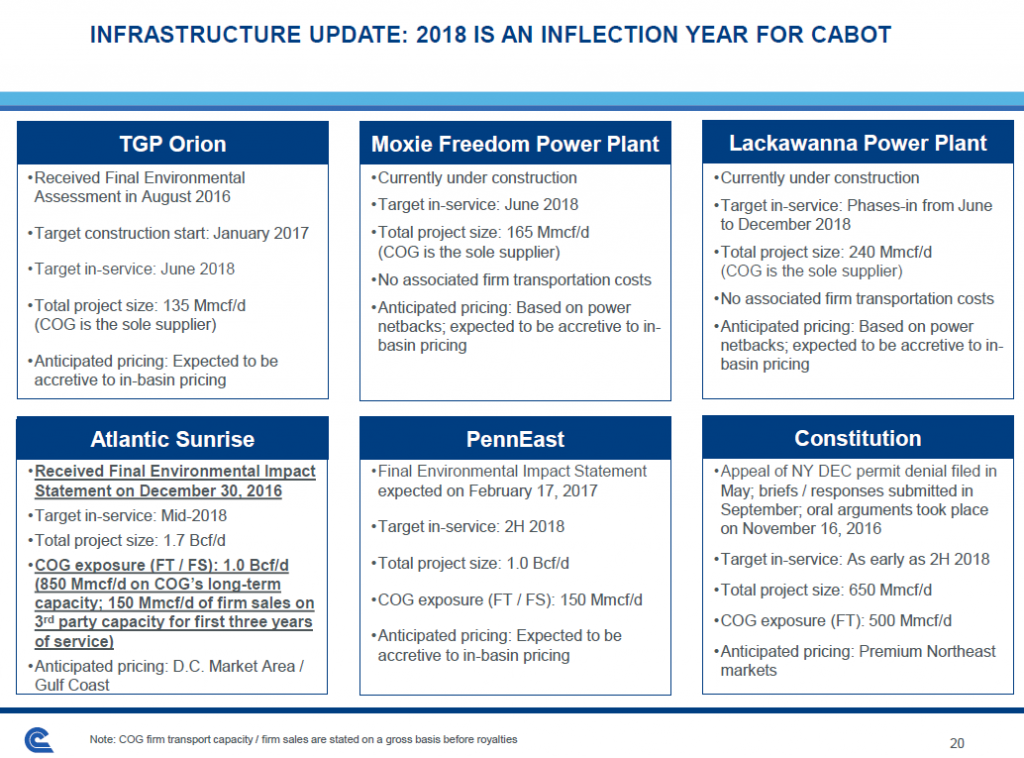

The $3 billion Atlantic Sunrise pipeline expansion that’s been awaiting approval by pipeline developer Williams Partners L.P. (ticker: WPZ) was approved by the Federal Energy Regulatory Commission (FERC) on Feb. 1, clearing a major regulatory hurdle. While this is not the last permit necessary for construction, it is a major win for the project.

The Atlantic Sunrise expansion project consists of approximately 200 miles of pipe, including about 185 miles of new natural gas pipeline in Pennsylvania, 11 miles of pipeline looping in Pennsylvania, 2.5 miles of pipeline replacements in Virginia and associated equipment and facilities. The new pipeline will connect the northeastern Marcellus production area to the Transco mainline in southeastern Pennsylvania. Additional existing Transco facilities will also be modified to allow gas to flow bi-directionally.

Delays pushed back startup from mid-2017 to mid-2018

The Atlantic Sunrise approval process began in April 2014 when Williams Partners (ticker: WPZ), the pipeline operator, began the pre-filing process. Williams originally sought to bring the system online in July 2017. In the project’s March 2015 certificate application Williams requested FERC issue their final order by April 2016. The project encountered several delays, however, with route changes in August and delays in the environmental review. This final environmental impact statement, expected in mid-October, was not issued until late December.

These delays pushed back the final authorization deadline to March 2017. Receiving approval on Friday, therefore, was a pleasant surprise for Williams. This approval accelerates expected start-up from the end of 2018 to mid-2018.

According to UBS Investment Research, the major permits that still await approval include: the US Army Corps 404 permit, several Pennsylvania Department of Environmental Protection permits, and the State Historic Preservation Office clearance. UBS characterizes these as low risk, and expects the pipeline to remain on schedule for construction in mid-2017 and start-up in mid-2018.

1.7 Bcf/d of transportation will relieve a limiting infrastructure bottleneck in the Marcellus

The pipeline project will help alleviate the serious transportation capacity deficiency in the Marcellus.

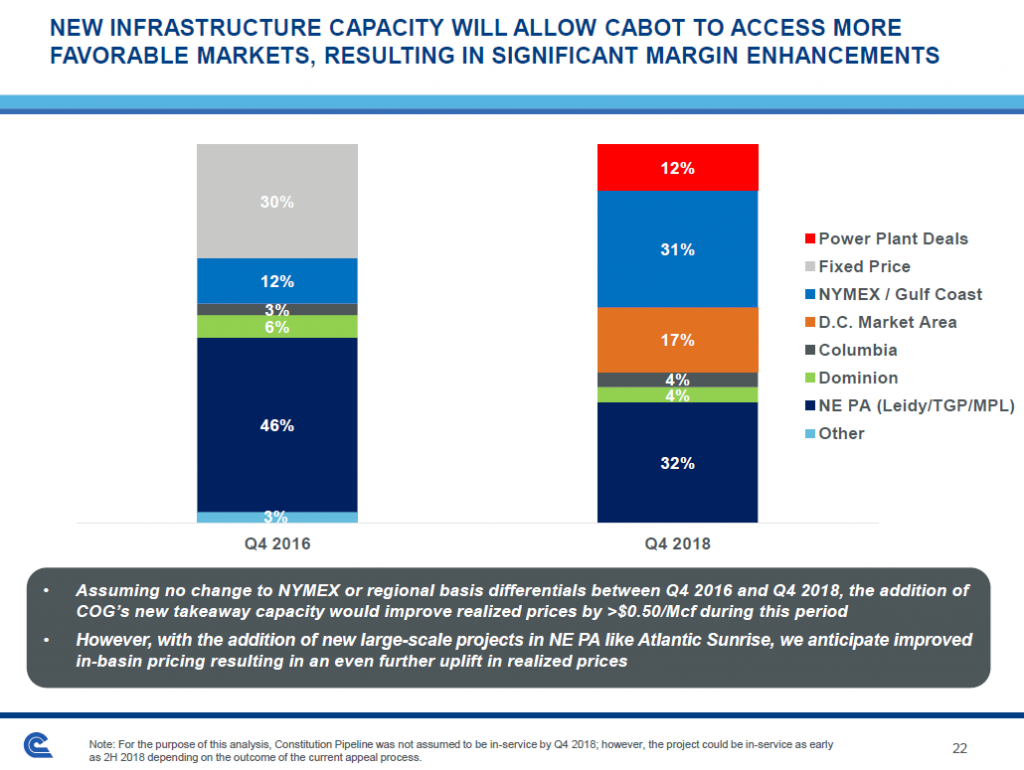

While production in the Marcellus boomed in the last ten years, pipelines lagged behind. With limited available transportation infrastructure, Appalachian producers have faced very low prices for natural gas. While recent improvements have shrunk the Marcellus-Henry Hub price gap, there are still significant infrastructure deficiencies. The $3 billion Atlantic Sunrise expansion has a 1.7 bcf/d capacity, which will aid producers attempting to get their products to market.

While transport capacity south is the bottleneck for the majority of the year, in winter the reverse is true. When northeastern cities like New York and Boston demand more natural gas than the infrastructure can supply, local spot prices can rise dramatically. Atlantic Sunrise will also add the ability for the main pipeline to flow gas in either direction, reducing this problem.

To end run the problem, some natural gas producers have made direct supply deals with power generation companies in the Marcellus region. Last summer Cabot Oil & Gas (ticker: COG) announced it would be the exclusive provider for the 1,500 megawatt Lackawanna Energy Center in Pennsylvania.

Cabot Oil & Gas will be chief beneficiary

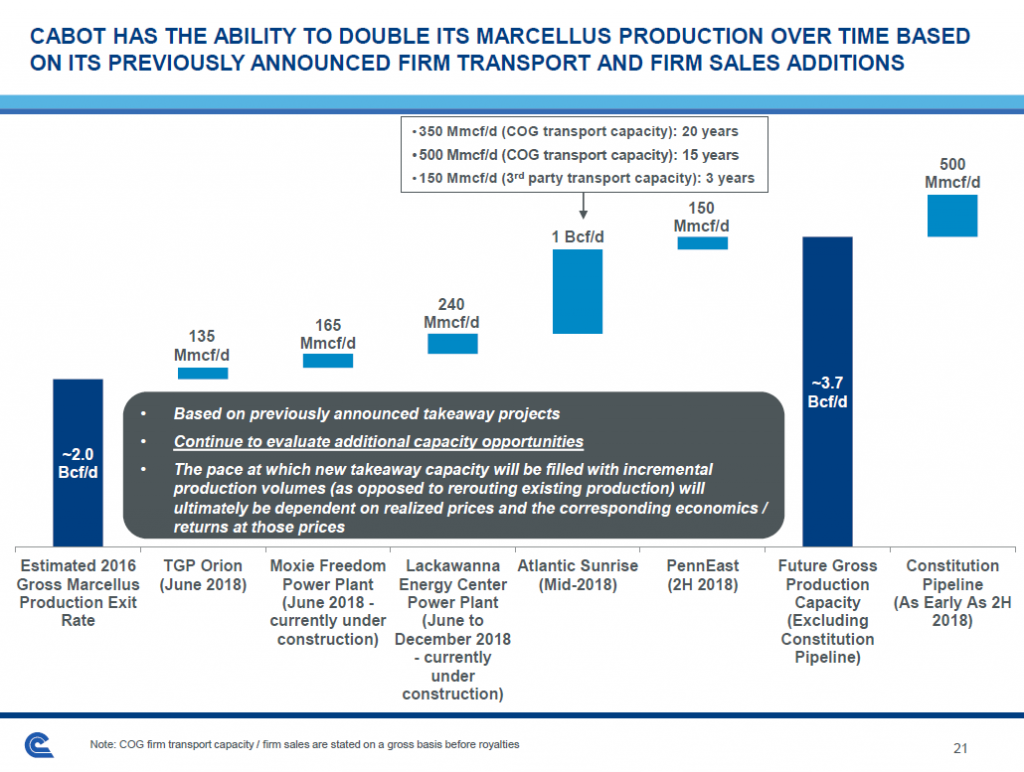

Cabot Oil & Gas will be the main shipper in the Atlantic Sunrise pipeline expansion, with 850 million cubic feet per day of capacity. The company was tallied as the second largest producer in Pennsylvania during 2015. Cabot has approximately 200,000 net acres in the dry gas window of the Marcellus Shale, primarily in Susquehanna County, Pennsylvania. Cabot’s Marcellus Shale properties accounted for 92% of the company’s proved reserves and 90% of its total net production as of year-end 2015.

Cabot reports in its January investor presentation for the Marcellus that it has catalogued approximately 3,450 drilling locations. Its unofficial tally for 2016 was 30 wells drilled / 67 wells completed on its Marcellus assets. The company said it is targeting 55 net wells drilled / 50 net wells completed in 2017.

COG shares jumped more than 10% on the news today.

Additional companies that have agreed to ship gas on Atlantic sunrise include Chief Oil & Gas and Seneca Resources.

Rover Pipeline also approved, FERC currently unable to rule on projects

The Atlantic Sunrise pipeline was not the only project to be approved, with the Rover Pipeline also receiving FERC approval late last week. This pipeline will transport gas from West Virginia and Pennsylvania across Ohio to Michigan. It will tie in with several pipelines serving Ohio, Michigan, Ontario, and the broader US pipeline network. With 3.3 bcf/d of capacity, the Rover will also help relieve the Marcellus infrastructure bottleneck.

The news is not all good for pipeline proposals, though, as FERC chairman Norman Bay resigned at the end of the day on Friday. This leaves the five person commission with only two members, not enough to have a quorum. Other pipeline projects will be in limbo until new members are appointed.